Rising Oil Prices? 3 Stocks Worth Considering

Energy stocks are seeing interest from investors following a surprise production cut from OPEC on Sunday. After retreating in 2023 and particularly so throughout March, oil prices surged on the news.

Saudi Arabia, OPEC’s top producer, announced the most significant cut, eliminating 500k barrels/day. Iraq wasn’t too far behind, slashing 211k barrels a day.

The United Arab Emirates, Kuwait, Kazakhstan, Algeria, Oman, and Gabon also announced cuts, bringing the total to roughly 1.6 million barrels/day (including Russia's already in place 500k barrels/day reduction).

Interestingly enough, the Committee noted that decreasing production serves as a ‘precautionary’ measure to maintain balance in the oil market.

With oil prices seeing an increase, several companies – ExxonMobil XOM, Chevron CVX, and BP p.l.c BP – stand to benefit. Let’s take a closer look at each one.

ExxonMobil

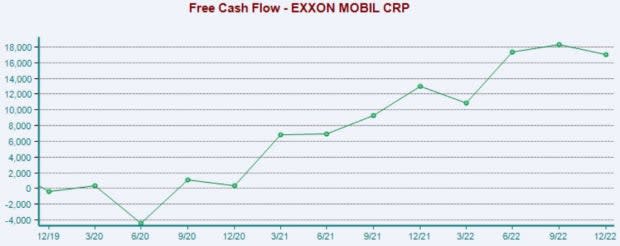

ExxonMobil is one of the world’s largest publicly traded international oil and gas companies with an established track record of CapEx discipline. Unsurprisingly, the company’s cash-generating abilities have been amplified amid increased energy prices, with XOM generating more than $17 billion in free cash flow throughout its latest quarter.

Image Source: Zacks Investment Research

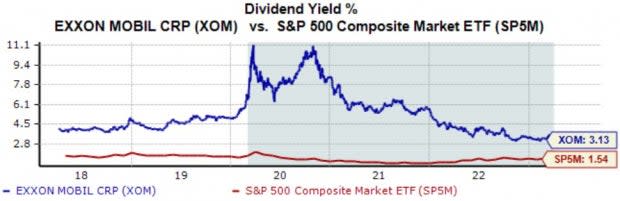

The favorable operating environment has also allowed XOM to increase its quarterly dividend, increasing the payout by roughly 3.4% just over the last year. Currently, ExxonMobil’s dividend yields 3.1% annually, above the broader market.

Image Source: Zacks Investment Research

The market reacted sluggishly to the company’s latest quarterly release; XOM posted mixed top and bottom line results, exceeding the Zacks Consensus EPS Estimate but falling short of sales expectations by roughly 5.5%.

Shares are up nearly 5% in 2023, underperforming relative to the general market.

Image Source: Zacks Investment Research

Chevron

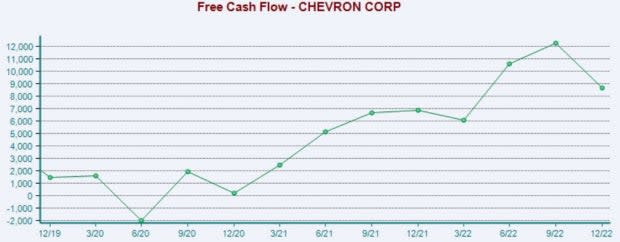

Chevron is fully integrated, participating in every aspect related to energy – from oil production to refining and marketing. Like XOM, Chevron’s cash-generating abilities have been impressive over the last year; CVX recently reported quarterly free cash flow of $8.7 billion, reflecting an improvement of 25% year-over-year.

Image Source: Zacks Investment Research

As we can see in the chart below, Chevron has also shown a commitment to rewarding its shareholders throughout the lucrative period, carrying a 6% one-year annualized dividend growth rate. Currently, CVX’s dividend yields 3.6% annually.

Image Source: Zacks Investment Research

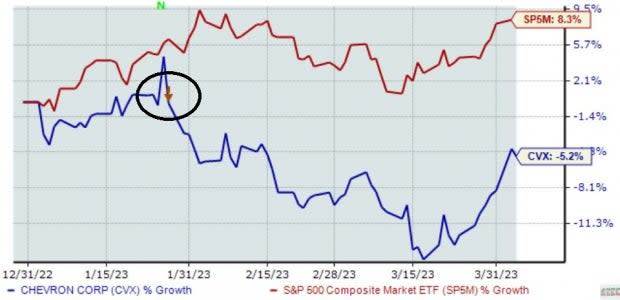

Chevron shares have faced adverse price action in 2023, with shares breaking off post-earnings and underperforming relative to the general market.

Image Source: Zacks Investment Research

BP p.l.c

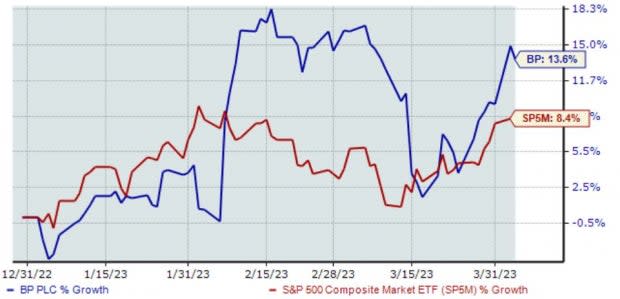

Headquartered in London, BP is one of the world's biggest multinational oil and gas companies. BP shares have been quietly strong so far in 2023, up more than 13% and outperforming the S&P 500 handily.

Image Source: Zacks Investment Research

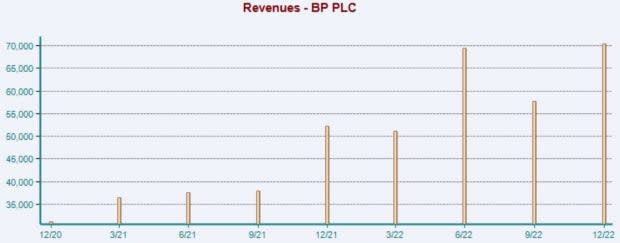

The company posted mixed results in its latest release, falling short of bottom line expectations. However, quarterly revenue totaled $70.4 billion, nearly 20% ahead of expectations and improving 34% year-over-year. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

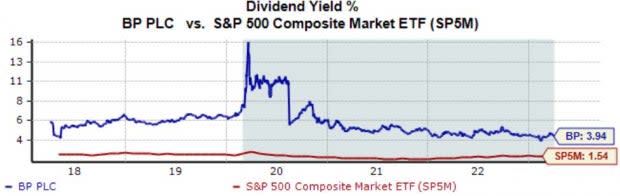

There were also several highlights within the latest earnings release, including a 10% increase to its dividend and a $2.75 million share buyback announcement. Currently, BP’s annual dividend yields 3.9%, nicely above the general market.

Image Source: Zacks Investment Research

Bottom Line

Following a surprise production cut from OPEC, oil prices climbed, and energy stocks jumped into focus.

As mentioned earlier, the Committee noted that decreasing production serves as a ‘precautionary’ measure to maintain balance in the oil market.

Several companies – ExxonMobil XOM, Chevron CVX, and BP p.l.c BP – all benefit from increased energy prices. In addition, all three pay a healthy dividend and carry improved balance sheets. For those interested in energy, all three deserve a watchlist spot.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance