SEHK Growth Leaders With High Insider Ownership Featuring BYD And Two More

As global markets navigate through a landscape marked by fluctuating inflation rates and cautious monetary policies, Hong Kong's market dynamics offer unique opportunities for investors. In this context, companies with high insider ownership can be particularly compelling, as they often signal strong confidence from those closest to the business in its growth prospects and governance.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

New Horizon Health (SEHK:6606) | 16.6% | 62.3% |

Fenbi (SEHK:2469) | 32.1% | 43% |

Meitu (SEHK:1357) | 38% | 33.7% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

Zhejiang Leapmotor Technology (SEHK:9863) | 14.2% | 73.8% |

Beijing Airdoc Technology (SEHK:2251) | 27.4% | 83.9% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 17.7% | 93.7% |

We'll examine a selection from our screener results.

BYD

Simply Wall St Growth Rating: ★★★★☆☆

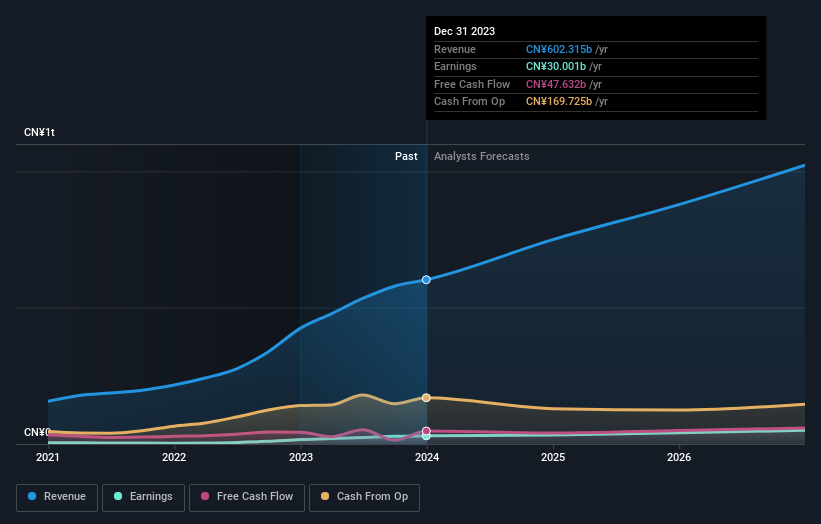

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and other international markets with a market capitalization of approximately HK$725.48 billion.

Operations: The company's revenue is generated from its automobile and battery sectors across various regions including China, Hong Kong, Macau, Taiwan, and internationally.

Insider Ownership: 30.1%

Revenue Growth Forecast: 14.5% p.a.

BYD, a growth company with substantial insider ownership in Hong Kong, has shown robust performance with earnings growing by 52.7% over the past year. Its revenue and earnings are forecasted to grow at 14.5% and 14.7% per year respectively, outpacing the Hong Kong market averages of 7.9% and 11.9%. The company's return on equity is projected to be high at 22.2%, indicating efficient management and profitability potential despite trading at a significant discount to its estimated fair value (29.5%). Recent strategic product launches like the BYD SHARK pickup truck in Mexico highlight its innovation trajectory and global market expansion efforts, enhancing its growth profile amidst competitive pressures.

J&T Global Express

Simply Wall St Growth Rating: ★★★★☆☆

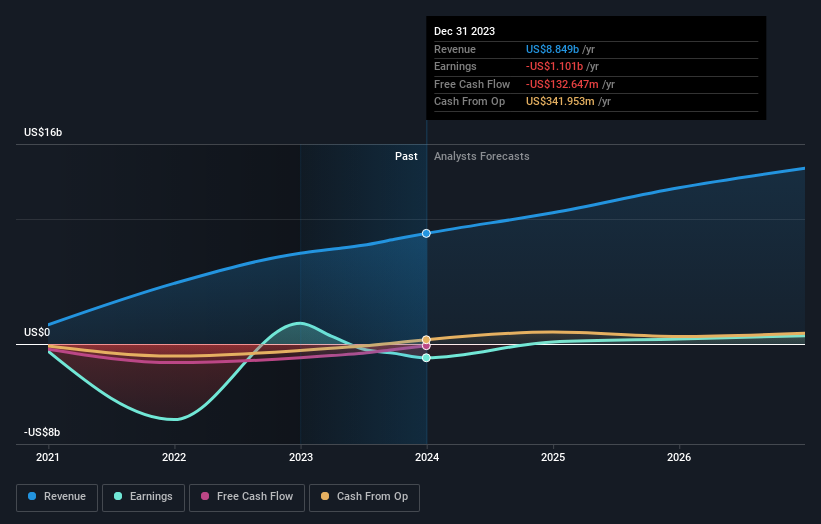

Overview: J&T Global Express Limited, an investment holding company, provides express delivery services and has a market capitalization of approximately HK$70.32 billion.

Operations: The firm specializes in express delivery services.

Insider Ownership: 20.2%

Revenue Growth Forecast: 15.5% p.a.

J&T Global Express, a Hong Kong-based growth company with high insider ownership, has recently shown significant operational strength. In the latest quarter ending March 31, 2024, parcel volume surged to 5.03 billion from 3.39 billion year-over-year. Despite recent board changes with the resignation of Mr. Yang and appointment of Mr. Lai, the company's revenue is forecasted to grow at a steady rate of 15.5% annually, outpacing the local market average of 7.9%. However, its Return on Equity (ROE) is expected to remain low at 17.6% in three years' time.

Click to explore a detailed breakdown of our findings in J&T Global Express' earnings growth report.

Our valuation report unveils the possibility J&T Global Express' shares may be trading at a premium.

Kingsoft

Simply Wall St Growth Rating: ★★★★☆☆

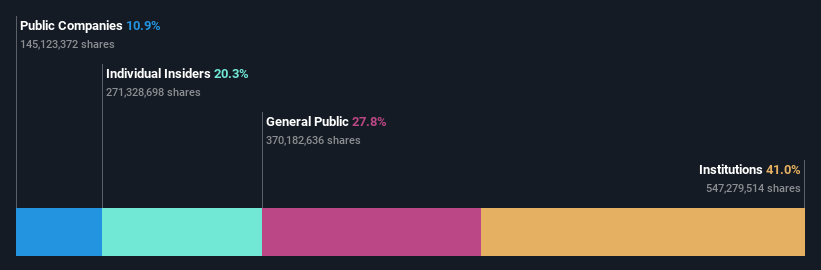

Overview: Kingsoft Corporation Limited operates in the entertainment and office software sectors, serving customers in Mainland China, Hong Kong, and internationally, with a market capitalization of approximately HK$35.02 billion.

Operations: The company's revenue is generated from two primary segments: office software and services, which brought in CN¥4.73 billion, and entertainment software and others, which accounted for CN¥3.97 billion.

Insider Ownership: 20.3%

Revenue Growth Forecast: 14.8% p.a.

Kingsoft, a notable entity in Hong Kong's tech sector, has seen substantial growth with recent earnings showcasing a significant rebound. For Q1 2024, revenue climbed to CNY 2.14 billion from CNY 1.97 billion year-over-year, and net income increased to CNY 284.57 million from CNY 192.34 million. Despite trading at 57.7% below its estimated fair value and analysts projecting a price increase of approximately 34%, its forecasted annual earnings growth of over 33% outstrips the local market's expectations significantly, though its projected Return on Equity remains modest at around 7%.

Dive into the specifics of Kingsoft here with our thorough growth forecast report.

Our valuation report here indicates Kingsoft may be undervalued.

Where To Now?

Delve into our full catalog of 53 Fast Growing SEHK Companies With High Insider Ownership here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211SEHK:1519SEHK:3888 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance