Sensient Technologies Corp (SXT) Q1 Earnings: Mixed Results Amidst Market Challenges

Revenue: $193.1M from Flavors & Extracts, up by 8.0% year-over-year, surpassing estimates of $367.80M.

Operating Income: Flavors & Extracts segment saw an increase to $23.7M, driven by higher volumes and favorable pricing.

Color Group Revenue: Declined to $160.0M, a decrease of 0.7% year-over-year, due to lower volumes in food and pharmaceuticals.

Asia Pacific Revenue: Slightly increased to $40.3M, with higher volumes offset by unfavorable exchange rates.

Corporate Expenses: Rose to $14.7M, mainly due to $2.8M in Portfolio Optimization Plan costs.

2024 Guidance: Raised to expect mid-single-digit revenue growth and adjusted EBITDA growth, with diluted EPS forecasted between $2.80 and $2.90.

Adjusted EPS: Projected to grow at a low to mid-single-digit rate from 2023's adjusted EPS of $2.86.

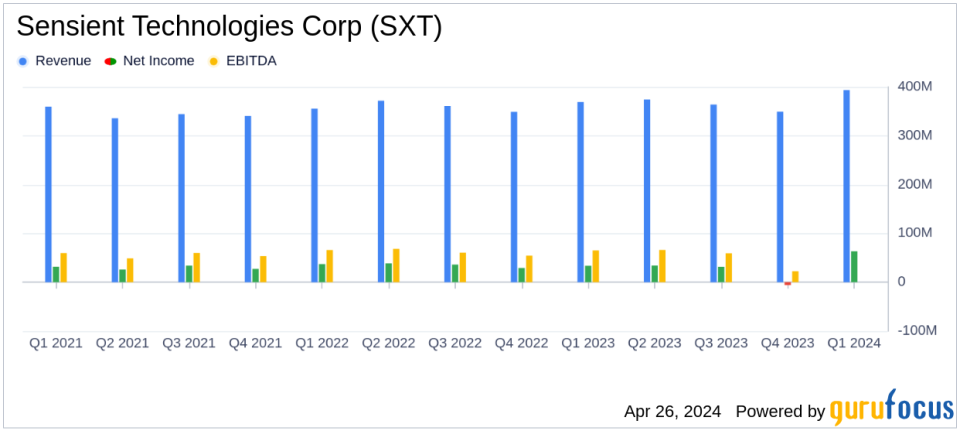

Sensient Technologies Corp (NYSE:SXT) disclosed its financial outcomes for the first quarter ended March 31, 2024, in its recent 8-K filing on April 26, 2024. The company, a prominent player in the flavors and colors sector, reported a mixed financial performance with notable variances across its business segments.

Sensient Technologies operates globally, providing essential ingredients and substances for a diverse range of industries, including food and beverage, pharmaceuticals, and personal care. The company's portfolio includes flavors, colorants, and other specialty ingredients, structured into three main segments: Flavors & Extracts, Color, and Asia Pacific.

Financial Performance Overview

For Q1 2024, Sensient reported a total revenue increase of 4.2% in reported terms and 3.8% in local currency terms. The Flavors & Extracts segment was a standout, posting a revenue of $193.1 million, up by 8.0% in reported terms, driven by higher volumes and favorable pricing. However, the Color segment experienced a slight decline, with revenue dropping by 0.7% to $160.0 million, affected by lower volumes in food and pharmaceuticals. The Asia Pacific segment saw a modest revenue increase of 0.6% to $40.3 million.

Operating income presented a mixed picture, with a total decrease of 2.8% in reported terms, though adjusted local currency results showed a slight improvement of 2.6%. This was influenced by varying performance across the segments, with the Flavors & Extracts segment improving due to volume and pricing, while the Color and Asia Pacific segments faced challenges primarily due to market conditions and higher input costs.

Strategic Initiatives and Market Challenges

Paul Manning, Chairman, President, and CEO of Sensient, expressed confidence in the company's strategic execution and market position, despite the mixed financial results. "Our underlying business and new sales wins remain strong. I am confident that our teams will execute on our strategy and deliver on expectations for 2024," Manning stated. The company has also raised its full-year guidance, expecting a mid-single-digit growth rate in 2024 revenue and adjusted EBITDA on a local currency basis, an improvement from previous forecasts.

The company continues to face market challenges, including volatility in global markets and input cost pressures. These factors are critical as they could influence pricing, supply chain efficiency, and overall profitability. Sensient's ability to navigate these challenges while continuing to innovate and optimize its product portfolio will be crucial for sustained growth.

Looking Ahead

For 2024, Sensient anticipates diluted earnings per share to be between $2.80 and $2.90, factoring in approximately 15 cents of costs related to its Portfolio Optimization Plan. This guidance reflects an optimistic outlook compared to the 2023 reported GAAP diluted earnings per share of $2.21. The company also highlighted potential risks, including economic conditions, raw material costs, and geopolitical tensions, which could impact future performance.

In conclusion, Sensient Technologies Corp's first-quarter results reflect a resilient business model capable of adapting to dynamic market conditions. While certain segments faced challenges, strategic pricing and volume growth in others highlight the company's ability to capitalize on its diverse portfolio. Investors and stakeholders will likely watch closely how Sensient navigates the evolving industry landscape and executes its growth strategies in the coming quarters.

Explore the complete 8-K earnings release (here) from Sensient Technologies Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance