Semi Equipment Still Overpriced: 3 Stocks on the Radar

The primary drivers of wafer fab equipment (WFE) demand are the strength of semiconductor demand and the existing capacity level. As far as the demand for semiconductors is concerned, it will be hugely boosted by ongoing transitions adopting AI, IoT, EVs and renewable energy. Government regulations and funding around the world will support this trend.

The future of warfare is also in the most advanced electronics. Therefore, strategic necessity will continue to boost demand and production around the world, particularly in China, the U.S. and Europe. These factors will drive capacity build right through this decade.

While there are constraints on selling leading edge semiconductors and equipment to China, the country is generating stronger-than-expected demand at the trailing edge, indicating significant capacity adds. Because of these reasons, things like the possibility of a recession and interest rates are likely to have limited effect on demand in the foreseeable future.

Gartner is optimistic about a solid recovery in semiconductor demand in 2024 with growth across all chip types led by memory. Because of the inventory glut in memory chips last year, there was a sharp pullback in the category with prices hitting rock bottom. In 2024, there will be a total reversal, with NAND revenue increasing 49.6% and DRAM increasing 88% for a combined growth of 66.3% in memory.

If softness in consumer and computing hit semiconductor demand in 2023, it is AI-driven workloads, particularly generative AI and LLM that will increase demand for servers and consequently, semiconductors (mainly GPUs and workload accelerators) this year. By 2027, Gartner expects that the integration of AI techniques into data center applications will result in a more than 20% increase in servers.

The strength of semiconductor demand is positive for equipment sales, although capacity not so much. This will bring about a 4% decline in WFE revenue this year, on top of a 10% decline in 2023, according to Gartner. Growth is expected to return thereafter with a 10% increase in 2025 and continuing through 2027.

Utilization rates are picking up now, which helps spares and services business at equipment makers. New tools are the result of continued innovation to facilitate the multiple technology transitions going on as we speak, and also to lower their cost of ownership.

According to SEMI, capex spending will accelerate this year despite the softening in auto and industrial markets that is keeping analog makers under pressure. The firm expects 2024 to be a transition year followed by a strong rebound in 2025, driven by capacity expansion, new fab projects and high demand for advanced technologies and solutions across front-end and back-end operations.

Overall, WFE sales are projected to increase 3% in 2024 and 18% in 2025; test equipment a respective 13.9% and 17%; and assembly and packaging 24.3% and 20%. On the memory side, NAND equipment is expected to grow 21% in 2024 and 51% in 2025, with DRAM growing 3% in 2024 and 20% in 2025. While China, Taiwan and Korea are expected to remain the top destinations for WFE through 2025, China growth will be affected by tough comps with 2023.

Despite this underlying strength, geopolitical considerations, including restrictions on trading with China could continue to weigh on stocks like Applied Materials (AMAT), Lam Research (LRCX) and ASML Holding N.V. (ASML).

About the Industry

This industry includes suppliers of manufacturing equipment, services and software for semiconductor wafer fabrication. Wafer fabrication involves the treatment of a silicon wafer to successive layers of conductive and semiconductive material using stencil-like structures called reticles. After each deposition of material on the surface, the excess material is etched away and the wafer exposed to a light source to implant the design.

The back-end process involves cutting up the individual die, packaging for protection/use, attachment of electrical leads and sorting. The industry depends on semiconductor demand, which primarily comes from cloud (growth is accelerating), ecommerce (growth is steady), PCs (turning the corner), smartphones (also turning the corner), IoT, AI, HPC (strong), automotive and industrial (slower) and communications infrastructure (5G-driven).

Factors Shaping the Industry

Technology transitions, such as the move toward larger wafer sizes (High-bandwidth memory or HBM, fab upgrades to 300mm, plus 200mm demand), shrinking nodes (pushing to 3nm and below), memory chip advancements (increasing layers and stacking are adding complexity), denser packaging (MEMS), etc. are positive for equipment purchases, since each transition requires advanced equipment for manufacturing. HBM in particular is expected to be a major driver this year, because it enables a 30% improvement in energy efficiency. TrendForce estimates that its share of DRAM revenue will grow from 8.4% in 2023 to 20.1% by the end of 2024: “HBM die size is generally 35 to 45 percent larger than DDR5 memory of the same capacity. The yield rate (including through silicon via) is approximately 20 to 30 percent lower than DDR5 and the production cycle (including TSV) is 1.5 to 2 months longer than DDR5.” Therefore, volume production will mean much more equipment demand than DDR5. SK Hynix accounts for most of the demand and Samsung (expected to take share this year) is a strong second consumer. With all the major chipmakers (NVIDIA, Intel and AMD) slated to refresh their CPU and/or GPU lines this year, and other players also looking to exploit the AI opportunity, capex should maintain its growth trajectory in the foreseeable future. Materials research, device complexities, the need for greater manufacturing integration and new applications are also important drivers. Other inflections will continue to come from advancement in front and back-end processes and from new chip architectures.

Semiconductor demand is the primary driver of equipment purchases and will remain very strong on the back of a huge innovation cycle in AI, IoT, EV and renewable energy that will transform every aspect of the economy. The market is expected to enter an upcycle next year, which will also drive equipment demand. Additionally, new fabs are likely to play a significant role in the next few of years. China in particular is investing heavily in capacity, and next year, lagging edge facilities will ramp up in the US to take advantage of the CHIPS Act. Other countries are also expected to build capacity for strategic reasons. With many new fabs expected to come online over the next decade, WFE demand is expected to remain very strong in the foreseeable future. In the short term however, it’s a concern that memory typically makes up the largest part of WFE spending, because that’s the segment where cyclicality is the most evident. That said, the memory market is poised to soar this year, reflecting positively on the near-term outlook. Over the next decade, the integration of memory with compute could stabilize demand to that extent.

Export regulations remain one of the biggest concerns right now. The increasing polarization between the two largest economies makes this a longer-term concern. Samsung, SK Hynix and TSMC have approvals but Gartner expects their China expansion plans to be conservative. NVIDIA was also banned from supplying its A800 and H800 chips to China, although they had specifically developed the chips for the market. Additionally, semi equipment makers generate substantial business from Chinese players, so the separation will be painful. Applied Materials has said that trade rules restricted it from more than 10% of the China market in 2023. The fab construction subsidies in the CHIPS Act are bringing additional capacity to the U.S. and the European Chips Act to Europe. At the same time, countries like China, India, Japan, South Korea and Taiwan are also aggressively wooing chipmakers to set up fabs. The onset of the AI revolution has everyone thinking that demand will accelerate manifold while strategic interests make such investments imperative.

Still-high interest rates are not expected to hold true in the case of WFE. For one thing, semiconductor demand is too strong at the moment and existing capacity just not enough. And second, most of the large equipment makers that account for the bulk of industry revenues, work closely with their clients through the development and markeing phases, especially now mothe manufacturing complexities are increasing ad reducing cost of ownership is a necessity. Therefore, sales are usually confirmed before the products actually hit the market. Also, equipment purchases are generally long-term strategic decisions, so demand tends to be relatively stable.

Geopolitical tensions such as Ukraine and Gaza continue. China’s increasing possessiveness about Taiwan is another concern. While this isnt conducive to

Zacks Industry Rank Reflects Limited Growth Prospects

The Zacks Semiconductor Equipment -Wafer Fabrication Industry is a stock group within the broader Zacks Computer And Technology Sector. It carries a Zacks Industry Rank #225, which places it in the bottom 10% of 250+ Zacks-classified industries.

Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1. So the group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates that market conditions, although improving, are not yet supportive of growth..

The industry’s aggregate earnings estimate revision for 2024 shows significant variation over the past year for a net 1.4% increase. The 2025 revision represents a 9.4% increase from 2024, picking up strongly from February.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

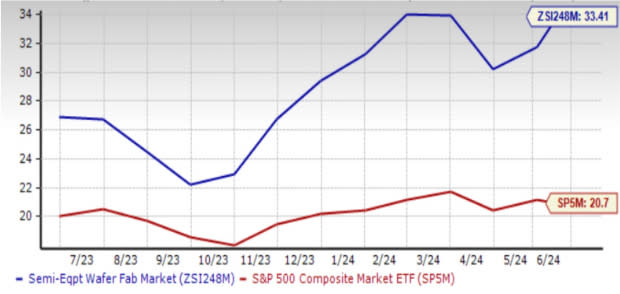

Industry Leads on Shareholder Returns

Looking at the Zacks Semiconductor-Wafer fab Equipment industry’s performance over the past year, it appears that there was some negative sentiment between August and October of last year, but sentiments turned thereafter as the industry soared to reach and then exceed both the broader sector and the S&P 500. This may be attributed to the long-term demand outlook for the industry, which trumps the uncertainty inherent in many others as the broader economy appears to be slowing down. The relative stability that comes from the long sales cycles and contracts are could be other reasons.

Net-net, the stocks in this industry have collectively gained 53.7% over the past year, while the Zacks Computer and Technology Sector gained 28.9% and the S&P 500 Composite 15.9%.

One-Year Price Performance

Image Source: Zacks Investment Research

Industry's Valuation Is Rich

On the basis of the forward 12-month price-to-earnings (P/E) ratio, a commonly used method of valuing semiconductor equipment stocks, we see that the industry is overvalued. It is currently trading at a 33.41X multiple, which is close to its highest point of 33.54X over the past year. The industry is also trading at an 20.6% premium to the sector’s 27.71X and a 61.4% premium to the S&P 500’s 20.7X.

Over the past year, the industry has traded as high as 33.54X, as low as 21.99X and at a median of 29.07X, as the chart below shows.

Forward 12 Month Price-to-Earnings (P/E) Ratio

Image Source: Zacks Investment Research

3 Stocks with Solid Long-Term Outlook

The strongest driver for the semiconductor and allied industries is the ongoing adoption of artificial intelligence, as well as things like IoT, automation/robotics, EVs and renewable energy, each with multiple legs of growth. Semiconductor demand boosts demand for related equipment, particularly as a result of step-up in Chinese spending, government incentives in several countries and production in new geographies.

Equipment demand is also more stable than chips, because semiconductor manufacturing equipment is high-value and so, is developed with significant customer collaboration. It is also a part of their long-term planning process. Geopolitical tensions could increase demand but could also disrupt the supply chain, thereby increasing cost and hurting profitability.

Here are three of #3 (Neutral) rated stocks that are worth keeping an eye on:

Applied Materials, Inc. (AMAT)

Applied Materials offers manufacturing equipment, services and software to the semiconductor, display, and related industries. Its long-term strategy positions it for continued strength in performance.

First, the company has deep customer relationships, which allows it to foresee inflections in the market that are so important for equipment makers to capitalize on. Therefore, it is one of the most important players catering to new and important trends in AI, IoT, EVs, renewable energy and the like. The close ties with customers and partners also help it develop product designs in close and early collaboration with customers, reducing the time to market and ensuring a strong uptake.

Second, the company has a huge breadth of products and capabilities, which along with its close relationships allow it to combine, co-optimize and integrate its technologies to develop customized solutions.

Third, It was an early investor in materials technology, which should help it gain leverage as manufacturing gets more complex, especially at the smaller nodes.

Fourth, its strategy of selling integrated solutions increases dollar content per product (integrated solutions have grown from a 20% revenue share in 2019 share to 30% today).

The company is strongly positioned to expand its total available market as HBM takes off this year. Management expects its HBM business to grow at a CAGR of 50% (it made up 5% of DRAM output in 2023) over the next few years with 2024 revenues growing 6X over 2023.

Another important inflection point is the shift from FinFET to gate-all-around grows Applied’s available market by $1 billion for every 100,000 wafer starts per month of capacity. Management expects that its share gains in this market will allow it to capture over 50% of the spending for the process equipment used in this new transistor module. The company is optimistic about continued share gains in its all its served markets.

The services business (AGS) is tied to the equipment business, and over time, a significant portion has become subscriptions-based. Currently, almost 17,000 tools are under service agreements, up 8% year-on-year. The high renewal rates of over 90% lend stability and visibility to revenues. Increasing fab utilization this year is driving demand in this segment.

2024 is shaping up well for the company, with leading-edge foundry-logic growing year-over-year, despite some important projects getting delayed. On the memory side, both NAND and DRAM are expected to grow this year.

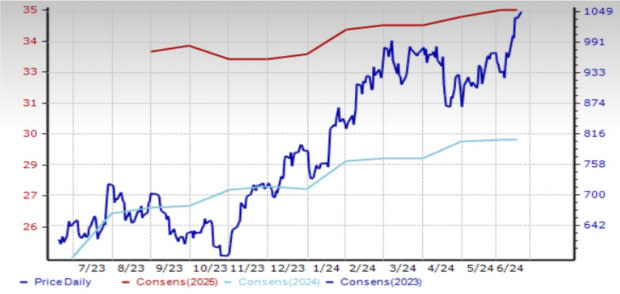

The Zacks Consensus Estimate for 2024 (ending October) has increased 27 cents (3.4%) in the last 30 days. The Zacks Consensus Estimate for 2025 has increased 19 cents (2.1%) during the same period. Analysts currently expect revenue and earnings in 2024 to grow a respective 1.4% and 3.2%. In 2025, they’re expected to grow a respective 9.8% and 13%.

Shares of the company have appreciated 70.6% over the past year.

Price and Consensus: AMAT

Image Source: Zacks Investment Research

Lam Research Corporation (LRCX)

Lam Research designs, manufactures, markets, refurbishes and services semiconductor processing equipment used in the fabrication of integrated circuits.

Lam has been diversifying its focus to foundry, logic and specialty technology segments by stepping up investments in innovation and new products. This diversification strategy has better positioned it to tap the technology inflection-driven potential in these segments of the market.

The next few years will see tremendous leaps in WFE spending for advanced compute, memory and storage. Storage in particular is at the very early stages, as 80% of enterprise data is still stored on HDDs. However, with improvements in NAND capability and cost, it’s extremely likely that its faster read-write capabilities will find many more takers.

Currently, its DRAM business is being driven by WFE spending on HBM, and stronger-than-expected demand from domestic China. On the NAND side, demand is expected to remain strong through the rest of the year and in 2025, driven by generative AI and other technologies. Foundry logic is being driven by China, which is running stronger than expected although sales are expected to drop off in the second half. Higher utilization is driving spares revenue.

Management expects semiconductor industry revenues to reach a trillion dollars by the end of the decade, involving considerable increases in manufacturing complexity. They believe that this will double WFE spending from 2023 levels. Lam's served markets of etch and deposition are expected to outpace growth in overall WFE and management has strategic initiatives in place to tap this potential.

The company is building its facilities close to its customers’ R&D labs (for example, such as in Korea, Taiwan and the US) to facilitate collaboration and reduce the time to solutions. It is also using its proprietary digital modeling technique called Semiverse Solutions that will reduce the time and cost of technology development.

In the last 30 days, there is no change in the Zacks Consensus Estimate for 2024 (ending June) and 2025. Both revenue and earnings are expected to decline in the mid-teens percentage rate this year (because of the slump in the memory market to which Lam has considerable exposure). In 2025 however, they are expected to grow 15.6% and 19%, respectively.

LRCX shares have appreciated 71.2% over the past year.

Price and Consensus: LRCX

Image Source: Zacks Investment Research

ASML Holding N.V. (ASML)

Veldhoven, the Netherlands-based ASML is the leading producer of advanced lithography tools used at the front-end of the semiconductor manufacturing process.

Like the other two major equipment makers, ASML too expects momentum in the business to continue, driven by AI, electrification and energy transition among other things. As the semiconductor market continues to expand and the technology nodes continue to shrink, the demand for its products continues to increase.

The company has orders from a number of new fabs being constructed across the world and management is also expecting a cyclical upturn in 2025, driven by all segments of the market. Additionally, ASML has several advanced tools in the pipeline for both memory and logic advanced nodes that improve upon the cost of ownership, generating higher ASPs and stronger margins for the company.

The DRAM business is currently being fueled by technology node transitions in support of advanced memories such as DDR5 and HBM. The expected slowdown in logic is mainly on account of customers digesting heavy investments in 2023. Based on a solid order book, management expects a strong 2025.

The Zacks Consensus Estimate for 2024 has increased 8 cents (less than a percentage point) while the 2025 estimate increased 67 cents (2.2%) in the last 30 days. While revenue and earnings are expected to see single-digit declines this year, analysts are looking for a 36.2% revenue increase and 55% earnings increase in 2025.

The shares are up 44.4% over the past year.

Price and Consensus: ASML

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ASML Holding N.V. (ASML) : Free Stock Analysis Report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance