Update: Seaboard (NYSEMKT:SEB) Stock Gained 11% In The Last Five Years

If you buy and hold a stock for many years, you'd hope to be making a profit. Furthermore, you'd generally like to see the share price rise faster than the market But Seaboard Corporation (NYSEMKT:SEB) has fallen short of that second goal, with a share price rise of 11% over five years, which is below the market return. Over the last twelve months the stock price has risen a very respectable 10%.

View our latest analysis for Seaboard

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Seaboard actually saw its EPS drop 44% per year.

Since the EPS are down strongly, it seems highly unlikely market participants are looking at EPS to value the company. The falling EPS doesn't correlate with the climbing share price, so it's worth taking a look at other metrics.

We doubt the modest 0.2% dividend yield is attracting many buyers to the stock. We are not particularly impressed by the annual compound revenue growth of 1.5% over five years. So why is the share price up? It's not immediately obvious to us, but a closer look at the company's progress over time might yield answers.

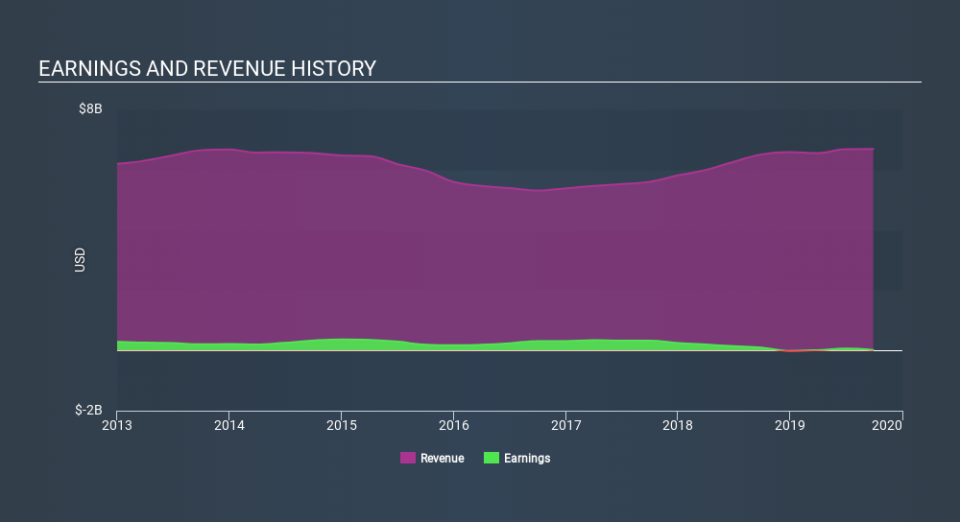

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Seaboard provided a TSR of 11% over the year (including dividends) . That's fairly close to the broader market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 2.1%. It is possible that management foresight will bring growth well into the future, even if the share price slows down. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance