Salesforce on Track to Become One of the Most Profitable Cloud Companies

Much of 2023's performance was driven by the narratives of strength seen in the technology sector. More specifically, the conversations around quality and growth were almost always dominated by the Magnificent 7, leading to crowded trades in this cohort of stocks. However, many other stocks also saw their fundamentals improving for the better, leading to more pronounced performances elsewhere.

Salesforce Inc. (NYSE:CRM) is one example of a stock whose performance in 2023 might be eclipsed by the larger mega-cap stocks, as can be seen below.

Salesforce's fundamentals have been consistently getting better, leading to a stronger balance sheet, with expectations rising for its margins and free cash. I think 2024 will continue to be good for the company, and I still see value in the stock at these levels.

Business model recap

The cloud software titan was founded in 1999, right before the dot-com bust. The company was one of the earliest pioneers of the subscription model that most software companies have come to adopt. Salesforce is a founder-led company, with its prolific CEO, Marc Benioff, continuing to lead.

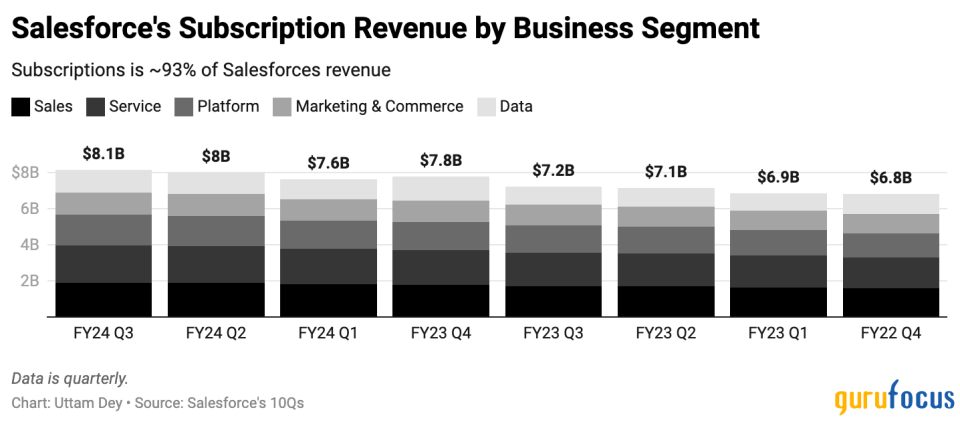

The San Francisco-based company is the face of customer relationship management software. Salesforce leverages its decades of customer management technology by selling cloud software to businesses and enterprises, helping them identify customers and manage various aspects of their customer relationships. Salesforce's CRM software provides this functionality to its clients via five business segments:

Sales: empowers sales teams to manage and automate their entire sales process.

Service: empowers support teams in organizations to manage post-sales relationships with their customers. This is the largest segment in terms of revenue.

Platform: enables organizations to build apps and integrate their own customized solutions on top of Salesforce's technology. One of their fastest-growing business segments. Slack, a popular communication services startup, was acquired and integrated into this segment.

Data: products revolving around end-to-end analytics solutions for organizations. This is also one of their fastest-growing and newest business segments. Previous acquisitions such as Tableau and MuleSoft were integrated into this segment.

Marketing and Commerce: Software to help teams plan and optimize customer lifecycle relationships.

It is important to understand Salesforce's business segments and its key products here since I will be using this to explain how these products are key to Salesforce growing its high-margin revenue.

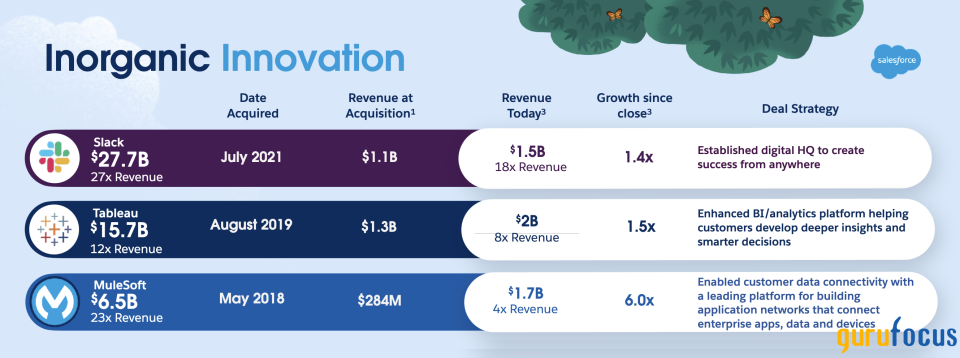

Salesforce's acquisitions are rewarding its top line

In the last several years, Salesforce has made some strategic acquisitions, buying startups such as Slack, Tableau and MuleSoft, spending close to $50 billion. While Slack's services focus on organizational communication software, Tableau's services focus on intelligent data and analytics dashboards abd MuleSoft's software focused on automation and analytics. The most important point here is that all these acquisitions have been playing a critical role in providing growth to Salesforce.

The slide above was taken from the company's most recent investor presentation in 2022. Apart from MuleSoft, Tableau and Slack were growing at least 8 times revenue, which was faster than Salesforce's revenue growth multiple at the time of 5.40. Moreover, all the startups acquired are accretive to Salesforce's artificial intelligence-focused ambitions. On the most recent third-quarter earnings call with investors, Salesforce's management announced for the first time that 17% of Fortune 100 companies were already using its EinsteinGPT AI CoPilot, a competitor to Microsoft's (NASDAQ:MSFT) OpenAI-based AI copilot. I believe the launch of AI capabilities and automation in its software has been key for Salesforce to turn back into growth mode. The chart below shows the revenue growth in constant currency by business segment.

While the Platform segment saw a huge bump in year-over-year revenue with the early adoption of AI tools, the trend in adoption has sustained in AI and automation tools such as MulesSft and Tableau, leading to stronger year-over-year revenue growth. In my opinion, the advantages of having diversified revenue streams, such as the segmented model currently at Salesforce, are that it creates opportunities for higher margin expansion across the board by using economies of scale and keeping its cost profile under control. I believe this is highly beneficial to Salesforce's operating margins and free cash.

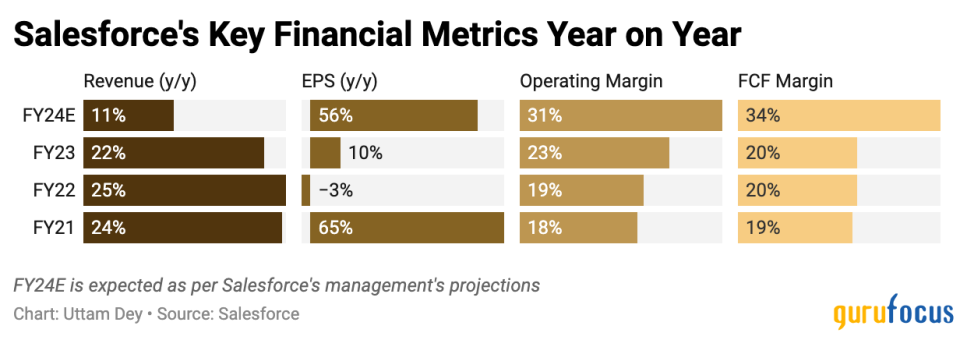

Salesforce's current value does not reflect all-round margin expansion

Per management's most recent forward-looking commentary, Salesforce is projected to grow 11% on a year-over-year basis. While those are still respectable gains, the real benefits for an investor will be seen in the company's margin expansion. The chart below shows how the company has gotten better with every year that goes by as it learns to drive more efficiency into its business and expand margins.

On the recent third-quarter call, management expressed immense confidence in moving ahead with achieving high-margin growth, with the chief financial officer saying, We view this as a floor, not a ceiling on our success, and we intend to continue our focus on operating margin.

I view these developments as very positive for the company, as they show more restraint in controlling expenses while leveraging the technology to grow the business further and deliver more free cash to investors.

According to estimates by FactSet, the S&P 500's earnings per share are expected to grow around 11% this year, which is quite strong for the index. Given these forward estimates, markets participants peg the index approximately at a forward premium of 19.5 versus this year's expected earnings. Salesforce's management is confident they will be able to grow their earnings by approximately 56% to $8.19 per share, driven by higher cost efficiency in expenses. Consensus estimates project Salesforce's earnings per share to grow by around 18%. Given that Salesforce has a history of beating earnings expectations by at least 1.95% in the past five years, I think management's forward-looking guidance and consensus estimates are quite reasonable to assume as the basis for my valuation. Per my calculations, I find a forward price-earnings ratio of 32 very reasonable in terms of its premium. This would give Salesforce's investors a further upside of at least 15.8%.

Risks and other factors to consider

My outlook for Salesforce considers there will be no recessions or slowdowns this year. I expect there will be no recession this year, and enterprise spending will continue to be strong. Gartner projects that worldwide IT spending will rise by 8%, but a bigger tailwind to Salesforce is that Gartner expects much of that 8% to be driven by spending in software at 13.8% and IT Services at 10.4%, which are the industries it operates in.

Another risk that may impact Salesforce is its exposure to debt. Per its most recent quarter, the company has debt outstanding with a total carrying value of $9.4 billion, of which $1 billion was related to the 2024 senior notes due in the next 12 months. With a net cash and cash equivalent position of $11.86 billion, I am confident that Salesforce is in compliance with all debt covenants.

Takeaways

Salesforce's management has shown remarkable focus in controlling its expenses and expanding margins to return free cash to shareholders. It made some large acquisitions in the last five years, which have started to add to Salesforce's growth prospects, while management scales the business towards higher operating margins. I believe these developments create significant opportunities for returns, making the stock undervalued.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance