Sedimentary Geothermal Resources Offer a Bright Future for Geothermal Energy

Next-generation, or “next-gen,” geothermal resources have the potential to increase geothermal power generation in the U.S. by twenty-fold by 2050. Next-gen geothermal concepts use technologies developed by the oil and gas industry to engineer reservoirs for geothermal energy generation, vastly expanding the available resource base. Typically, the term next-gen geothermal refers to enhanced geothermal systems (EGS) or advanced closed-loop systems (AGS), which have been getting a lot of attention due to the success of high-profile government and private pilot projects. However, there is another, largely overlooked next-gen geothermal approach with a lower technology risk than EGS and AGS: sedimentary geothermal systems. Until recently, sedimentary geothermal resources were considered too niche, too expensive, or just lumped into the EGS bucket. Thanks to recent technological advances, cost reductions, and market demand, sedimentary geothermal resources are being viewed as a new market-ready path to clean geothermal energy.

What Are Sedimentary Geothermal Resources?

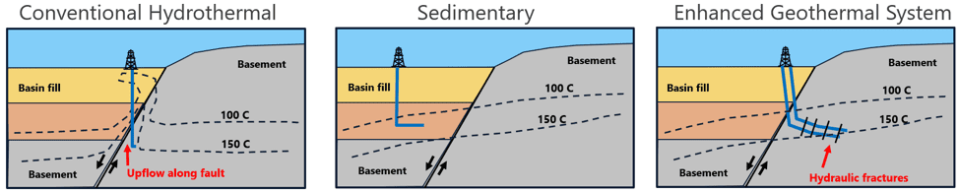

To produce economic geothermal resources, two major characteristics in the subsurface need to be present: sufficient heat and permeability. Conventional geothermal systems (often termed “hydrothermal” resources), which power the vast majority of the 30-plus geothermal power plants in the U.S., rely on finding natural fractures in reservoirs to provide permeability (Figure 1). These natural fractures and fracture networks need to be very big, because geothermal wells need significant flow rates relative to oil and gas wells in order to be economic. Due to the constraints of this unique geology, there has been limited geothermal power deployment in the U.S. equivalent to less than 4 GW of generation. [caption id="attachment_220728" align="aligncenter" width="720"]

1. Enhanced geothermal system (EGS) developments sidestep the constraint of finding natural fracture permeability and instead drill into hot, un-fractured rock and stimulate hydraulic fractures—creating their own fracture permeability. While EGS pilot projects have been occurring for decades, the recent applications of horizontal drilling and multi-stage hydraulic fracturing developed in the oil and gas industry have opened up new possibilities for EGS developments. Courtesy: Projeo[/caption] Sedimentary geothermal resources offer a middle course approach between conventional geothermal and EGS developments by targeting sedimentary rock reservoirs with high natural porosity and permeability in hot sedimentary basins (Figure 1). The use of horizontal wells completed within the reservoir can increase the flow rates of production wells and improve project economics. Many of the areas being considered for sedimentary geothermal development are data-rich traditional oil gas basins, which decreases exploration costs and project risk. A prominent example is the Gulf Coast of Texas, where multiple companies have been exploring for and developing geothermal power projects.

Technical and Market Readiness

The convergence of four factors have improved the economic feasibility of sedimentary geothermal developments. First, like EGS, sedimentary geothermal project economics benefit from oil and gas industry technology developments that have resulted in decreased drilling costs for horizontal wells. Second, these projects benefit from increasingly efficient topside generation facilities that can produce power from lower temperatures. This is significant because many viable sedimentary geothermal reservoirs are within the 100C–150C temperature range, which is typically lower than temperatures targeted for EGS. Third, since many sedimentary geothermal reservoirs are within oil and gas basins or are near heavy industrial zones, they can be utilized to power existing oil and gas infrastructure or sell power directly to industrial facilities in a “behind-the-meter” offtake agreement. (For example, an oil and gas producer using geothermal to power a nearby gas processing facility.) Finally, the market is signaling that off-takers are willing to pay a premium for firm, carbon-free electricity generation, especially in areas where there is a large penetration of intermittent renewables that are replacing coal or natural gas power generation. This is best evidenced by the state of California, which recently mandated that public utilities add 1 GW of geothermal power or other “firm” carbon-free resources by 2026, to ensure grid reliability as the state builds out its clean energy portfolio.

Sedimentary Geothermal at Work

While the industry considers exploring for and developing new sedimentary geothermal resources in the future, it can look to current producing sedimentary geothermal developments for direction. One such development is the Salton Sea geothermal fields operated by Ormat Technologies in the Imperial Valley in California. Another example is the DEEP Earth Energy Project in the Williston Basin in Canada. This greenfield geothermal project aims to be the first utility-scale geothermal power production plant in Canada when its first 5-MW pilot power plant comes online this year.

Workforce and Investments Ready to Scale

The overlap in the skillset and infrastructure needed for oil and gas development and sedimentary geothermal projects means that these projects can help transition oil industry workers to the clean energy economy. The Department of Energy (DOE) estimates there is a workforce of more than 300,000 skilled in oil and gas, and electric power industries, ready to support geothermal development. The obvious overlap is in drilling and completions, but subsurface geoscience and reservoir engineering skillsets can also be transitioned successfully from oil and gas to geothermal. In fact, there are many oil and gas subsurface workflows, like basin modeling and reservoir quality prediction, which are more applicable to sedimentary geothermal resources than conventional hydrothermal resources. The DOE is also investing in geothermal buildout, with the next big tranche of funding coming through the Geothermal Energy from Oil and Gas Demonstrated Engineering program, or “GEODE.” Set to kick off this year, GEODE is allocating $155 million over four years to geothermal technology development and demonstration projects, focusing on technology transfer from oil and gas. Sedimentary geothermal projects are well-positioned to leverage this DOE funding in concert with private capital—and are poised to play a key role in the energy transition. With the right investment and focus, this emerging resource can accelerate the country’s path to a low-carbon, sustainable energy future. —Kellen Gunderson is a project manager with Projeo.

Yahoo Finance

Yahoo Finance