Schwab (SCHW) Q4 Earnings Miss Estimates as Revenues Fall

Charles Schwab’s SCHW fourth-quarter 2019 adjusted earnings of 63 cents per share lagged the Zacks Consensus Estimate by a penny. Also, the bottom line decreased 3% from the prior-year quarter. Results for the reported quarter excluded $25 million (1 cent per share) expenses relating to two pending acquisitions.

Lower revenues and a slight rise in operating expenses hurt the results. However, rise in client assets and net new assets along with higher new brokerage accounts number acted as tailwinds.

Net income available to common shareholders was $801 million, down 9% year over year.

For 2019, adjusted earnings of $2.72 per share improved 11% year over year and beat the consensus estimate of $2.70. Net income available to common shareholders was $3.53 billion, up 6% from 2018 level.

Revenues Down, Expenses Rise

Net revenues for the quarter were $2.61 billion, down 2% year over year. The fall was due to decline in trading revenues (down 58%), net interest revenues (down 2%), and other revenues (down 2%) partially offset by a 12% rise in asset management and administration fees. The reported figure marginally surpassed the Zacks Consensus Estimate of $2.60 billion.

For 2019, net revenues grew 6% to $10.72 billion, while lagging the consensus estimate of $10.73 billion.

Total non-interest expenses rose 2% year over year to $1.49 billion. All expense components, except regulatory fees and assessments costs, advertising and market development costs, and other costs, increased.

Pre-tax profit margin declined to 42.7% from 45.3%.

At the end of the fourth quarter, Schwab’s average interest-earning assets grew nearly 1% year over year to $269.8 billion.

Annualized return on equity as of Dec 31, 2019, came in at 17%, down from 20% at the end of prior-year quarter.

Other Business Developments

As of Dec 31, 2019, Schwab had total client assets of $4.04 trillion (up 24% year over year). Also, net new assets, brought by new and existing clients, were $77.3 billion, up 40%.

Schwab added 433,000 new brokerage accounts in the reported quarter, up 14% from the year-ago quarter. As of Dec 31, 2019, the company had 12.3 million active brokerage accounts, 1.4 million banking accounts and 1.7 million corporate retirement plan participants.

Share Repurchase Update

Schwab repurchased 6.4 million shares for $230 million during the fourth quarter.

Our Take

Schwab’s planned acquisitions of TD Ameritrade AMTD and USAA’s Investment Management Company are likely to enhance its profitability over time. The company also intends to strengthen trading business by offering commission free trading, which will likely result in higher client assets and brokerage accounts.

However, continuous rise in expenses (due to higher compensation costs) is expected to hurt the bottom line. Moreover, a dismal interest rate scenario might hurt margins.

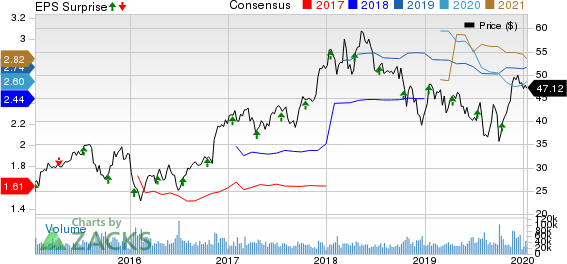

The Charles Schwab Corporation Price, Consensus and EPS Surprise

The Charles Schwab Corporation price-consensus-eps-surprise-chart | The Charles Schwab Corporation Quote

Currently, Schwab carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Release Dates of Other Investment Brokers

We now look forward to TD Ameritrade, Raymond James RJF and E*TRADE Financial ETFC, which are slated to announce results on Jan 21, Jan 22 and Jan 23, respectively.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, SherazMian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

TD Ameritrade Holding Corporation (AMTD) : Free Stock Analysis Report

Raymond James Financial, Inc. (RJF) : Free Stock Analysis Report

E*TRADE Financial Corporation (ETFC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance