Is Rogers Communications Inc.'s (TSE:RCI.B) P/E Ratio Really That Good?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

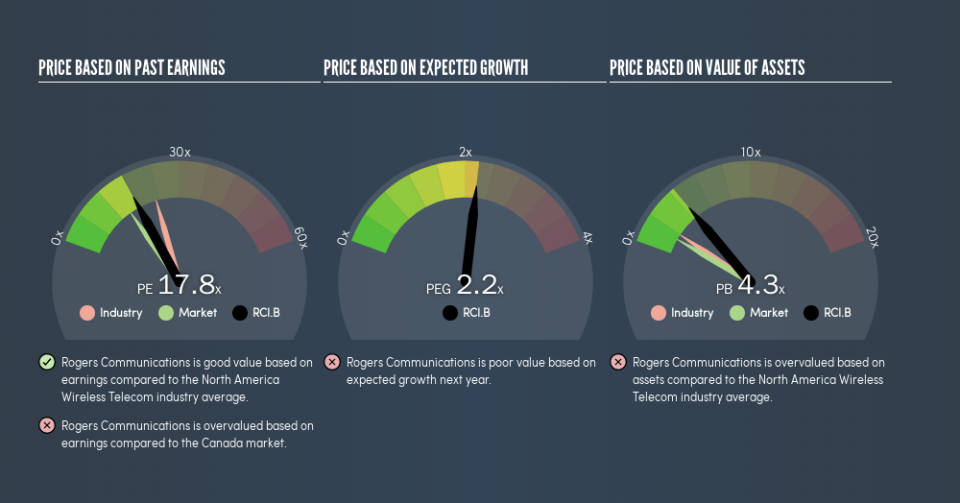

This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). We'll apply a basic P/E ratio analysis to Rogers Communications Inc.'s (TSE:RCI.B), to help you decide if the stock is worth further research. Rogers Communications has a price to earnings ratio of 17.82, based on the last twelve months. That is equivalent to an earnings yield of about 5.6%.

View our latest analysis for Rogers Communications

How Do I Calculate Rogers Communications's Price To Earnings Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for Rogers Communications:

P/E of 17.82 = CA$70.1 ÷ CA$3.93 (Based on the trailing twelve months to March 2019.)

Is A High P/E Ratio Good?

A higher P/E ratio implies that investors pay a higher price for the earning power of the business. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.'

How Growth Rates Impact P/E Ratios

Earnings growth rates have a big influence on P/E ratios. That's because companies that grow earnings per share quickly will rapidly increase the 'E' in the equation. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. Then, a lower P/E should attract more buyers, pushing the share price up.

Rogers Communications's earnings per share grew by -3.4% in the last twelve months. And its annual EPS growth rate over 5 years is 4.5%.

Does Rogers Communications Have A Relatively High Or Low P/E For Its Industry?

One good way to get a quick read on what market participants expect of a company is to look at its P/E ratio. We can see in the image below that the average P/E (23.1) for companies in the wireless telecom industry is higher than Rogers Communications's P/E.

This suggests that market participants think Rogers Communications will underperform other companies in its industry. While current expectations are low, the stock could be undervalued if the situation is better than the market assumes. You should delve deeper. I like to check if company insiders have been buying or selling.

Remember: P/E Ratios Don't Consider The Balance Sheet

Don't forget that the P/E ratio considers market capitalization. That means it doesn't take debt or cash into account. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

How Does Rogers Communications's Debt Impact Its P/E Ratio?

Rogers Communications has net debt equal to 45% of its market cap. You'd want to be aware of this fact, but it doesn't bother us.

The Bottom Line On Rogers Communications's P/E Ratio

Rogers Communications trades on a P/E ratio of 17.8, which is above the CA market average of 14.9. Given the debt is only modest, and earnings are already moving in the right direction, it's not surprising that the market expects continued improvement.

Investors should be looking to buy stocks that the market is wrong about. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

But note: Rogers Communications may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance