Rockwell Collins Wins $14.9M Deal to Support RQ-7B Shadow

Rockwell Collins, Inc. COL recently won a $14.9-million contract for providing Airborne Computer Equipment V Architecture Zero equipment associated with RQ-7B Shadow Tactical Unmanned Aircraft System. The contract was awarded by the U.S. Army Contracting Command, Aberdeen Proving Ground, Maryland.

Rockwell Collins will engage in the production of software and hardware on the RQ-7B Shadow. Work related to the deal is expected to be completed by Sept. 27, 2021.

What is RQ-7B Shadow Tactical Unmanned Aircraft System

The RQ-7B Shadow is the choice Tactical Unmanned Aircraft System (TUAS) of the U.S. Army and Marine Corps to provide reconnaissance, surveillance, targeting and assessment. It can see targets up to 77.67 miles away from the brigade tactical operations center and recognize tactical vehicles up to 8,000 feet above the ground at more than 3.5 kilometers slant range, day or night. The RQ-7B Shadow is deployed in squadrons as an asset of the Marine Expeditionary Force or Marine Expeditionary Brigade.

Our View

Rockwell Collins’ focus on research and development (“R&D”) as well as systematic investments in inorganic growth programs is expected to boost performance in the future. During the third quarter of fiscal 2018, the company invested $351 million in its R&D program to introduce improved products. During the quarter, R&D spending improved 17.4% year over year. Such investments on the R&D front will enable the company develop high quality and technically advanced products as well as cater to increasing demand from clients.

Per Markets and Markets, the Unmanned Aerial Vehicle market is expected to reach $52.30 billion during 2018-2025, at a CAGR of 14.15%. Moreover, the fiscal 2019 defense budget has authorized the United States to spend $717 billion on defense, which bodes well for defense contractors like Rockwell Collins.

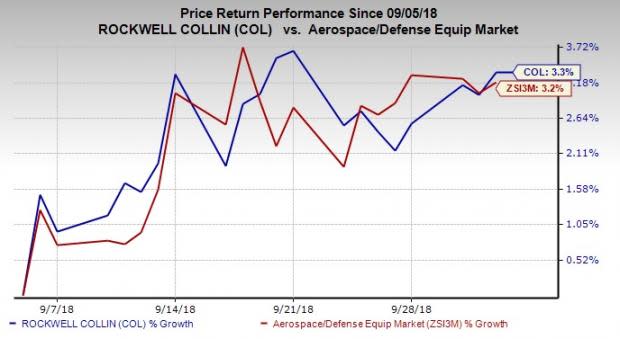

Price Performance

Rockwell Collins’ shares have improved about 3.3% in past month compared with the industry’s rise of 3.2%.

Zacks Rank & Stocks to Consider

Rockwell Collins currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the same sector are Huntington Ingalls Industries, Inc HII, AeroVironment, Inc AVAV and FLIR Systems, Inc FLIR. While Huntington Ingalls and AeroVironment sport a Zacks Rank #1 (Strong Buy), FLIR Systems carried a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Huntington Ingalls Industries came up with an average positive earnings surprise of 9.48% in the past four quarters. The Zacks Consensus Estimate for 2018 earnings climbed 1.5% in the past 60 days.

AeroVironment delivered an average positive earnings surprise of 365.27% in the past four quarters. The Zacks Consensus Estimate for fiscal 2019 earnings moved up 22.5% in the past 60 days.

FLIR Systems Holdings pulled off an average positive earnings surprise of 8.94% in the past four quarters. The Zacks Consensus Estimate for 2018 earnings has inched up 0.9% in the past 60 days.

5 Companies Verge on Apple-Like Run

Did you miss Apple's 9X stock explosion after they launched their iPhone in 2007? Now 2018 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs. A bonus Zacks Special Report names this breakthrough and the 5 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains.

Click to see them right now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Huntington Ingalls Industries, Inc. (HII) : Free Stock Analysis Report

AeroVironment, Inc. (AVAV) : Free Stock Analysis Report

Rockwell Collins, Inc. (COL) : Free Stock Analysis Report

FLIR Systems, Inc. (FLIR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance