Saudi Prince’s Trillion-Dollar Makeover Faces Funding Cutbacks

(Bloomberg) -- Saudi Arabia is likely to cut billions of dollars in spending on some of its biggest development projects, and place other plans on hold, as the kingdom grapples with the scale of its vast economic makeover.

Most Read from Bloomberg

Tesla Delays Robotaxi Event in Blow to Musk’s Autonomy Drive

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Stock Rotation Hits Megacaps on Bets Fed Will Cut: Markets Wrap

Saudi Prince’s Trillion-Dollar Makeover Faces Funding Cutbacks

A government committee led by the de facto Saudi ruler, Crown Prince Mohammed Bin Salman, is close to completing a sweeping review of mega projects including the sprawling desert development known as Neom, people familiar with the matter said, asking not to be identified as the information is private.

Neom, which is being developed on the Red Sea coast, is expected to be allocated 20% less than its targeted budget for this year, the people said. Its plans to launch a new airline for the area are on hold, they said.

Other developments being curtailed include Qiddiya Coast, an unannounced tourism and entertainment project in Jeddah on the Red Sea that had a potential budget of $50 billion at one point, according to the people.

The cuts mark a shift in priorities for Saudi Arabia, which under its Vision 2030 plan to reshape the economy has announced projects costing an estimated $1.25 trillion. Lower oil prices, weaker-than-projected foreign investment and at least three more years of deficits in the national budget means it must now decide what to focus on first and at what pace.

“The reality is that this kind of spending would create some sort of overheating in the economy and that’s not really desirable,” said Jean-Michel Saliba, Bank of America Corp.’s Middle East and North Africa economist. “There’s also a risk to the profitability of projects if they go ahead sort of unabated without financial constraint.”

New from Bloomberg: Get the Mideast Money newsletter, a weekly look at the intersection of wealth and power in the region.

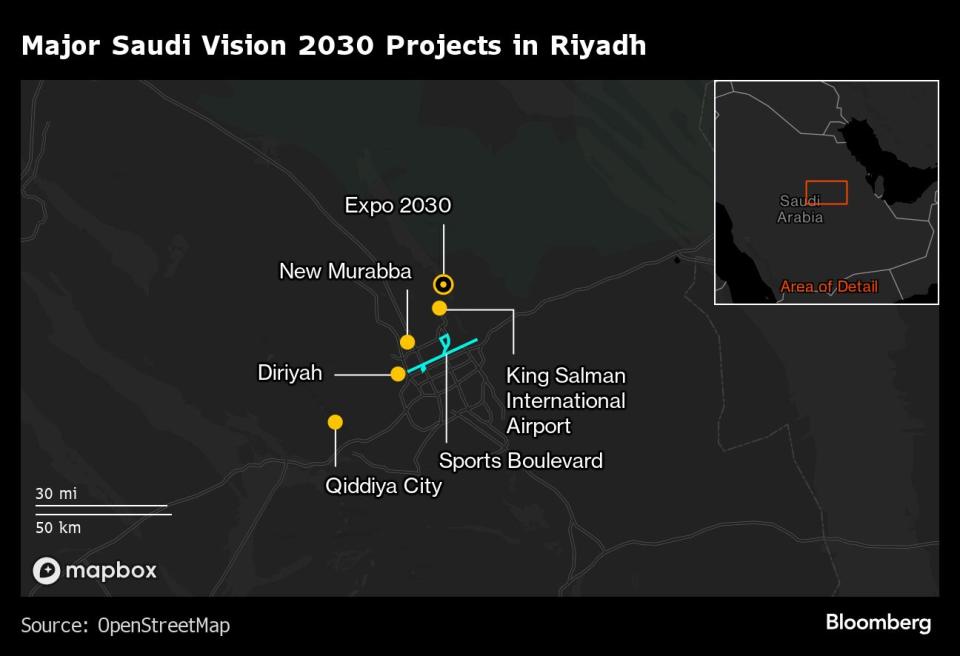

Saudi Arabia had said in December that some projects would be delayed or accelerated after the government reviewed its ability to finance its commitments without affecting its credit rating. In particular, the capital Riyadh is benefiting as developments there take priority over ones like Neom, some of the people said.

While Vision 2030 may not mirror Saudi Arabia’s initial intentions, the “rightsizing” of projects is a sign the kingdom is maturing, said Goldman Sachs Group Inc.’s MENA economist, Farouk Soussa.

“What they’re doing in terms of adjusting these projects gives us a lot of comfort,” Soussa said. “They’re basically saying they’re not going to go for broke or bet the house on any one particular thing. If it’s possible, they’ll do it. If not, they won’t. They’re being quite sensible.”

MBS unveiled his economic transformation plan eight years ago. The kingdom has since announced projects so vast that real estate consultant Knight Frank has projected that it could become the world’s biggest construction market.

Neom, MBS’s most high-profile development, is now facing the first ever significant cuts to its targeted spending, people familiar with the matter said. Its signature project — a pair of mirror-clad towers expected to eventually span the length of about 105 miles called The Line — has already seen some plans scaled back, Bloomberg has reported.

Further downsizing of others is expected as the government committee delivers its decisions, they said. The kingdom’s plans for its projects remain flexible, with most still under review, all final decisions taken by the crown prince and further changes possible at any time, people familiar with the matter said.

Officials for Qiddiya declined to comment. Officials at Neom and in the Saudi government didn’t comment.

Prioritizing

Any change in the scale or pace of large Saudi developments would have ramifications for both local and international businesses. A person familiar with the work of one Chinese company on a project inside Neom said it had been scaled down substantially, though the firm is seeing new demand in Riyadh.

Even though some spending will be crimped, Saudi Arabia will continue to be a big spender on construction. The kingdom has slated capital expenditures of more than $50 billion for 2024 to support mega projects.

In addition, many of its largest projects have been backed by Saudi Arabia’s Public Investment Fund. The sovereign wealth fund, which has almost $1 trillion in assets, aims to deploy as much as $70 billion in capital a year from 2025, though some of that will be on investments abroad. The PIF declined to comment.

New developments are still regularly being announced and some plans that have long been under way are progressing. Projects in Riyadh have become a priority as Saudi Arabia prepares to host the 2030 World Expo in the capital and potentially the 2034 FIFA World Cup, according to people familiar with the matter.

Plans to develop Riyadh’s airport into one of the world’s biggest, a giant new urban development called New Murabba, and the entertainment city of Qiddiya in the capital are all continuing, the people said. The historical heritage project in northwest Riyadh known as Diriyah is also moving ahead, with a contract worth $2 billion awarded this week.

Evidence of Saudi Arabia’s funding challenges have been piling up. The kingdom recently raised more than $12 billion by selling shares in state-backed oil giant Saudi Aramco and has been one of the most active issuers of international sovereign debt among emerging markets this year.

Meanwhile, the PIF faces its own constraints, becoming an active debt issuer itself and also encouraging its subsidiaries to borrow more. Aramco, whose dividends are a crucial source of cash for the government and the PIF, also raised $6 billion in its first bond sale in three years this week.

Part of the kingdom’s challenge is to now balance spending with meaningful increases in foreign direct investment.

Quarterly inflows have struggled to gather pace since 2022, when a group co-led by BlackRock Inc. invested $15.5 billion in Saudi Arabia’s natural gas pipelines.

The kingdom saw FDI inflows of about $4.5 billion in the first quarter, suggesting significant increases will be needed to reach the 2024 target of $29 billion.

“A big part of this is down to the magnitude of the overall spending and investment that’s needed,” said Monica Malik, chief economist at Abu Dhabi Commercial Bank PJSC. “Projects have been fighting each other for resources, and people and prices are going up.”

--With assistance from Fahad Abuljadayel.

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance