Risk Appetites Roaring Anew in Wall Street’s Unflappable Markets

(Bloomberg) -- To get a sense of the speculative euphoria in risky assets right now, consider Friday’s trading action. A slew of investing pros was transfixed by a meme-stock guru live streaming his near-$300 million position in GameStop Corp. — even as the world’s largest bond market sank anew on hot economic data.

Most Read from Bloomberg

Russia Is Sending Young Africans to Die in Its War Against Ukraine

Putin Is Running Out of Time to Achieve Breakthrough in Ukraine

Love or hate Keith Gill, who goes by the Roaring Kitty online moniker, his ability to command a crowd bespeaks a central fact of Wall Street life these days: The durability of bullish appetites across investing styles.

Strong payrolls data pushed back bets on interest-rate cuts — yet again — but it barely registered in equities. The S&P 500 reversed an early loss to end Friday little changed, after reaching fresh records earlier this week.

Despite uneven economic reports of late, greed is back. Cathie Wood’s flagship fund jumped 3% this week, more money flowed into junk bonds and crypto, while a Citigroup Inc. gauge of cross-asset volatility is hovering near 2017 lows.

“The market focus today tells you that people are not worried about the macro,” said Priya Misra, portfolio manager at JPMorgan Asset Management. “We are in a soft landing right now and sounds like investors have a lot of conviction that it will continue.”

While a spike in bond yields capped the week, for pure spectacle it was no match for day-trading hero Gill. His social-media antics are again fanning speculative spirits at a time of steady, if softening, economic growth.

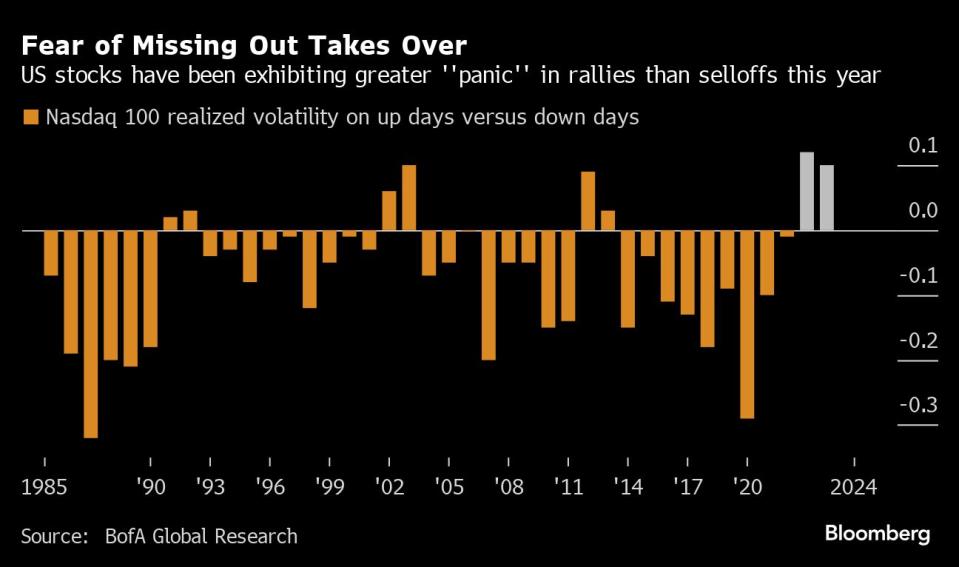

Hints of fervor underpin a broad cross-asset rally that is happening alongside steep drops in market turbulence and pricing for hedges. In one tell-tale development, implied volatility has been perking up more on the very days the Nasdaq 100 rallies than the days it sells off.

It’s a sign stocks are exhibiting greater “panic” in rallies than selloffs, per Bank of America Corp. in a risk-taking dynamic that has only transpired in eight of the last 40 years.

“We have no plans at this stage to reduce risk,” said Nathan Thooft, global head of asset allocation at Manulife Asset Management in Boston which oversees $160 billion in assets. “We do believe investors will miss out on additional equity returns if they exit or choose not to participate in the equity markets.”

Despite Friday’s bond upheaval, the S&P 500 finished near a record high as the Nasdaq 100 gained 2.5% over the five days. At around 12, the Cboe Volatility Index, known as the VIX, is hovering near pre-pandemic levels. Elsewhere, the Citi Global Risk Factor, a model measuring the volatility across 22 exchange-traded funds, shows a broad-based decline.

Nowhere is the fear of missing out on asset gains more visible than Gill’s reprisal of his 2021 role as meme-stock savant. His big-money bets on video-game retailer GameStop have sent it on roller-coaster rides for the better part of a month.

On Friday, his live YouTube broadcast drew more than 600,000 viewers at one point — though that wasn’t enough to stem a 40% drop in the stock, following the announcement of an equity sale.

Economic data continues to underpin conflicting narratives, with Friday’s job report closing the door on imminent easing action by the Federal Reserve. Earlier this week, separate reports showed jobless claims topping estimates and labor costs rising by less than previously reported. A measure of business activity saw its largest monthly gain since 2021 too, pushing the services sector to expand by the most in nine months.

“If we pick and choose the data to look at, it is the best of times (which seems in line with the stock market),” said Peter Tchir, head of macro strategies at Academy Securities. “If we look at other data, it is the worst of times (which seems to line up with sentiment surveys).”

Wall Street strategists and traders alike are pushing back their easing expectations. Citigroup Inc. economists — among the last few holdouts seeing a rate cut in July — revised their call for a rate cut to September, joining at least six other banks. This has done little to dissuade equity proponents.

For Morgan Stanley Investment Management’s Andrew Slimmon, the argument for staying bullish on equities is simple: Despite cash yielding 5%, the upside in risky assets is typically more lucrative.

“The number one push-back is ‘why would I buy equities when I can get 5% in money markets?’” he said in an interview with Bloomberg Television. “My simple response is because equities return historically double that.”

--With assistance from Katie Greifeld and Bailey Lipschultz.

Most Read from Bloomberg Businessweek

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

Sam Altman Was Bending the World to His Will Long Before OpenAI

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

Startup Brings New Hope to the Pursuit of Reviving Frozen Bodies

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance