Salesforce (CRM) Jumps 16% on Q4 Earnings Beat, Strong Q1 View

Salesforce CRM stock soared 15.8% during Wednesday’s extended trading session following the enterprise cloud computing solution provider’s better-than-expected financial results for the fourth quarter of fiscal 2023. The company’s upbeat guidance for the first quarter of fiscal 2024 also boosted investors’ confidence in the stock, sending its share price higher in the after-hour trade.

Fourth-Quarter Fiscal 2023 Performance

Salesforce’s fourth-quarter fiscal 2023 non-GAAP earnings doubled to $1.68 per share from the 84 cents reported in the year-ago quarter. The figure surpassed the Zacks Consensus Estimate of $1.36.

The quarterly non-GAAP earnings included a loss of 25 cents per share from the mark-to-mark accounting of CRM’s strategic investments at a non-GAAP tax rate of 22%. However, the company’s ongoing restructuring initiative, which includes trimming the workforce, benefited fourth-quarter non-GAAP earnings by 9 cents per share.

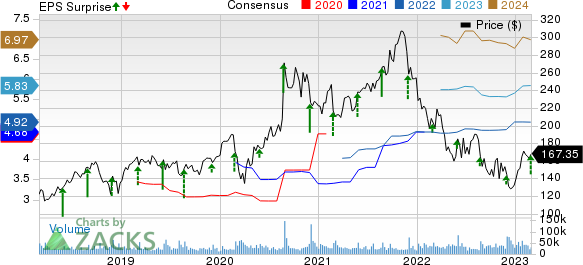

Salesforce Inc. Price, Consensus and EPS Surprise

Salesforce Inc. price-consensus-eps-surprise-chart | Salesforce Inc. Quote

Salesforce’s quarterly revenues of $8.38 billion climbed 14% year over year, surpassing the Zacks Consensus Estimate of $7.99 billion. The top line also improved 17% in constant currency (cc).

The company has been benefiting from the robust demand environment as customers are undergoing a major digital transformation. Thus, the rapid adoption of its cloud-based solutions resulted in the better-than-anticipated performance in the fiscal fourth quarter.

Coming to CRM’s business segments, revenues from Subscription and Support (93% of the total revenues) increased 14.1% from the year-earlier period to $7.79 billion. Professional Services and Other (7% of total sales) revenues climbed 19.5% to $595 million.

Under the Subscription and Support segment, Sales Cloud revenues grew 13% year over year to $1.8 billion. Revenues from Service Cloud, one of the company’s largest and fastest-growing businesses, also improved 13% to $1.9 billion.

Marketing & Commerce Cloud revenues jumped 13% to $1.2 billion. Salesforce Platform and Other revenues were up 15% to $1.6 billion. Also, revenues from Data increased 18% year over year to $1.3 billion.

Geographically, Salesforce registered revenue growth of 14% in America (67.5% of the total revenues), 30% in the Asia Pacific (9.4%) and 20% in the EMEA (23.1%) on a year-over-year basis.

Salesforce’s gross profit came in at $6.28 billion, up 18.3% from the prior-year period. Moreover, the gross margin improved 200 basis points (bps) to 75%.

Salesforce recorded a non-GAAP operating income of $2.45 billion, up 123.3% from the year-ago quarter’s level of $1.1 billion. Moreover, the non-GAAP operating margin expanded 1,420 bps to 29.2% from 15% in the year-ago quarter due to lower operating expenses as a percentage of total sales. Operating expenses as a percentage of revenues declined to 71% from 75% in the year-ago quarter.

Salesforce exited the fiscal fourth quarter with cash, cash equivalents and marketable securities of $12.5 billion, up from the $11.9 billion recorded at the end of the previous quarter.

CRM generated operating cash flow of $2.79 billion and free cash flow of $2.57 billion in the fourth quarter. In fiscal 2023, the company generated operating and free cash flows of $7.11 billion and $6.31 billion, respectively.

As of Jan 31, 2023, the current remaining performance obligation reflecting revenues under contract for the next 12 months was $24.6 billion, up 12% on a year-over-year basis. In the fourth quarter and full fiscal 2023, the company bought back shares worth $2.32 billion and $4 billion, respectively.

Concurrent with its fourth-quarter results, Salesforce announces the expansion of its ongoing share repurchase program to $20 billion from the initial announcement of $10 billion made in 2022. With the total fiscal 2023 buyback of $4 billion, the company has now $16 billion remaining under its current authorization limit.

Strong Guidance for Q1 and FY24

Salesforce provided strong guidance for the first quarter and fiscal 2024. For the fiscal first quarter, Salesforce projects total sales between $8.16 billion and $8.18 billion (midpoint $8.17 billion), which is higher than the Zacks Consensus Estimate of $8.09 billion at the midpoint.

The revenue guidance includes a $150-million negative impact of unfavorable currency exchange rates. Furthermore, CRM anticipates non-GAAP earnings per share in the band of $1.60-$1.61 for the current quarter, which is way higher than the consensus mark of $1.30.

For fiscal 2024, Salesforce forecasts revenues in the range of $34.5-$34.7 billion, which is more than the Zacks Consensus Estimate of $34.09 billion. The company expects no impact from foreign currency exchange rates.

The company projects fiscal 2024 non-GAAP earnings between $7.12 and $7.14 per share, which is higher than the consensus mark of $5.83 per share. Salesforce estimates a non-GAAP operating margin of approximately 27% for the fiscal and expects a year-over-year increase in operating cash flow in the 15%-16% range.

Zacks Rank & Other Key Picks

Currently, Salesforce carries a Zacks Rank #2 (Buy). Shares of CRM have decreased 19.9% over the past year.

Some other top-ranked stocks from the broader technology sector are Clarivate Plc CLVT, Aspen Technology AZPN and ServiceNow NOW, each carrying a Zacks Rank #2 at present. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Clarivate’s fourth-quarter 2022 earnings has remained unchanged at 17 cents per share over the past 60 days. For 2022, earnings estimates have been revised a penny northward to 81 cents per share in the past 60 days.

Clarivate's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 9.4%. Shares of CLVT have fallen 20.3% in the trailing 12 months.

The Zacks Consensus Estimate for Aspen Technology's third-quarter fiscal 2023 earnings has been revised upward by 17 cents to $1.66 per share in the past 60 days. For fiscal 2023, earnings estimates have been revised northward by 2 cents to $7.10 per share in the past 30 days.

Aspen Technology’s earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missing the same on one occasion, the average surprise being 5.2%. Shares of AZPN have rallied 45.5% over the past year.

The Zacks Consensus Estimate for ServiceNow's first-quarter 2023 earnings has been revised northward by a penny to $2.02 per share over the past 30 days. For 2023, earnings estimates have moved downward by 3 cents to $9.15 per share in the past seven days.

ServiceNow's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 6.9%. Shares of NOW have plunged 24.9% in the trailing 12 months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

Clarivate PLC (CLVT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance