SAP Stock Gains 59% in a Year: Will the Rally Continue?

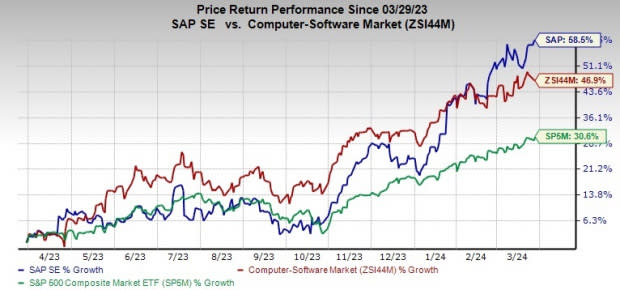

SAP SE SAP stock is continuing its upward trajectory, with a gain of 58.5% in the past year compared with 30.6% and 46.9% growth of the S&P 500 Composite and the sub-industry, respectively.

The company is one of the largest independent software vendors in the world and the leading provider of enterprise resource planning (ERP) software. SAP boasts an extensive partner ecosystem with more than 20,000 partners worldwide in over 140 countries.

Cloud Strategy Paying Off

SAP has been primarily concentrating on expanding its cloud business to become one of the leading players in the category. Current cloud backlog — a key indicator of go-to-market success in cloud business — increased 25% (up 27% at cc) to €13.75 billion in the last reported quarter.

The company’s efforts have received a major push with the launch of Rise with SAP solution. This solution helps companies transform their business processes and operations to become more nimble, digital and intelligent. The solution continues to gain significant traction and will help the company drive its market share in the cloud ERP solutions’ space.

Image Source: Zacks Investment Research

Momentum in SAP’s business technology platform, particularly S/4HANA solutions, augurs well. More companies have begun deploying S/4HANA solutions partly or entirely in the cloud. In the fourth quarter of 2023, SAP S/4HANA cloud revenues increased 55% (up 61% at cc) year over year to €1.03 billion.

SAP S/4HANA’s current cloud backlog was up 58% (up 61% at cc) year over year. Rise with SAP will also help the company boost the uptake of its SAP S/4HANA solution by providing customers with more options for implementation and support from certified partners.

Frequent product launches like Grow with SAP and SAP Datasphere, as well as strategic acquisitions and collaborations, bode well for its cloud business.

Opportunities in Generative AI

Management remains optimistic about the generative AI trend and expects it to positively impact revenues going forward. SAP recently teamed up with NVIDIA for empowering enterprise customers to leverage data and generative AI more effectively across its cloud solutions and applications.

The companies are working together to develop and offer SAP Business AI, which includes scalable, industry-specific generative AI capabilities within SAP's Joule copilot and throughout the company's cloud solution and application portfolio. The generative AI center offers quick access to a wide variety of large language models and supports reliable and ethical business AI.

With the focus on vital strategic growth areas, especially Business AI, and to position the company for future growth, SAP is taking up a restructuring program in 2024. Under this plan, it intends to eliminate 8,000 positions across its operations to ensure that the company’s skill set and resources are well-poised to meet future business requirements.

It expects to incur around €2 billion in restructuring expenses. The majority of these expenses is expected to be recognized in the first half of 2024, thereby affecting IFRS operating profit. The restructuring program is not expected to provide major cost benefits in 2024, per management.

Robust Outlook

Management anticipates cloud revenues for 2024 in the range of €17-€17.3 billion, suggesting an increase of 24-27% at cc from the prior-year levels. Cloud and software revenues are now expected between €29 billion and €29.5 billion, implying 8-10% growth at cc from the year-earlier actuals.

Management projects non-IFRS operating profit in the range of €7.6-€7.9 billion, indicating a rise of 17-21% at cc. Free cash flow is estimated to be €3.5 billion.

The company continues to expect cloud revenues and total revenues of more than €21.5 billion and €37.5 billion, respectively, for 2025. Free cash flow is now projected to be €8 billion compared with the earlier projection of €7.5 billion.

Estimate Revision Activity

On a year-over-year basis, revenues for 2024 and 2025 are projected to rise 8.5% and 11.6% to $36.56 billion and $40.81 billion, respectively.

SAP’s earnings per share (EPS) are indicated to climb 15.7% on a year-over-year basis to $7.44 in 2025. The long-term EPS growth rate is 11.1%.

Few Headwinds

However, continued softness in the software license and support business segment coupled with global macroeconomic weakness is concerning. Increasing costs and stiff competition are additional headwinds for this Zacks Rank #3 (Hold) stock.

Moreover, SAP revised its guidance for some metrics for 2025. Non-IFRS cloud gross profit is now expected to be €16.2 billion (including share-based compensation expenses of €0.1 billion) compared with the earlier projection of €16.3 billion (excluding share-based compensation expenses).

Non-IFRS operating profit is now anticipated to be €10 billion (which includes share-based compensation expenses of €2 billion) compared with €11.5 billion (excluding share-based compensation expenses) projected earlier.

Stocks to Consider

Some better-ranked stocks worth consideration in the broader technology space are Manhattan Associates MANH, Synopsys SNPS and Microsoft MSFT. While MANH and SNPS sport a Zacks Rank #1 (Strong Buy) each, MSFT carries a Zacks Rank of 2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MANH’s 2024 EPS has increased 3.6% in the past 60 days to $3.76. Manhattan Associates’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 27.6%. Shares of MANH have surged 66.1% in the past year.

The Zacks Consensus Estimate for SNPS’ fiscal 2024 EPS stands at to $13.38. The long-term earnings growth rate is 17.5%. SNPS’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 4.1%. Shares of SNPS have soared 52.9% in the past year.

The Zacks Consensus Estimate for Microsoft’s fiscal 2024 EPS is pegged at $11.63, indicating growth of 18.6% from the year-ago levels. MSFT’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 8.8%. The long-term earnings growth rate is 16.2%. Shares of MSFT have rallied 50.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

SAP SE (SAP) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance