'Rocky transition' to chip-cards not such a disaster, says Morgan Stanley

If you’ve stood at a credit card reader in your local CVS, Walgreens, or Trader Joe’s, and waited impatiently for it to process your chip-based card, you’re not alone. Or if you’ve been frustrated by how many retailers still aren’t even taking chip cards, you’re not alone.

Credit-card issuers began sending out chip-based cards to all their customers last year, and nearly 80% of US credit cards (95% of American Express cards) are now chip-based. But many merchants still aren’t using them—even merchants that have the right hardware to do so. According to EMV Migration Forum, only 1 million of the 5 million chip-enabled terminals at US retailers are being used for chip cards.

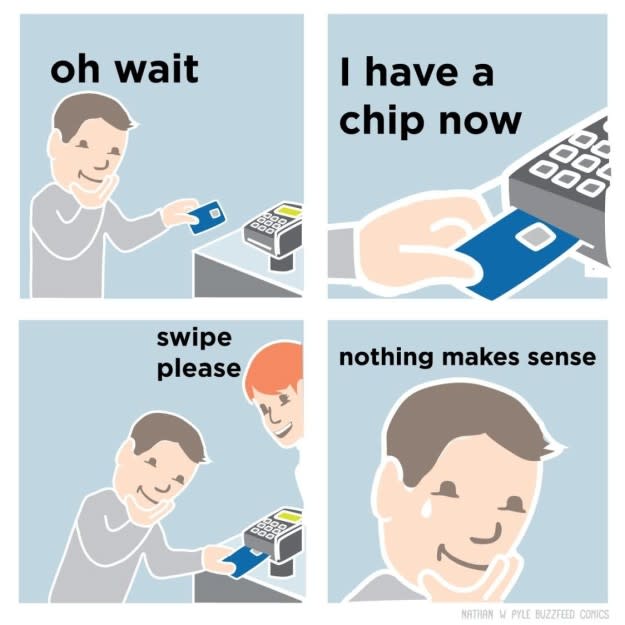

But while consumer frustration has led to plenty of Internet memes on Twitter and BuzzFeed, a new report from Morgan Stanley says, “Chip card concern is overblown… for now.”

The report acknowledges that the transition to chip-based credit cards in the US has been “rocky” and “protracted and choppy.” That’s because, 10 months after the October 2015 deadline merchants had to switch over their point-of-sale systems, only 57% of companies Morgan Stanley surveyed have made the switch. But another 26% expect to install the new readers by the end of the year.

Beginning last October, banks no longer take on liability for any fraud that occurs at a merchant from a magnet-stripe swipe. In other words: Retailers can choose never to switch, if they wish, but they will be liable if a transaction is fraudulent. And fraud is more likely when a card is swiped with magnet-stripe than inserted with chip.

“Given most [merchants] are at or near done, we view risk from in-store credit fraud as nearly immaterial at this time,” says Morgan Stanley. In addition, what exposure there is from potential fraud “is mostly captured in company expectations.”

There’s another surprising nugget in the report: Fast-food restaurants are in less of a hurry to make the switch to chip-readers. That’s because starting this month, to ease the transition, Visa and American Express (but not MasterCard) set a $25 minimum on counterfeit “chargebacks” that merchants will owe, meaning that if a fraudulent transaction occurs for less than $25, the card companies will still cover it, through April 2018. Morgan Stanley points out that this “disincentivizes” QSR (quick-serve restaurant) businesses to switch. That makes sense; the average order total at McDonald’s is just $11. Many fast food franchises might figure that if fraud occurs, it will be less than the $25 minimum anyway. (But in two years, that minimum goes away.)

As for the chip-card wait that consumers hate? Retailers, for one, say they haven’t noticed many complaints. “Surprisingly, most retailers see little to no issue with longer chip card transaction times,” the report says.

Inserting a chip-card does take longer (by seconds) than swiping a mag-stripe card, but it’s more secure, even if that may be small comfort to impatient shoppers.

—

Daniel Roberts is a writer at Yahoo Finance, covering sports business and technology. Follow him on Twitter at @readDanwrite.

Read more:

These 3 very different apps helped me save money

TransferWise enters the hot US-to-Mexico payments market

I got six parking tickets in NYC in one week– and beat them all

Meet the Reddit-like social network that rewards bloggers in bitcoin

Yahoo Finance

Yahoo Finance