Royal Gold (RGLD) Provides Update on Operations for Q4

Royal Gold, Inc. RGLD has issued an update for its fourth-quarter fiscal 2020 (ended Jun 30, 2020) operations. During the quarter, RGLD Gold AG — the fully-owned subsidiary of Royal Gold — sold 51,000 gold equivalent ounces consisting of 44,000 gold ounces, 450,000 silver ounces and 800 tons of copper related to its streaming agreements. Stream sales during the fiscal fourth quarter were in line with the guided range of 50,000 to 55,000 gold equivalent ounces.

The company ended the fiscal fourth quarter with 25,000 gold equivalent ounces in inventory, including 19,000 ounces of gold, 475,000 silver ounces and 300 tons of copper. The average realized price of gold and silver was $1,686 and $15.77 per ounce, respectively, in the quarter. Notably, the same for the prior quarter was $1,569 and $17.79 per ounce, respectively. Average realized copper prices were $5,235 per ton, down from the previous quarter’s $5,493 per ton.

In the fiscal fourth quarter, cost of sales was around $406 per gold equivalent ounce compared with the third-quarter figure of $355 per gold equivalent ounce. The cost of sales is based on the quarterly average silver-gold ratio of roughly 104 to 1, and copper-gold ratio of approximately 0.32 tons per ounce.

The Zacks Consensus Estimate for the fourth-quarter fiscal 2020 revenues is pegged at $113 million, suggesting a decline of 2.7% from the year-ago quarter. The same for earnings is pegged at 51 cents, calling for an increase of 13.3% from the prior-year reported figure.

Several mining companies halted their operations as governments across the globe imposed restrictions to contain the spread of coronavirus. Royal Gold’s several operating counterparties have also announced the temporarily suspension of mine operations. Further addition or extension of production curtailment at its mining properties will likely have a material impact on its revenues and financials in the future.

Royal Gold’s investments in the Mount Milligan, Andacollo, Pueblo Viejo, Rainy River, Peñasquito and Cortez properties are expected to generate significant revenues in fiscal 2020 and beyond. For fiscal 2020, Mount Milligan mine’s operator Centerra continues to expect consolidated gold production between 740,000 ounces and 820,000 ounces and payable copper production of 80-90 million pounds from the mine.

Gold prices have been up 18.1% so far this year fueled by the coronavirus crisis, low interest rates, U.S-China trade conflicts and the civil unrest in the United States. With the pandemic showing no signs of dissipating any time soon, the uncertainty regarding its impact on the global economy will continue to trigger safe-haven demand for gold. The combination of lower mined gold supply and higher demand, and geopolitical tensions are likely to drive prices north. This bodes well for Royal Gold.

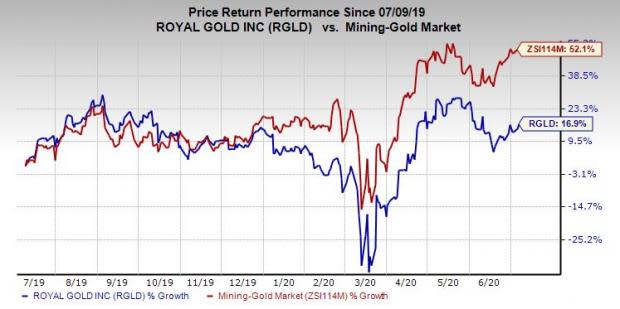

Price Performance

The company’s shares have gained 16.9% over the past year compared with the industry’s growth of 52.1%.

Zacks Rank & Key Picks

Royal Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Sandstorm Gold Ltd SAND, Harmony Gold Mining Company Limited HMY and AngloGold Ashanti Limited AU, all carrying a Zacks Rank #2 (Buy) currently. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Sandstorm Gold has an expected earnings growth rate of 33.3% for 2020. The company’s shares have surged 71.8% in the past year.

Harmony Gold has a projected earnings growth rate of 28.6% for fiscal 2020. Its shares have soared 87.7% in a year’s time.

AngloGold has an estimated earnings growth rate of 109.9% for the ongoing year. The company’s shares have appreciated 71.3% in the past year.

5 Stocks to Soar Past the Pandemic: In addition to the companies you learned about above, we invite you to learn about 5 cutting-edge stocks that could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of the decade.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sandstorm Gold Ltd (SAND) : Free Stock Analysis Report

AngloGold Ashanti Limited (AU) : Free Stock Analysis Report

Harmony Gold Mining Company Limited (HMY) : Free Stock Analysis Report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance