RTX Corp (RTX) Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts with Strong Sales Growth

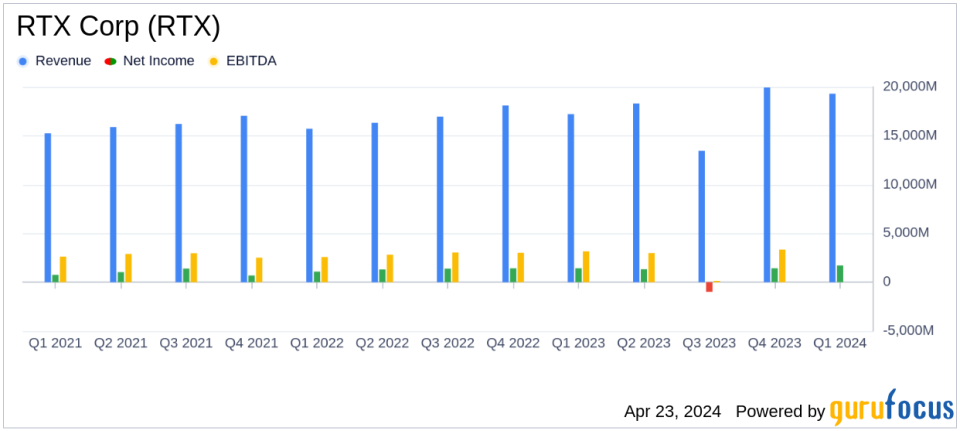

Reported Q1 Revenue: $19.3 billion, a 12% increase year-over-year, surpassing estimates of $18.414 billion.

GAAP EPS: $1.28, a 32% rise from the previous year, exceeding the estimated $1.23.

Adjusted EPS: $1.34, up 10% from last year, indicating strong profitability adjustments.

Net Income: Reported at $1.709 billion, up 20% year-over-year, exceeding the estimated $1.632 billion.

Free Cash Flow: Reported a free cash outflow of $125 million, reflecting investment and operational expenditures.

Backlog: Reached a record $202 billion, with significant bookings in defense and commercial aerospace, underscoring robust future revenue potential.

Full-Year Outlook: Reaffirmed, with expected sales between $78.0 and $79.0 billion and adjusted EPS forecasted at $5.25 to $5.40.

On April 23, 2024, RTX Corp (NYSE:RTX) disclosed its financial results for the first quarter of 2024, demonstrating significant growth and operational achievements. The company reported a robust sales increase and a record backlog, indicating a strong market position. This performance analysis, based on the company's 8-K filing, will delve into the financial metrics, segment performance, and strategic initiatives shaping RTX's trajectory.

Financial Performance Highlights

RTX reported first-quarter sales of $19.3 billion, marking a 12% increase compared to the previous year and surpassing the analyst's estimated revenue of $18.4 billion. This growth was mirrored in both reported and organic metrics. The company achieved a GAAP EPS of $1.28, up 32% from the prior year, and an adjusted EPS of $1.34, reflecting a 10% increase. These figures compare favorably to the estimated EPS of $1.23, showcasing RTX's ability to exceed market expectations.

The net income attributable to common shareholders was reported at $1.7 billion, with adjusted net income slightly higher at $1.8 billion, remaining stable compared to the previous year. Despite higher interest expenses and lower pension income, the growth in adjusted segment operating profit helped maintain net income levels. The operating cash flow stood at $342 million, with a free cash outflow of $125 million due to significant capital expenditures of $467 million.

Segment Analysis and Strategic Developments

RTX operates through three primary segments: Collins Aerospace, Pratt & Whitney, and Raytheon, each contributing uniquely to the quarter's success. Collins Aerospace saw a 9% increase in sales, driven by robust demand in commercial aerospace, which offset a slight decline in operating profit due to higher costs. Pratt & Whitney reported a 23% sales increase, benefiting from higher volume in commercial and military engines, though operating profit slightly declined due to mixed market conditions.

Raytheon's sales grew by 6%, with a significant 74% increase in operating profit, primarily due to higher volume and improved productivity. Notably, the segment benefited from a $375 million net gain from the divestiture of the Cybersecurity, Intelligence, and Services business.

Strategic Initiatives and Market Position

RTX's strategic initiatives, including operational modernization and technological innovation, are pivotal in sustaining long-term growth. The company's record backlog of $202 billion, coupled with a Q1 book-to-bill ratio of 1.34, underscores strong demand and positions RTX favorably for future performance. The divestiture of non-core businesses and focus on high-priority areas such as defense and aerospace further align RTX with industry growth vectors.

President and COO Chris Calio highlighted the company's momentum and focus on key priorities, stating:

"RTX saw strong momentum in the first quarter, delivering 12 percent organic sales growth and winning over $25 billion in new orders across our businesses. We are making progress on our key priorities to deliver for customers and shareowners, including executing on our GTF fleet management plans, which remain on track."

Outlook and Forward Guidance

RTX reaffirmed its full-year outlook for 2024, projecting sales between $78.0 and $79.0 billion and an adjusted EPS range of $5.25 to $5.40. The company also expects free cash flow of approximately $5.7 billion. This guidance reflects RTX's confidence in its operational strategies and market demand.

In conclusion, RTX's Q1 2024 results not only surpassed analyst revenue forecasts but also highlighted the company's strategic positioning and operational efficiency. With a strong backlog and focused growth strategies, RTX is well-equipped to navigate the dynamic aerospace and defense markets, promising sustained value for its shareholders.

Explore the complete 8-K earnings release (here) from RTX Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance