Shaanxi Coal Industry And Two More Premier Dividend Stocks

As global markets navigate through various economic signals, China's equity landscape remains a focal point, especially following the government's significant measures to stabilize the property sector. In this context, evaluating dividend stocks like Shaanxi Coal Industry becomes crucial as investors look for stability and potential income amid fluctuating market conditions.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.20% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.56% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.04% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.31% | ★★★★★★ |

Jiangsu Yanghe Brewery (SZSE:002304) | 4.86% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.10% | ★★★★★★ |

Changchun High-Tech Industry (Group) (SZSE:000661) | 3.98% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.46% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.26% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.53% | ★★★★★★ |

Click here to see the full list of 185 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Shaanxi Coal Industry

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shaanxi Coal Industry Company Limited operates in the mining, production, washing, and processing of coal, serving both Chinese and international markets with a market capitalization of approximately CN¥248.29 billion.

Operations: Shaanxi Coal Industry Company Limited generates its revenue primarily through the mining, production, washing, and processing of coal for markets in China and abroad.

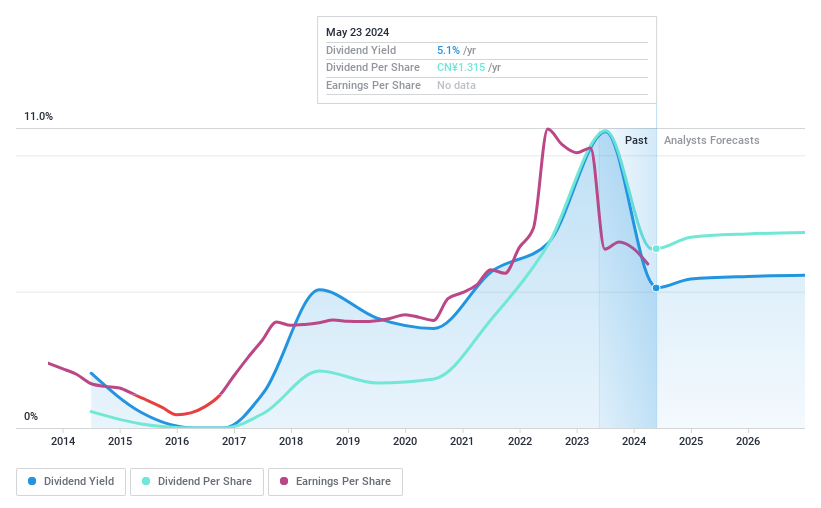

Dividend Yield: 5.1%

Shaanxi Coal Industry, with a payout ratio of 67.1%, maintains dividends backed by earnings and cash flows, the latter showing a cash payout ratio of 46.7%. Despite a robust dividend yield at 5.13%, its profit margins declined to 11.4% from last year's 20.8%. The stock trades at a significant discount, priced 59.6% below estimated fair value, yet it faces challenges with an unstable dividend history over the past decade and recent declines in quarterly revenue and net income as reported on May 16, 2024.

Henan Shenhuo Coal Industary and Electricity Power

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Henan Shenhuo Coal Industary and Electricity Power Corporation Limited, with a market cap of CN¥52.40 billion, is engaged in the production, processing, washing, and sale of aluminum and coal products in China.

Operations: Henan Shenhuo Coal Industary and Electricity Power Corporation Limited generates its revenue primarily through the production and sale of aluminum and coal.

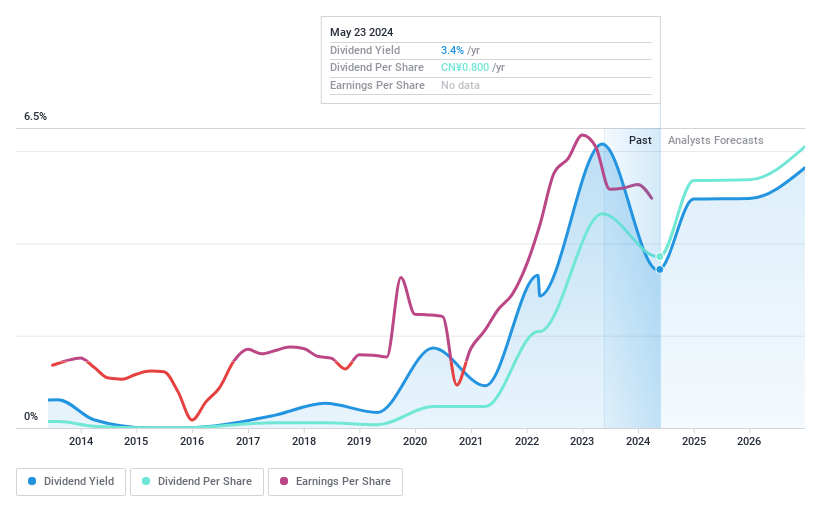

Dividend Yield: 3.4%

Henan Shenhuo Coal Industary and Electricity Power recently declared a dividend of CNY 8 per 10 shares, effective May 2024, reflecting a commitment to shareholder returns despite a challenging financial backdrop. In Q1 2024, the company's revenue and net income fell to CNY 8.22 billion and CNY 1.09 billion respectively, from higher figures last year. This downturn aligns with an unstable dividend history over the past decade, marked by significant fluctuations in payouts. However, with a payout ratio of just 32.7% and cash payout ratio at 19.7%, the dividends are well-covered by both earnings and cash flow, suggesting sustainability amidst financial pressures.

Inner Mongolia Dian Tou Energy

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inner Mongolia Dian Tou Energy Corporation Limited operates in China, focusing on the production and sale of coal products, with a market capitalization of approximately CN¥50.37 billion.

Operations: Inner Mongolia Dian Tou Energy Corporation Limited generates its revenue primarily from the production and sale of coal products.

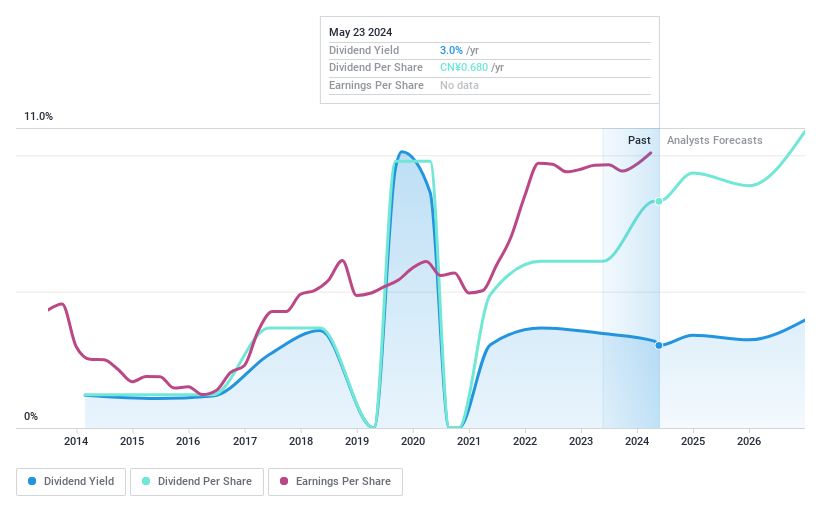

Dividend Yield: 3%

Inner Mongolia Dian Tou Energy reported a robust increase in Q1 2024 earnings, with net income rising to CNY 1.94 billion from CNY 1.62 billion year-over-year, supported by sales growth to CNY 7.34 billion. Despite this performance, the company's dividend sustainability is questionable; dividends are not well-covered by cash flows or free cash flow, and past payments have been inconsistent. However, its recent proposal for a final dividend of CNY 6.80 per 10 shares signals ongoing shareholder returns amidst financial growth and strategic planning discussed at their latest annual meeting.

Key Takeaways

Delve into our full catalog of 185 Top Dividend Stocks here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:601225 SZSE:000933 and SZSE:002128.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance