Rivian's (RIVN) Q3 Loss Narrower Than Expected, Sales Rise

Rivian Automotive RIVN incurred a net adjusted loss of $1.57 a share in the third quarter of 2022, narrower than the Zacks Consensus Estimate of a loss of $1.78 a share. The bottom line also improved from the year-ago loss figure of $7.69 a share. Total revenues came in at $536 million, surpassing the consensus mark of $514 million. In the year-ago quarter, the EV maker reported revenues of $1 million in its first-ever quarterly results since going public. Third-quarter revenues improved from $364 million generated in the second quarter of 2022.

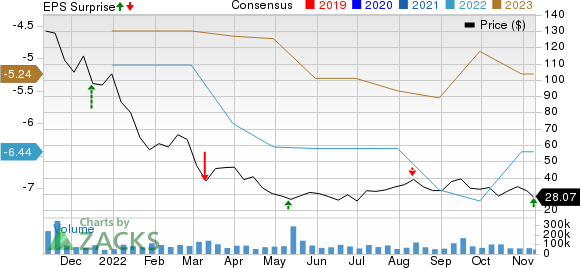

Rivian Automotive, Inc. Price, Consensus and EPS Surprise

Rivian Automotive, Inc. price-consensus-eps-surprise-chart | Rivian Automotive, Inc. Quote

Quarter Highlights

The company produced 7,363 vehicles during the quarter under review, up 67% from 4,401 in the second quarter of 2022. In the year-ago quarter, Rivian delivered 11 EVs in total. Deliveries jumped 47% sequentially to 6,584 units. The company’s net R1 preorder backlog in the United States and Canada was around 114,000 units as of Nov 7.

RIVN recorded a negative gross profit of $917 million during the quarter under review, deteriorating from $82 million in the year-ago period. The figure also worsened from the second-quarter 2022 negative gross profit of $704 million. Operating expenses rose to $857 million from $694 million in the year-ago period. The increase in expenses stemmed from stock-based compensation expenses and efforts associated with the firm’s R1 and RCV programs. Additionally, other advanced product development activities and investments in core in-vehicle technologies escalated the R&D costs that contributed to rising operating expenses. The figure, however, shrunk from $1,004 million in the previous quarter.

Rivian ended the quarter with $13.3 billion in cash and cash equivalents, down from $18.1 billion as of Dec 31, 2021 . Long-term debt totaled $1.23 billion as of Sep 30, almost flat with the Dec 31, 2021 level. Net cash used in operating activities totaled $1.37 billion in the quarter compared with $0.68 billion in the year-ago period. Capex in the third quarter totaled $298 million compared with $467 million in the same period last year. Given the higher year-over-year net cash used in operating activities and massive capital spending, Rivian witnessed a negative free cash flow of $1.67 billion in the third quarter of 2022, which deteriorated from a negative $1.15 billion during the corresponding period of 2021.

RIVN has reaffirmed its target to produce 25,000 vehicles this year. It has also maintained its guidance of a negative adjusted EBITDA of $5,450 million for 2022. Meanwhile, capex forecast has been brought down to $1,750 million from $2,000 million estimated earlier. Although Rivian is focused on ramping production, it believes supply-chain bottlenecks will remain a hindrance.

Zacks Rank & Peer Releases

RIVN currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Here’s a snapshot of some recent earnings releases of some EV makers.

EV magnate Tesla Inc. TSLA reported earnings of $1.05 a share in third-quarter, up from the year-ago figure of 62 cents and surpassing the Zacks Consensus Estimate of 95 cents. Tesla delivered its 7th consecutive beat this earnings season. Total revenues came in at $21,454 million, witnessing year-over-year growth of 56%. However, the top line lagged the consensus mark of $22,323 million.

Nikola NKLA incurred an adjusted loss per share of 28 cents in the third quarter, narrower than the Zacks Consensus Estimate of a loss of 56 cents but wider than the year-ago loss figure of 25 cents. It recorded revenues of $24.2 million, which crossed the consensus figure of $23 million.

Fisker Inc.’s FSR net loss per share of 49 cents in the third quarter was wider than the Zacks Consensus Estimate of a loss of 43 cents and the year-ago loss of 37 cents. It recorded revenues of $14 million, decreasing from the year-ago figure of $15 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Fisker Inc. (FSR) : Free Stock Analysis Report

Nikola Corporation (NKLA) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance