Rockwell Automation (ROK) Beats on Q1 Earnings, Ups Guidance

Rockwell Automation ROK has reported adjusted earnings per share of $2.46 in first-quarter fiscal 2023 (ended Dec 31, 2022), surpassing the Zacks Consensus Estimate of $1.81. The bottom line rose 15% year over year on higher sales volume and positive price/cost.

Including one-time items, earnings were $3.31 per share in the fiscal first quarter compared with the prior-year quarter’s $2.05 per share.

Total revenues were $1,981 million, up 6.7% from the prior-year quarter. The top line beat the Zacks Consensus Estimate of $1,892 million. Organic sales in the quarter were up 9.9% and acquisitions contributed 0.8% to sales growth, while currency translation had a negative impact of 4%.

Operational Update

The cost of sales increased 5.3% year over year to around $1,167 million. The gross profit rose 8.6% year over year to $814 million. Selling, general and administrative expenses moved up 4.9% year over year to $470 million.

Consolidated segmental operating income totaled $401 million, up 12.9% from the prior-year quarter. The total segment operating margin was 20.2% in the fiscal first quarter, higher than the prior year’s 19.1%. The improvement in margins was driven by positive price/cost and higher sales volume, partially offset by higher investment spend.

Rockwell Automation, Inc. Price, Consensus and EPS Surprise

Rockwell Automation, Inc. price-consensus-eps-surprise-chart | Rockwell Automation, Inc. Quote

Segmental Results

Intelligent Devices: Net sales amounted to $936 million in the fiscal first quarter, up 4% year over year. Segmental operating earnings totaled $209 million compared with the year-earlier quarter’s $213 million. The segmental operating margin decreased to 22.4% in the quarter from the year-ago quarter’s 23.7%. The decline was driven by higher investment spend and an unfavorable currency impact, somewhat offset by the positive impacts of higher price/cost.

Software & Control: Net sales rose 11.6% year over year to $573 million in the reported quarter. Segmental operating earnings increased 41.5% year over year to $167 million. The segment’s operating margin was 29.2% compared with 22.9% in the year-earlier quarter.

Lifecycle Services: Net sales for the segment were $472 million in the reported quarter, up 6.4% year over year. Segmental operating earnings totaled $24.3 million compared with the prior-year quarter’s $24.5 million. The segment’s operating margin was 5.2% in the reported quarter compared with the year-earlier quarter’s 5.5%.

Fiscal 2023 Guidance

Backed by solid backlog levels and fiscal first-quarter performance, as well as assuming supply-chain stabilization, Rockwell Automation updated its reported sales growth guidance to 10% - 14.% for fiscal 2023. This marks an increase from prior stated growth of 7.5-11.5%. Organic growth sales guidance has been updated to 11-15% from the previously stated 9-13% for fiscal 2023. Adjusted earnings per share for fiscal 2023 are expected between $10.70 and $11.50, up from the $10.20-$11 mentioned earlier.

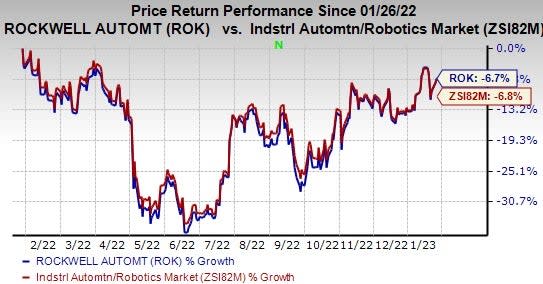

Price Performance

In the past year, Rockwell Automation’s shares have declined 6.7% compared with the industry’s fall of 6.8%.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

Rockwell Automation currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are KnowBe4, Inc. KNBE, O-I Glass, Inc. OI, and Deere & Company DE. KNBE and OI flaunt a Zacks Rank #1 (Strong Buy) at present, and DE has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

KnowBe4’s earnings surprise in the last four quarters was 216.7%, on average. The Zacks Consensus Estimate for the company’s 2022 earnings is pegged at 25 cents, indicating a year-over-year rise of 127.3%. The consensus estimate for 2022 earnings has moved up 25% in the past 60 days. KNBE’s shares have gained 17% in a year.

O-I Glass has an average trailing four-quarter earnings surprise of 14.9%. The Zacks Consensus Estimate for OI’s 2022 earnings is pegged at $2.25 per share. This indicates a 22.9% increase from the prior-year reported figure. The consensus estimate for 2022 earnings has been unchanged in the past 60 days. OI’s shares gained 45.6% in the last year.

The Zacks Consensus Estimate for Deere & Company’s fiscal 2023 earnings per share is pegged at $27.86, suggesting an increase of 19.6% from that reported last year. The consensus estimate for fiscal 2023 earnings moved 2.7% upward in the last 60 days. DE has a trailing four-quarter average earnings surprise of 7.1%. Its shares gained 12% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

OI Glass, Inc. (OI) : Free Stock Analysis Report

Deere & Company (DE) : Free Stock Analysis Report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

KnowBe4, Inc. (KNBE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance