Royal Caribbean Group Reports Strong 2023 Results and Forecasts Record Earnings for 2024

Adjusted EPS for 2023: $6.77, surpassing company guidance.

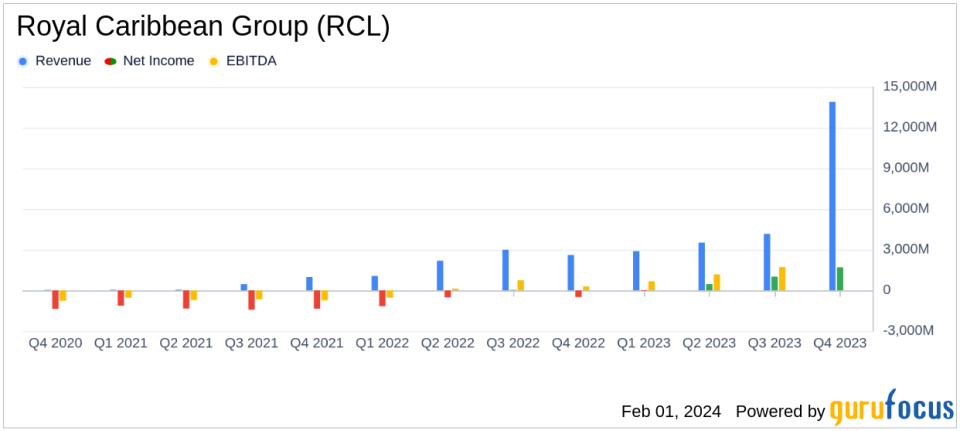

Net Income: $1.7 billion for 2023, a significant recovery from the previous year's loss.

Revenue: $13.9 billion in 2023, driven by strong demand and increased gross margin yields.

Booked Position: Record start to WAVE season with higher booked load factors and rates.

2024 Outlook: Adjusted EPS forecasted to be $9.50 - $9.70, with net yields expected to increase 5.25% to 7.25% in Constant Currency.

Debt Reduction: Approximately $4 billion of debt paid off in 2023, moving closer to investment grade metrics.

Capital Expenditures: Expected to be approximately $3.3 billion for 2024, primarily for new ship orders.

On February 1, 2024, Royal Caribbean Group (NYSE:RCL) released its 8-K filing, announcing a strong finish for 2023 and an optimistic outlook for 2024. The company, known for its innovation and diverse brand portfolio in the cruise vacation industry, reported a significant turnaround with a net income of $1.7 billion for the year, compared to a net loss in the previous year.

Royal Caribbean Group operates 64 ships across five global and partner brands, including Royal Caribbean International, Celebrity Cruises, and Silversea. The company also has a 50% investment in a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. With 10 more ships on order, Royal Caribbean is well-positioned to cater to the growing demand for cruise vacations.

Financial Highlights and Challenges

The company's financial achievements in 2023 were underscored by a 13.2% increase in Gross Margin Yields and a 13.5% increase in Net Yields in Constant Currency, both compared to 2019. Despite these gains, Gross Cruise Costs per Available Passenger Cruise Day (APCD) also rose by 10.9%, reflecting the broader inflationary pressures faced by the industry.

These financial metrics are critical for Royal Caribbean, as they reflect the company's ability to manage costs and maximize revenue per passenger day, which is essential for profitability in the travel and leisure industry. The company's record booked position for 2024, with higher load factors and rates than in previous years, suggests a strong demand that could lead to further revenue growth.

Income Statement and Balance Sheet Analysis

The income statement for 2023 showed total revenues of $13.9 billion, with passenger ticket revenues contributing $9.568 billion and onboard and other revenues accounting for $4.332 billion. The balance sheet as of December 31, 2023, indicated a solid liquidity position with cash and cash equivalents of $497 million and a customer deposit balance of $5.3 billion, reflecting the strong future bookings.

2023 was an exceptional year, propelled by unmatched demand for our brands from new and loyal guests," said Jason Liberty, president and CEO, Royal Caribbean Group. "With the wind in our sails and record-breaking bookings, 2024 is poised to be another robust year, and we expect to achieve two of our Trifecta goals one year early," added Liberty.

Looking Ahead to 2024

For 2024, Royal Caribbean anticipates a 40% year-over-year growth in Adjusted EPS, with expectations to achieve two of its Trifecta goals: triple-digit EBITDA per APCD and Return on Invested Capital (ROIC) in the teens. The company's focus on delivering exceptional vacations and long-term shareholder value, coupled with the introduction of new ships like the Icon of the Seas, positions it for continued success.

The company's commitment to reducing debt and improving its balance sheet was evident as it paid off approximately $4 billion of debt in 2023. This strategic financial management is expected to bring the company closer to investment grade metrics in 2024.

Royal Caribbean Group's strong performance in 2023 and optimistic forecast for 2024 reflect the resilience and potential of the cruise industry as it continues to recover and grow post-pandemic. With a focus on innovation, quality, and customer experience, RCL is charting a course for sustained profitability and shareholder value.

Explore the complete 8-K earnings release (here) from Royal Caribbean Group for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance