ServiceNow Is a High-Quality Business, but Its Growth Is Priced In

ServiceNow Inc. (NYSE:NOW) is a cloud platform company that needs no introduction. It is a high-quality software business with a lively CEO, Bill McDermot, who has been able to steer the Santa Clara, Califormia-based company to even greater heights than his predecessor. In 2023, the company's stock easily outperformed both the Nasdaq index and the S&P500 index with an impressive 82% gain.

At the heart of the company's performance was impressive growth in its core software subscriptions business, delivering around 80% gross margins. Better yet, the company expects up to a third of its revenue to be recognized as operating income next year while seeing no dilution in its growth trajectories. Naturally, with such an incredible all-round performance, market participants have put a tremendous amount of faith in ServiceNow.

However, my own research suggests much of its immediate growth prospects are already baked into the current price, limiting upside in the stock.

A look at the business model

ServiceNow operates in the information technology service management and IT operations management categories of cloud software. Its software helps organizations plan, implement, manage and optimize back-end information technology services to meet the organizational user's end goals of achieving higher productivity. The company was founded in 2004, around the time internet-based technology startups flourished, with the aim of solving the software solutions gap technology companies faced with their technical management support systems and IT helpdesk systems. The company had the fortune of having some exemplary CEOs leading the company, such as Frank Slootman (current CEO of Snowflake (NYSE:SNOW)) and John Donahoe (current CEO of Nike (NYSE:NKE)). McDermot (ex-SAP (NYSE:SAP)) currently leads ServiceNow.

ServiceNow operates as a cloud platform, which means its cloud software has evolved into an ecosystem where enterprise clients can subscribe to its core products and services. In addition, clients can also purchase additional application subscriptions from ServiceNow's app store. Enterprise clients pay periodic subscription fees to get access to its IT platform services while also paying license fees per seat for each user in their organization that needs access to ServiceNow's platform.

In terms of competitors, ServiceNow easily maintains a strong edge.

ServiceNow outpaces the competition with strong market share gains

Technology research giant Gartner has consistently named ServiceNow as a leader in the ITSM and ITOM software spaces, as per its most recent report. It has held onto this leadership position for the past nine years, and its lead over competitors is expected to extend further, as can be seen in the following image.

In my opinion, ServiceNow has been very strategic in developing its product strategy and user acquisition strategy. I will explain how its product strategy is accretive to its subscription business in the next section, but I will use this section to elucidate its user acquisition strategy.

The highlight of ServiceNow's user acquisition success lies in its efforts to move quickly and forge partnerships with leading hyperscalers early on. A separate study conducted by market research company ReportLinker shows how ServiceNow partnered with cloud companies such as Microsoft (NASDAQ:MSFT), Alphabet's (NASDAQ:GOOG) Google, IBM (NYSE:IBM) and Nutanix (NASDAQ:NTNX) to gain access to their cloud customers and distribute its IT services platform. This is one of the core strategies that has allowed ServiceNow to target and acquire large enterprises as its customers.

Over time, ServiceNow has reaped the benefits of attracting large customers, as they have been most loyal, with the annual contract values expanding over the years, as can be seen in the charts below. The growing ACV trend is attributable to the 20% per year average growth (since 2021) seen in its customers that contribute more than $1 million in annual recurring revenue.

I see these customer trends as conglomerative to ServiceNow's success in expanding its market share in the ITSM space. Moreover, I see ServiceNow's market dominance giving it leverage during customer contract negotiation, leading to higher contract values.

ServiceNow's AI-focused product roadmap and platform adoption

In the previous section, I discussed how ServiceNow's product strategy is accretive to its subscription business. The company maintains a number of advanced product differentiations, such as native process mining and workforce optimization, that give its products clear advantages over its nearest competitors, such as BMC Software, Atlassian (NASDAQ:TEAM) and Freshworks (NASDAQ:FRSH).

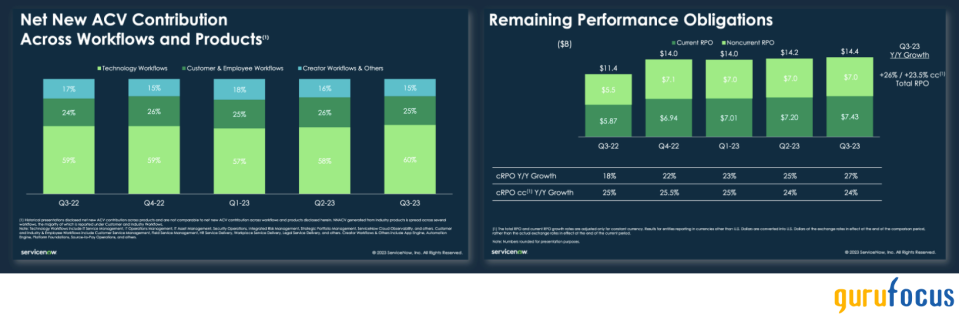

ServiceNow usually follows an 18-month product roadmap and is currently rolling out its Vancouver release to customers. Self-service employee platforms and AIOPs are some of the key product themes that the company is deploying in its product releases, which I think is extremely healthy for future platform adoption rates. I noted earlier how ServiceNow was seeing consistent growth in its cRPO, with the company seeing very strong cRPO growth in the most recent quarter at 27%. I had also noted how ACV had been expanding over time. In the chart below, I added some more context as to some key drivers that are steering those trends in ACV.

From the above chart, 60% of all ACV is being driven by Technology Workflows, which gained 1% over the past four quarters. These trends only add to my argument that ServiceNow's focus on adding artificial intelligece capabilities to its software products increases its platform adoption.

Valuations suggest ServiceNow is at a fair price

As I had established earlier, subscription revenues account for at least 96% of ServiceNow's sales, with the remaining revenue being contributed by other services such as maintenance and support. Since the company issues guidance on its subscription business, I will use this metric as the primary measure when talking about revenue.

Per its third-quarter 2023 report, ServiceNow's subscriptions grew by 27% year over year, which was extremely strong. While gross margins for its subscription business fell by 2% as compared to the same period last year, overall gross margins remained unchanged on a year-over-year basis at 82%. I see this drop in gross margins as a one-off, especially given the company continued to grow its non-GAAP operating margins to a very healthy 30%. The company still expects gross margins for fiscal 2023 to be 84%.

ServiceNow expects that it will grow its subscription revenue by 24.6% in fiscal 2023. Consensus expectations peg its top line at 23.3% growth to $8.9 billion while 2024 revenue is expected to grow by 21% to $10.8 billion. Management expects to realize 26% of its top line as non-GAAP operating income, while its non-GAAP operating margin is expected to grow to 28% in 2024. This means ServiceNow's non-GAAP operating income should grow by around 30% year-over-year. Given the S&P 500 trades at a forward price-earnings ratio of 19.50 while ServiceNow trades at a forward price-earnings ratio of 53.5, I see no room for upside.

Risks and other factors to consider

My outlook does not factor in any slowdowns in the economy that would impact enterprise spending on ServiceNow's platform. If the U.S. were to experience a slowdown or recession, enterprise clients would try to renegotiate their agreements and push out IT budgets as well as cloud migration budgets, putting downward pressure on ServiceNow.

On the plus side, ServiceNow usually tends to underperform and will overdeliver as it gets through a strong year. For example, the company started the year projecting a 23.5% increase in its revenue growth, but now sees 24.6% growth in its subscription business. If enterprise spending continues to be strong in fiscal 2024, expect ServiceNow to revise its targets higher. These upward revisions in its earnings would give more upside to the stock, though I will have to rework my valuations to arrive at a new fair price.

Takeaways

ServiceNow continues to impress me with its expanding revenue and high margins, bolstering its software platform-based subscription business. The company is led by an enterprising set of management executives focused on sustainably growing the company and delivering high value for its shareholders. However, I fear the markets currently expect too much of ServiceNow, and I see the company currently priced at a fair value.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance