Sandstorm Gold (SAND) Q2 Earnings & Revenues Miss Estimates

Shares of Sandstorm Gold Ltd SAND have declined 8% since reporting second-quarter 2021 results on Aug 5, as higher costs negated the impact of record attributable gold equivalent ounces and higher revenues, leading to weaker-than-expected results. The company reported earnings per share of 4 cents, which missed the Zacks Consensus Estimate of 5 cents. The bottom line came in-line with the year-ago quarter as increase in cost of sales and higher tax expense negated gains from higher revenues.

Sandstorm Gold’s total revenues were $26.4 million, which lagged the Zacks Consensus Estimate of $30 million. Total revenues, however, increased 41% year over year due to an increase in the attributable gold equivalent ounces, and a 5% increase in the average realized selling price of gold. The company reported record attributable gold equivalent ounces of 18,004 ounces compared with 10,920 ounces in the prior-year quarter.

Cost of sales was up 45.6% year over year to $4.1 million during the reported quarter. Gross profit soared 78% year over year to $13.5 million. Gross margin was 51.2% in the second quarter compared with the prior-year quarter’s 40.6%.

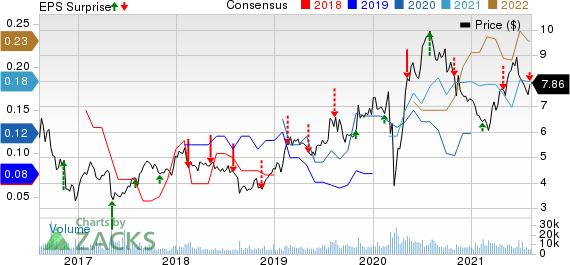

Sandstorm Gold Ltd Price, Consensus and EPS Surprise

Sandstorm Gold Ltd price-consensus-eps-surprise-chart | Sandstorm Gold Ltd Quote

Average cash cost per attributable gold equivalent ounce was $227 in the reported quarter, down from $257 per ounce in the second quarter of 2020. Cash operating margins was $1,569 per attributable gold equivalent ounce in second-quarter 2021, marking an increase from $1,458 per ounce in the prior-year quarter.

Financial Position

Sandstorm Gold had cash and cash equivalents of $45.8 million as of Jun 30, 2021, down from $114 million held as on Dec 31, 2021. Net cash provided by operating activities for the first half of 2021 was $43.7 million, up from the prior-year period’s $27.7 million. The increase in cash flow was due to the higher number of attributable gold equivalent ounces sold and a rise in the average realized selling price of gold and silver.

The company had no bank debt as of Jun 30, 2021. During the second quarter, Sandstorm Gold entered into over $140 million in stream and royalty transactions. These acquisitions provide it with immediate cash flow, exposure to quality assets, increased diversification, and exploration upside.

Guidance

Sandstorm Gold expects attributable gold equivalent ounces between 62,000 ounces and 69,000 ounces in 2021. The company provided its 2025 guidance for attributable gold equivalent production to be over 125,000 ounces.

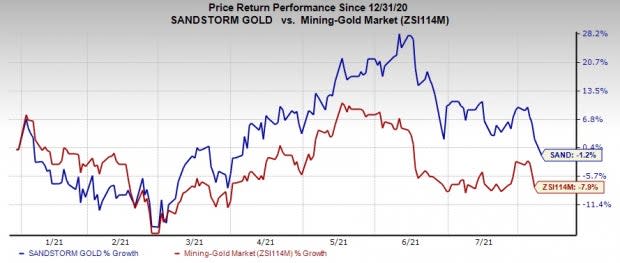

Price Performance

Shares of the company have fallen 1.2% so far this year compared with the industry’s decline of 7.9%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Sandstorm Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space include Nucor Corporation NUE, Cabot Corporation CBT and Dow Inc. DOW.

Nucor has a projected earnings growth rate of 455% for 2021. The company’s shares have soared 103% so far this year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cabot has an expected earnings growth rate of 137% for the current fiscal year. The company’s shares have gained 20% so far this year. It currently sports a Zacks Rank #1.

Dow has an estimated earnings growth rate of 403% for the current year. So far this year, the company’s shares have gained 11%. It currently carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sandstorm Gold Ltd (SAND) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance