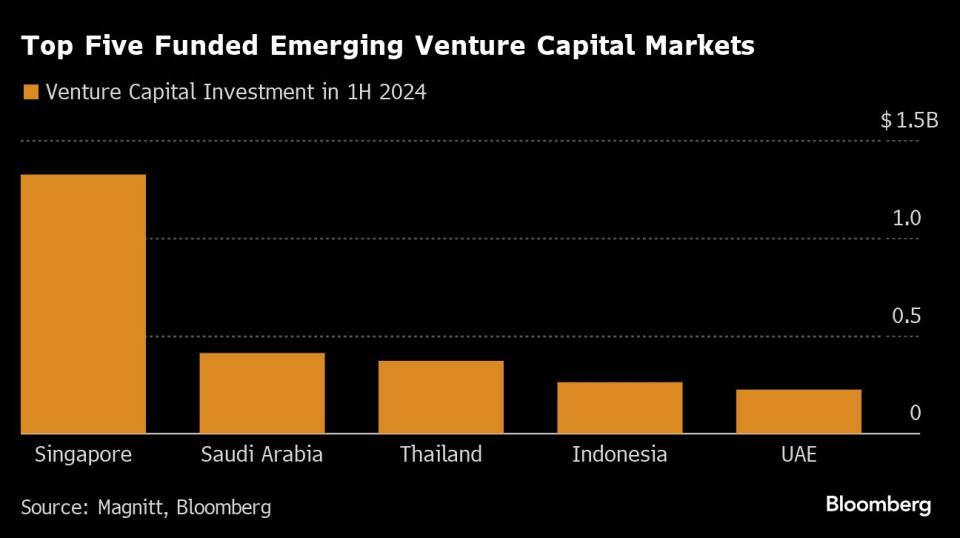

Saudi Arabia Trails Only Singapore in Emerging Market VC Funding Race

(Bloomberg) -- Saudi Arabia ranked second across the emerging-market venture capital space in the first half of 2024, trailing only Singapore, according to VC data firm Magnitt.

Most Read from Bloomberg

Biden Vows to Stay in 2024 Race Even as NATO Gaffes Risk His Campaign

Tesla Delays Robotaxi Event in Blow to Musk’s Autonomy Drive

US and Germany Foiled Russian Plot to Kill CEO of Arms Manufacturer Rheinmetall

Software startup Salla raised $130 million in the period, boosting the kingdom’s venture capital fundraising to $412 million — the highest in the Middle East and North Africa, the Dubai-based company said.

However, startup funding in both the MENA region and emerging markets including Southeast Asia fell by more than a third from a year earlier as investors sought more early-stage deals that raise less money.

Venture capital investment in MENA alone amounted to $768 million, the worst first-half performance since the Covid-19 pandemic, Magnitt said. Deal count also dropped, by 18% to 211.

The data reflects a broader slowdown in the industry as investors shift attention toward funding rounds of $1 million to $5 million, according to Magnitt. So-called mega-rounds of $100 million or more have been on the decline.

“They have shifted away from late stage to early stage investments because of the high cost of capital,” said Magnitt Chief Executive Officer Philip Bahoshy. “Startups now have to be cost efficient, they cannot just rely on another investment round to raise funds.”

Saudi Arabia was a notable standout for Magnitt, which said VC fundraising there was down 7% from a year ago — far less than its peers. Saudi startups like Salla have received a significant boost from investments by local VC fund STV and Sanabil, a unit of the kingdom’s sovereign wealth fund known as the PIF.

New from Bloomberg: Get the Mideast Money newsletter, a weekly look at the intersection of wealth and power in the region.

New from Bloomberg: Get the Mideast Money newsletter, a weekly look at the intersection of wealth and power in the region.

The Saudi Public Investment Fund has been funneling money into tech firms and startups as it seeks to build a VC industry and encourage young entrepreneurs to set up businesses to diversify the economy and add jobs.

The UAE ranked second in MENA fundraising. Startups there raised $225 million, down 19% from a year earlier. Still, the market proved resilient as deal count increased, Magnitt said.

The venture capital industry in the MENA region is also drawing more attention. The number of investors in regional startups jumped by 30% from a year earlier, indicating “strong and sustained interest,” Magnitt said.

The e-commerce and retail industry was the biggest recipient of funding, while fintech claimed the highest number of deals, according to the firm.

‘Bit of Sobriety’

In Asia, Singapore startups raised more $1.3 billion, boosted in part by three mega deals.

Broader fundraising across Southeast Asia, the Middle East, Pakistan, Turkey and Africa totaled $3.5 billion in the first half, down 34% from a year earlier, Magnitt data showed.

Alexandre Lazarow, global venture capitalist and founder of Fluent Ventures, attributed lower levels in part to more practical investing strategies.

“People had been investing with very little diligence in much larger rounds. Blitzscaling was in vogue,” Lazarow said in an interview. “What’s coming back today is a little bit of sobriety on how to build a company and invest in that company.”

He expects the market to pick up again in early 2025.

(Updates to add context in the lede and throughout)

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance