'I have a sense of timing': Jerry Seinfeld once said why he didn't take $100M to keep making 'Seinfeld' — now his old pal Larry David is ending 'Curb.' Here's how to know when to retire

In 1998, comedian Jerry Seinfeld made a decision that was no laughing matter: he ended the iconic sitcom that bore his name.

The choice came even though the funnyman had been offered more than $100 million to film one more season.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Inflation is still white-hot — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

Anything can happen in 2024. Try these 5 easy money hacks to help you make and save thousands of dollars in the new year (they will only take seconds)

During a June 2013 interview on the The Howard Stern Show, Seinfeld reiterated the importance of timing and honoring the sitcom and its fans by ending the show with a bang.

“I have to say, I have a sense of timing,” he told Stern. “I have it in jokes, I have it in my sets, I have it in my career. I knew when to move to L.A. I knew when I was ready for The Tonight Show. I knew when I was ready to do something bigger like the sitcom. I just knew. And I knew that was our moment.”

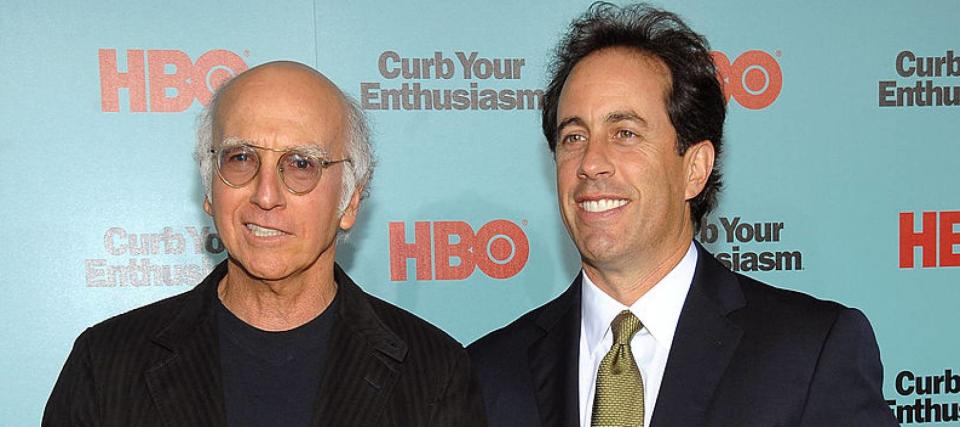

Now, more than a decade after that comment, Seinfeld's old friend Larry David, with whom he created and supervised the Seinfeld sitcom, has announced a similar decision to end Curb Your Enthusiasm, the long-running and much-beloved HBO comedy, after the latter show’s 12th season ends in a few weeks. David has said the same thing before, but this time he insists he means it.

“I’m not lying.” he told The Hollywood Reporter. “OK, yeah, 15 years ago I said it was the last season — that’s what I say when I don’t think I’m going to come up with another one. But this is it.”

Albeit not exactly a true follow-up or sequel to Seinfeld, Curb is something of a spiritual successor: Both shows' main characters exhibit breathtaking self-centredness, and neither show is interested in offering traditional moral lessons.

And recently, some critics have openly speculated that Curb will end as Seinfeld did: with the main character behind bars.

How do you know when to call it quits in your career, especially if things are going well? And, assuming you haven’t made the hundreds of millions that Seinfeld and David have raked in over the years, how do you know when you’ve saved enough money to live comfortably in retirement?

Here are two things to consider that may help clear your way.

Trust your timing

Retirement has earned the nickname “golden years” for good reason. It’s time that you’ve earned through a lifetime of hard work to relax, spend time with family and live a life of leisure.

But even if you’ve spent 40 years saving and investing in preparation for retirement, deciding exactly when to call it quits on your career can be tricky — especially when, like Seinfeld, you have a golden opportunity to shore up your finances by working a little longer.

If you’re reaching retirement age but still feeling happy, fulfilled and are finding meaning in your work, delaying retirement by even one year can have a big impact on your finances.

You’ll earn another year of salary, and if your employer offers a 401(k) plan, you’ll be able to stash away another $22,500 in the coming year — or a whopping $30,000 if you are age 50 or older — which will compound and grow (along with the rest of your retirement savings) over time.

Read more: No landlord? No problem! Explore hassle-free real estate investments

Another benefit to working longer is that it may delay when you start to claim Social Security. The earliest Amercians can start claiming Social Security is age 62, but those who opt to delay receive higher monthly payments, with the maximum benefits available to those who claim starting age 70 or older.

There are many reasons why people claim Social Security before they reach the full retirement age — but keep in mind that waiting will secure you a bigger monthly check when you may be less able to go back to work to earn some quick cash.

While there are financial benefits to working longer, remember that your time gets increasingly more valuable as you age. It’s important to figure out your priorities. If your career no longer features on your “most important list,” then it might be time to let go and enjoy your retirement.

Figure out your finances

One of the most common questions that soon-to-be retirees have is: how much money will I need?

That sum is going to be different for everyone based on timeline, lifestyle, where you want to retire, any outstanding debts — including credit cards, personal loans and mortgages — and your overall financial goals.

There are several different schools of thought you can draw inspiration from to reach your magic number without resorting to the nice round sum of $1 million, which may not actually cut it today as inflation and health-care costs take bigger bites out of Americans’ budgets.

For years, financial planners and retirees have relied on the “4% rule,” which states retirees should plan to withdraw 4% of their assets every year, increasing or decreasing that distribution annually based on inflation. The 4% rule is based on the notion that retirement savings should sustain you for at least 30 years, which may not work for you if you plan to retire early or keep working into your 70s.

You may also want to consider the “multiply by 25 rule,” where you need to think about how much annual income you'd like to have in retirement, then multiply it by 25 — and that's how much you should save. So if you want to live on $60,000 a year for 25 years of retirement, you'd need to have $1.5 million socked away.

Neither rule is perfect, but they can be a good springboard for thinking about your retirement finances. If you’re still unsure about where to start or how to plan for your golden years, you may want to consider working with a financial adviser who can help you concoct a plan that best suits your needs.

What to read next

Maximizing your tax strategy: The key to $1.3 million in extra wealth

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance