Select Medical (SEM) Rises 42.4% YTD: More Growth Ahead?

Select Medical Holdings Corporation SEM, a leading healthcare company operating different types of hospitals through its subsidiaries, has performed well over the year-to-date period and has the potential to sustain momentum in the coming days.

The increase in patient days and admissions within the Critical Illness Recovery Hospital and Rehabilitation Hospital segments may bolster investor confidence. Consequently, investors may consider holding onto their current positions in the stock.

Let’s delve deeper & check the positives for the stock.

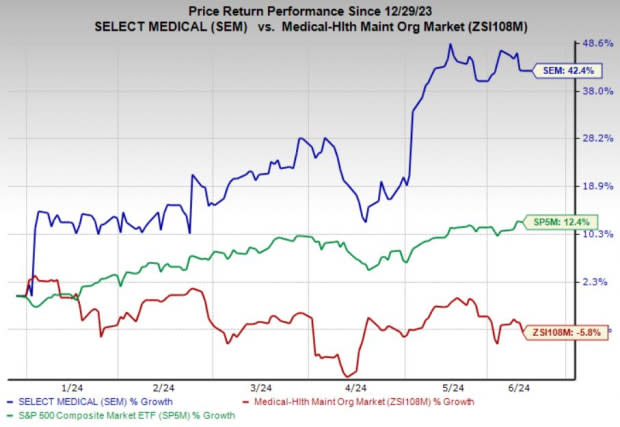

An Outperformer: A glimpse at the company’s price trend reveals that the stock has had an impressive run so far this year. Shares of SEM have returned 42.4% against the 5.8% decline of the industry it belongs to, and outperforming the S&P 500 Index’s 12.4% growth.

Image Source: Zacks Investment Research

Northward Estimate Revisions: One estimate for the 2024 bottom line moved north in the past 30 days versus no southward revision, reflecting analysts’ confidence in the company. The Zacks Consensus Estimate for 2024 earnings has moved up 2.9% during this time.

Strong Growth Prospects: The Zacks Consensus Estimate for SEM’s 2024 bottom line indicates a 5.5% year-over-year increase to $2.10 per share. The consensus estimate for 2025 indicates 12.5% growth on a year-over-year basis. The company beat earnings estimates thrice in the past four quarters and met once, with an average surprise of 19.3%.

Factors to Consider: Strategic expansion of facilities is enabling the company to capture a larger market share. The upward trend in patient admissions due to rising disease incidence signals increasing demand for its services. We expect its Critical Illness Recovery Hospital and Rehabilitation Hospital segments to witness 1.5% and 3.3% year-over-year growth in admissions this year, respectively. Similarly, we expect its Outpatient Rehabilitation and Concentra units to witness nearly 2% and 1% growth in the number of visits from the previous year, respectively.

Along with rising footfall, revenue per visit is also expected to increase in the coming days, which will further boost its revenues. The Zacks Consensus Estimate for SEM’s 2024 top line indicates 4.1% year-over-year growth to more than $6.9 billion. Moreover, to focus on its core operations, its management has given a nod for a separation plan of its Concentra business, which will improve profitability and raise shareholder value. The move is likely to be completed in late 2024.

These positive factors are likely to help this Zacks Rank #3 (Hold) company maintain its share growth trajectory and continue outperforming the industry.

Risks

Despite the upside potential, there are a few factors that investors should keep an eye on.

Its long-term debt-to-capital of 69.8% remains well above the industry’s average of 38.4%. SEM exited the first quarter with cash and cash equivalents of only $92.6 million, while long-term debt, net of the current portion, amounted to $3.8 billion, up from $3.6 billion at 2023-end.

Also, Select Medical’s return on invested capital of 6.3% is much lower than the industry average of 10.5%, reflecting a comparatively inefficient utilization of its capital. Nevertheless, we believe that a systematic and strategic plan of action to focus more on profitable operations will drive SEM’s growth in the long term.

Stocks to Consider

Investors interested in the broader Medical space may look at some better-ranked players like Sera Prognostics, Inc. SERA, HealthEquity, Inc. HQY and Brookdale Senior Living Inc. BKD, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Sera Prognostics’ 2024 bottom line suggests a 19% year-over-year improvement. SERA‘s average earnings surprise for the past four quarters is at 3.7%. The consensus mark for its current-year revenues indicates a 14.4% year-over-year increase.

The Zacks Consensus Estimate for HealthEquity’s current-year earnings implies a 30.2% increase from the year-ago reported figure. HQY beat earnings estimates in each of the last four quarters, with an average surprise of 17.2%. The consensus mark for its current-year revenues is pegged at almost $1.2 billion, which indicates a 15.9% year-over-year increase.

The Zacks Consensus Estimate for Brookdale Senior’s full-year 2024 earnings suggests a 38.1% year-over-year improvement. It has witnessed one upward estimate revision over the past 60 days against no movement in the opposite direction. BKD beat earnings estimates in two of the past four quarters and missed on the other occasions.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brookdale Senior Living Inc. (BKD) : Free Stock Analysis Report

Select Medical Holdings Corporation (SEM) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Sera Prognostics, Inc. (SERA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance