Samsung Billionaire Jay Y. Lee Acquitted in Succession Suit

(Bloomberg) -- Samsung Electronics Co. Executive Chairman Jay Y. Lee scored an important victory Monday after a Seoul court acquitted him of stock manipulation charges, allowing the billionaire to keep leading a conglomerate under threat from rivals old and new.

Most Read from Bloomberg

A 99% Bond Wipeout Hands Hedge Funds a Harsh Lesson on China

Epstein Contacted Staley for Years at Barclays Using Go-Between, Court Filings Claim

Citadel Among Hedge Funds That Got Morgan Stanley’s Block-Trading Leaks

Xi’s Markets Shakeup Surprised Insiders, Showing Alarm Over Rout

The acquittal lifts a weight off the world’s largest maker of memory chips and displays, which is struggling with a global downturn and a stiff challenge from Apple Inc. in smartphones and SK Hynix Inc. in the nascent field of AI. The surprise decision finally removes the threat of jail time that’s dogged one of Korea’s most prominent businesspeople for years.

A Seoul Central District Court judge delivered the verdict after about an hour’s recitation of the ruling, focusing on whether Lee manipulated the 2015 merger of Samsung C&T Corp. and Cheil Industries Inc. to gain influence and improper benefit. On Monday, the judge pointed out a litany of inadequacies in the case, including inadmissible evidence and a lack of proof about Lee’s intentions or that Samsung and Lee misled shareholders.

Samsung’s shares finished 1.2% lower after the verdict was handed down. An expressionless Lee left the courtroom without speaking with reporters. His lawyers said in a statement they felt this vindicated the handling of the controversial 2015 deal and thanked the court.

“The ruling reflects the economic sentiment,” said Kim Sung-soo, who teaches political science at Seoul’s Hanyang University. “There are people who don’t want to shackle Korea’s biggest company, though there will be people who will raise questions about justice.”

Lee, 55, was embroiled for years in legal struggles that rocked the tech establishment and triggered a political scandal that led to the impeachment of former President Park Geun-hye. In November, prosecutors sought a five-year prison sentence along with a 500 million won ($376,000) fine for Lee on charges of stock-price rigging and accounting fraud. The charges were connected to the merger of the two Samsung affiliates, which prosecutors said helped cement Lee’s control of the conglomerate.

Special prosecutors first indicted him in 2017 on separate charges of bribery and corruption, alleging Samsung provided horses and other payments to a confidante of Park’s in exchange for government support in his succession. He was convicted and spent time in and out of jail until he was paroled in 2021.

In 2022, he secured a presidential pardon from the graft charges, allowing him to formally take the helm of the conglomerate that his grandfather created in 1938.

Monday’s case was related to the original charges, and centers on whether Lee and Samsung used illegal means to help him take control of the Samsung Group, which also encompasses shipbuilding, construction and finance. Lee has denied wrongdoing and in his final argument in November, he pleaded for a chance to lead South Korea’s biggest company at a time of heightened geopolitical risks and technological disruption.

Why Samsung’s Billionaire Heir Is In and Out of Jail: QuickTake

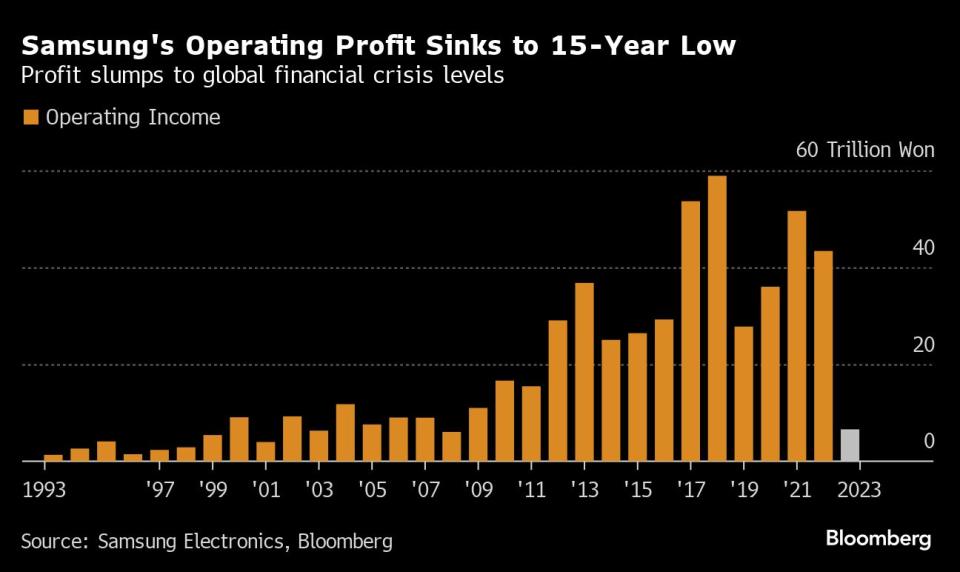

The verdict is especially encouraging to a company struggling to find a way out of a global smartphone and memory chip slump that’s engulfed the industry’s largest players for well over a year. In January, Samsung posted its fourth straight quarter of profit decline, underscoring the extent to which its fortunes have waned alongside macroeconomic and demand declines.

At the same time, the company is in the unaccustomed position of playing catch-up to SK Hynix, which has sped ahead in the promising field of high-bandwidth memory. Such HBM chips are used to help Nvidia Corp.’s accelerators in training artificial intelligence models.

Samsung said its HBM sales rose by more than 40% in the December quarter, and that memory demand showed signs of recovery, with mobile shipments expected to grow.

Read More: Samsung’s Profit Falls Again on Uneven Chip Demand Recovery

--With assistance from Shinhye Kang and Seyoon Kim.

(Updates with comments from the second paragraph. A previous story corrected the case timeframe.)

Most Read from Bloomberg Businessweek

How Jack Dorsey’s Plan to Get Elon Musk to Save Twitter Went South

OpenAI's Secret Weapon Is Sam Altman's 33-Year-Old Lieutenant

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance