SEHK Growth Companies With High Insider Ownership And At Least 12% Revenue Growth

Amid fluctuating global markets, the Hong Kong stock market has shown resilience, with the Hang Seng Index posting modest gains. This backdrop sets an intriguing stage for investors interested in growth companies with high insider ownership and robust revenue growth. In today's investment climate, companies demonstrating strong internal confidence through high insider ownership coupled with significant revenue expansion are particularly compelling. These firms often signal stability and a deep-rooted belief in long-term prospects by their key stakeholders.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

Fenbi (SEHK:2469) | 32.5% | 43% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

Tian Tu Capital (SEHK:1973) | 33.9% | 70.5% |

DPC Dash (SEHK:1405) | 38.2% | 89.7% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 76.5% |

Beijing Airdoc Technology (SEHK:2251) | 28.2% | 83.9% |

Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

Here we highlight a subset of our preferred stocks from the screener.

iDreamSky Technology Holdings

Simply Wall St Growth Rating: ★★★★★★

Overview: iDreamSky Technology Holdings Limited is an investment holding company that operates a digital entertainment platform, publishing games through mobile apps and websites in the People’s Republic of China, with a market capitalization of approximately HK$4.45 billion.

Operations: The company generates revenue primarily from its Game and Information Services, including SaaS and other related services, totaling CN¥1.92 billion.

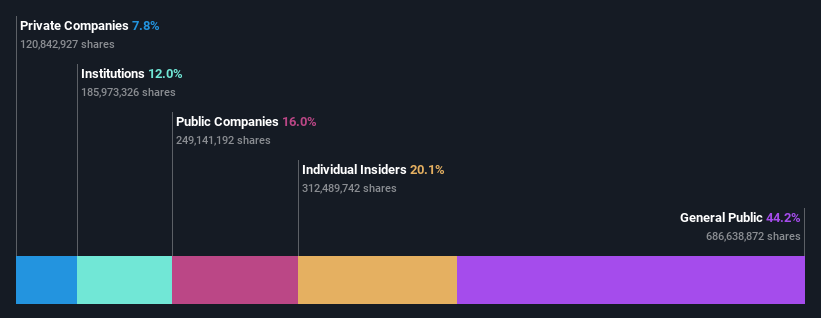

Insider Ownership: 20.1%

Revenue Growth Forecast: 29.8% p.a.

iDreamSky Technology Holdings, despite recent financial struggles with a net loss reported for 2023, shows promising signs of recovery. Insider ownership remains robust, indicating confidence from those closest to the company. The firm is poised for significant growth with revenue expected to increase by 29.8% annually, outpacing the Hong Kong market average. Additionally, profitability is anticipated within three years alongside a strong forecasted return on equity of 24.8%. These factors suggest a potential turnaround driven by internal optimism and strategic adjustments.

BYD

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$756.48 billion.

Operations: The company's revenue is generated from its automobile and battery sectors across various regions including China, Hong Kong, Macau, and Taiwan.

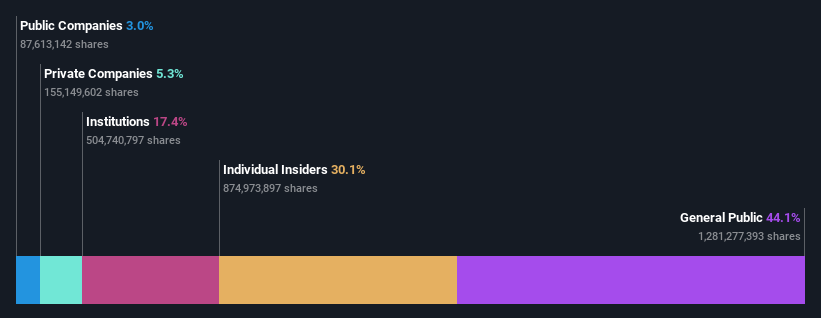

Insider Ownership: 30.1%

Revenue Growth Forecast: 13.9% p.a.

BYD, a key player in the electric vehicle market, demonstrates strong insider confidence with significant ownership and robust growth metrics. Recent amendments to company bylaws and consistent dividend payouts reflect stable governance and shareholder value focus. Notably, BYD's aggressive expansion in global markets, exemplified by the launch of BYD SHARK in Mexico, aligns with its substantial year-over-year sales and production volume increases. While its revenue growth forecasts are promising at 13.9% annually, they do not surpass the high-growth threshold of 20% per year often seen in leading growth companies.

Meituan

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meituan is a technology retail company based in the People's Republic of China, with a market capitalization of approximately HK$721.27 billion.

Operations: The company generates its revenue from various technology retail operations across China.

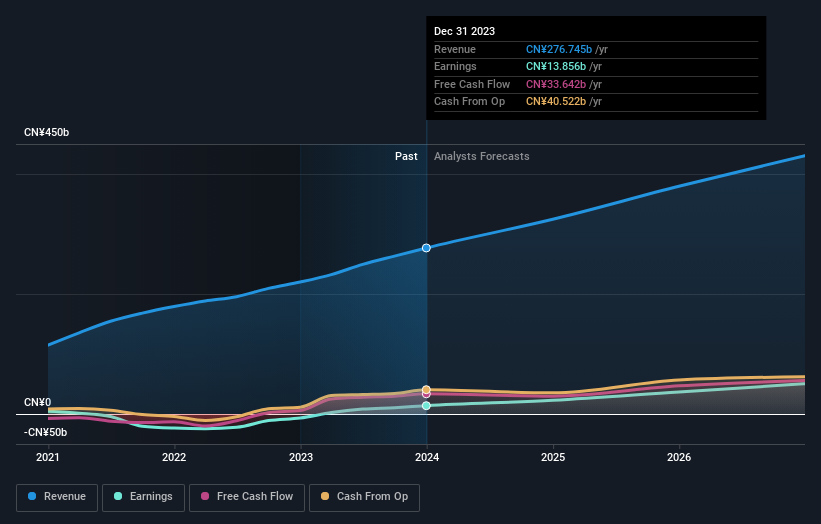

Insider Ownership: 11.4%

Revenue Growth Forecast: 12.8% p.a.

Meituan, a prominent growth company in Hong Kong with high insider ownership, recently announced a significant share repurchase program valued at US$2 billion. The company's financial performance is robust, with first-quarter sales rising to CNY 73.28 billion and net income increasing to CNY 5.37 billion. Despite substantial insider selling over the past three months, Meituan's revenue and earnings are forecasted to grow by 12.8% and 31.4% per year respectively, outpacing the Hong Kong market averages.

Click here and access our complete growth analysis report to understand the dynamics of Meituan.

Our valuation report unveils the possibility Meituan's shares may be trading at a premium.

Seize The Opportunity

Get an in-depth perspective on all 53 Fast Growing SEHK Companies With High Insider Ownership by using our screener here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1119 SEHK:1211 and SEHK:3690.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance