Rising delinquencies offer economic warning signs

Note: A version of this article was published on TKer.co.

Stocks rallied last week, with the S&P 500 climbing 1.3% to close at 4,415.24. The index is now up 15% year to date, up 23.4% from its October 12, 2022 closing low of 3,577.03, and down 7.9% from its January 3, 2022 record closing high of 4,796.56.

While the overall data indicate continued economic growth, there are signs of stress developing that bear watching.

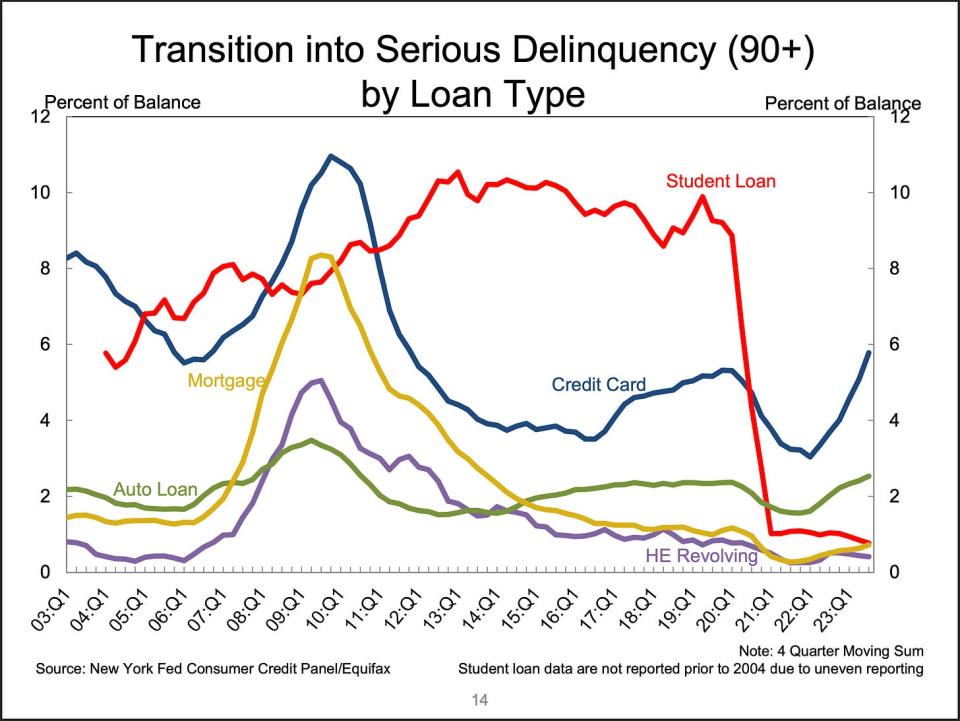

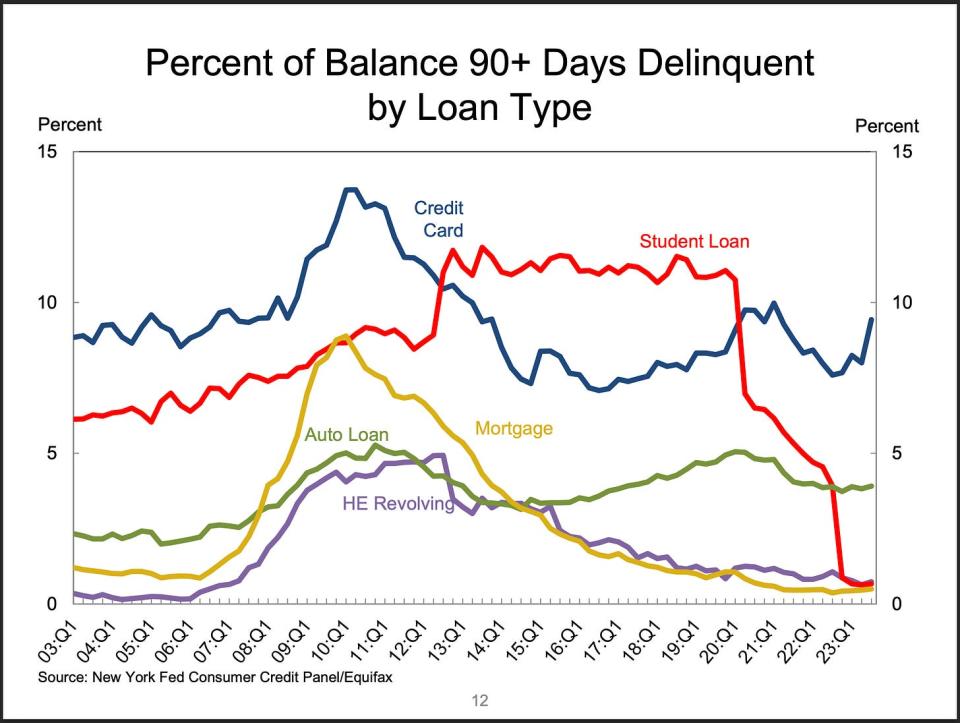

According to the New York Fed’s Q3 Household Debt and Credit (HHDC) report, the share of debt newly transitioning into delinquency continues to rise for mortgages, auto loans, and credit cards.

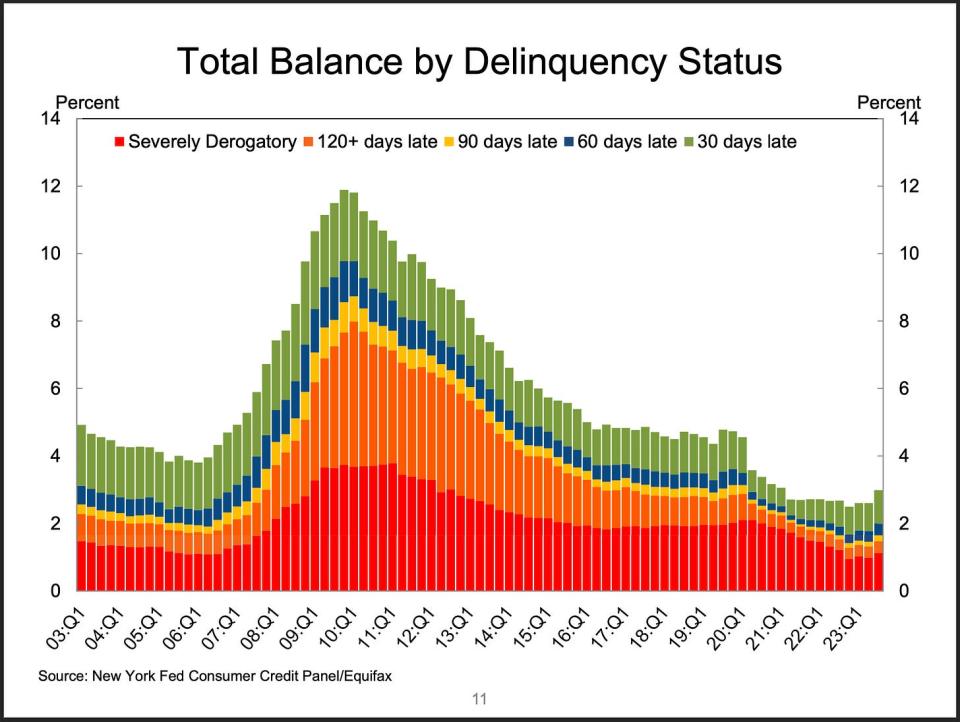

When you include the debt, the delinquency rates, while rising, continue to reflect a normalization back to prepandemic levels.

In other words, while the "flow" into new delinquency has been picking up, the "stock" of delinquencies remains below prepandemic levels.

"As of September, 3.0% of outstanding debt was in some stage of delinquency, up by 0.4 percentage points from the second quarter yet 1.7 percentage points lower than the fourth quarter of 2019," New York Fed researchers wrote.

The rise in delinquencies comes as banks have been tightening lending standards.

According to the Federal Reserve’s October Senior Loan Officer Opinion Survey on Bank Lending Practices, lending standards have tightened for residential real estate loans…

… and for consumer loans.

Consistent with softening, but not particularly bad

There’s not much to celebrate here, especially if you are a consumer that’s affected or you are someone hoping for hotter economic growth.

These deteriorating metrics, however, do appear in line with the Federal Reserve’s ongoing efforts to bring down inflation by reining the economy by tightening monetary policy. Indeed, key labor market metrics have been cooling for over a year. Read more on the evolving labor market here, here, here, and here.

That said, it’s also arguably premature to conclude that the decelerating economy is destined to transition into one that’s in an outright recession.

"Overall this looks consistent with a softening trajectory for consumer spending, but not a particularly bad one," JPMorgan’s Daniel Silver wrote in response to the HHDC report.

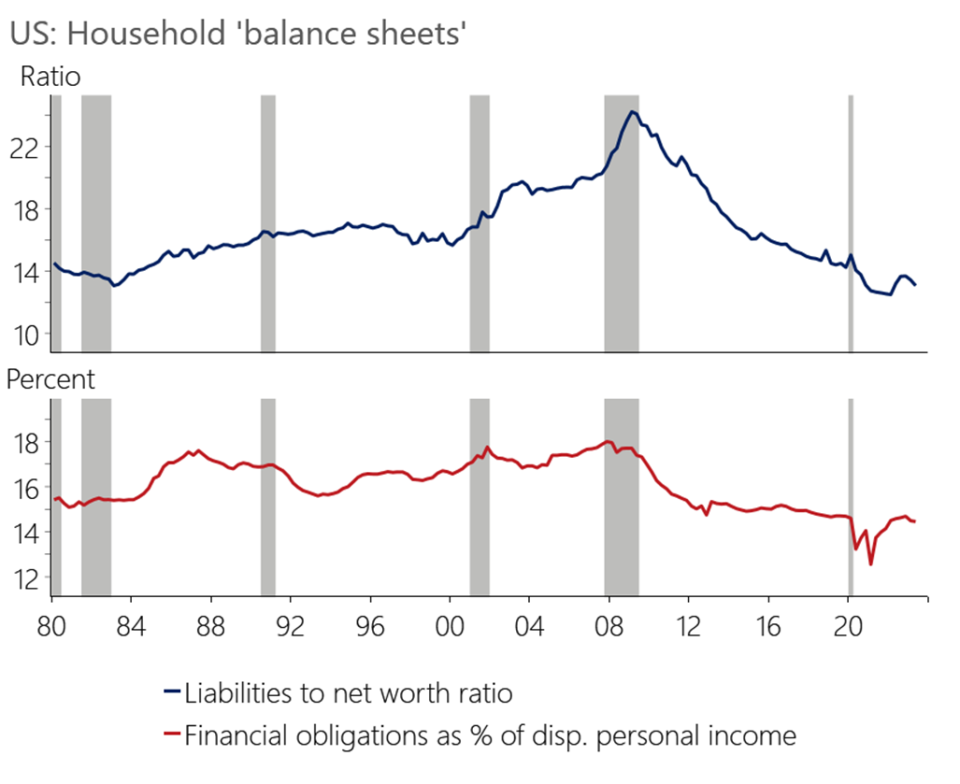

Make no mistake: Consumer finances continue to be in remarkably good shape.

"We have emphasized that household balance sheets look very strong after a long streak of deleveraging following the Global Financial Crisis, and this could reduce the need for most households to tighten their belts," Oxford Economics’ Daniel von Ahlen wrote on Friday. "The surge in equity and home prices since the pandemic mean that household net worth is at record highs."

Keep in mind that the deteriorating credit metrics discussed above occurred during a period of robust GDP growth, supported by resilient consumer spending growth. And the economy continues to be supported by many other tailwinds pointing to more growth ahead.

The restart of student loan payments have had limited impact

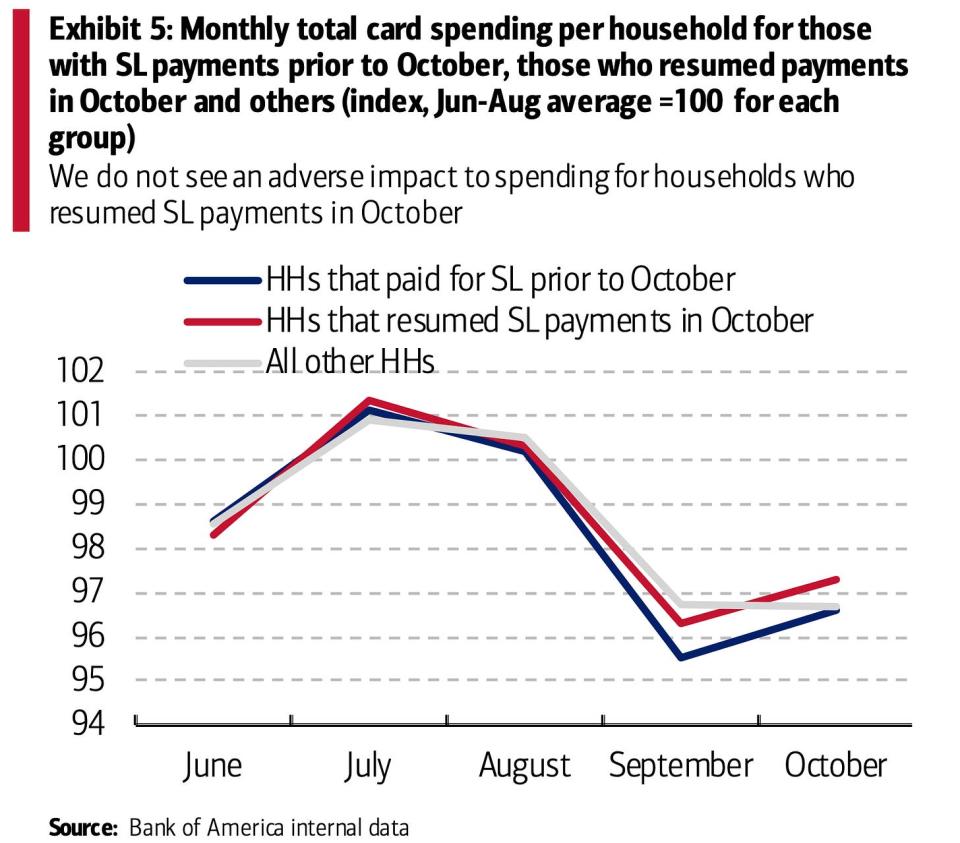

So far, the resumption of student loan payments has had a limited effect on the consumer picture.

"We should also keep in mind that the 3Q [HHDC] report is probably too early to see potential negative effects of the end of forbearance on student loans, although the early read from some related data is that this likely will not end up being a huge drag on consumers," JPM’s Silver said.

According to JPMorgan’s analysis, Chase Consumer Card spending data as of November 1 suggests the U.S. Census’ control measure of retail sales — which is used in calculating GDP growth — was up 0.52% month-over-month in October.

Citing their own proprietary data, Bank of America analysts found card spending declined by 0.2% in October.

"With the end of the student loan moratorium, many are wondering if consumers will cut back on spending to make loan repayments," Bank of American analysts wrote. "When we look at the spending of households who made a [student loan] payment for the first time in 2023 in October, we do not see any obvious sign of an adverse impact relative to other groups of households."

For more, read: What the restart of student loan payments could mean for the economy 🎓

Be vigilant 👀

Just because the stock market usually goes up and the economy is usually growing doesn’t mean they are always doing so.

Bear markets and recessions are unfortunate hurdles on the long-run path to building wealth in risk assets.

To reiterate, the overall data indicate continued economic growth — and consequently suggest a bullish "Goldilocks" soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

But as the data continues to come in, we’ll have to be vigilant as we watch for signs that the economic narratives may be shifting.

Reviewing the macro crosscurrents

There were a few notable data points and macroeconomic developments from last week to consider:

Moody’s turns negative on U.S. credit rating. On Friday, bond rating agency Moody’s changed its outlook for the U.S. government’s Aaa credit rating to "negative from stable." From Moody’s: "The key driver of the outlook change to negative is Moody's assessment that the downside risks to the US' fiscal strength have increased and may no longer be fully offset by the sovereign's unique credit strengths. In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues, Moody's expects that the US' fiscal deficits will remain very large, significantly weakening debt affordability. Continued political polarization within US Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability."

A bond rating agency’s changed view on the U.S. usually isn’t as big a deal as it might sound.

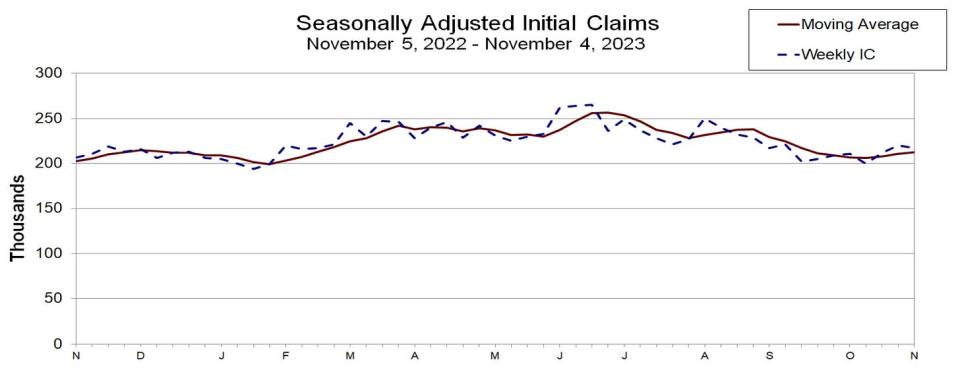

Unemployment claims tick down. Initial claims for unemployment benefits fell to 217,000 during the week ending November 4, down from 220,000 the week prior. While this is up from a September 2022 low of 182,000, it continues to trend at levels associated with economic growth.

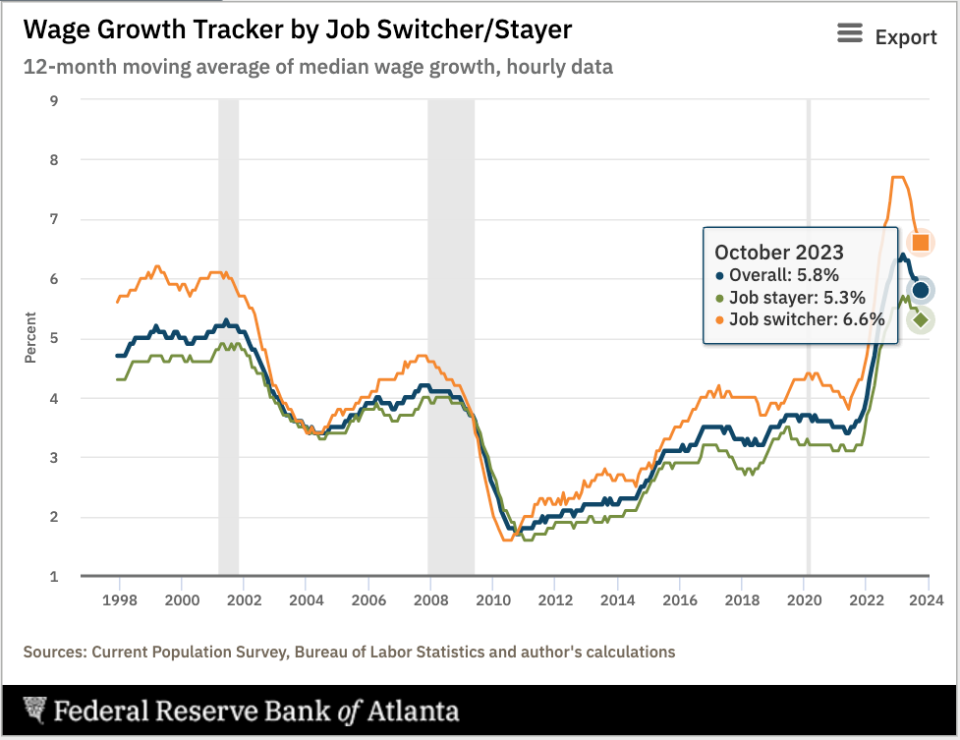

Job switchers lose pay advantage as wage growth cools. According to the Atlanta Fed’s wage growth tracker, the gap wage growth between those who switch jobs and those who stay at their jobs continues to close. Job switchers saw 6.6% wage growth in the 12 months ending in October, whereas job stayers saw 5.3% growth during the period.

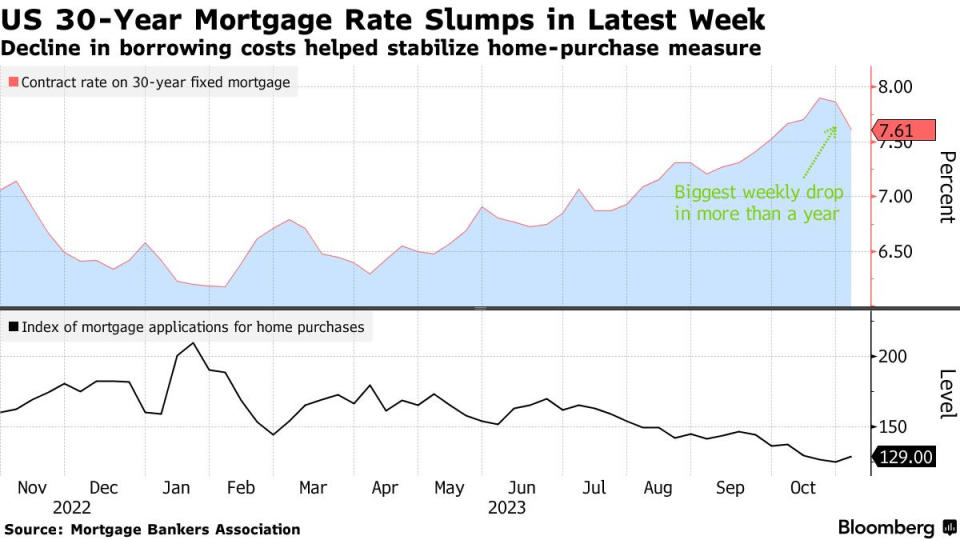

Mortgage rates fall, mortgage applications rise. From Bloomberg: "The average 30-year mortgage rate plunged last week by the most in more than a year, helping generate the biggest advance in home purchase applications since early June. The contract rate on a 30-year fixed mortgage slid 25 basis points to 7.61%, the lowest level since the end of September, according to the Mortgage Bankers Association. The group’s index of mortgage applications for home purchases increased 3% in the week ended Nov. 3, the data out Wednesday showed."

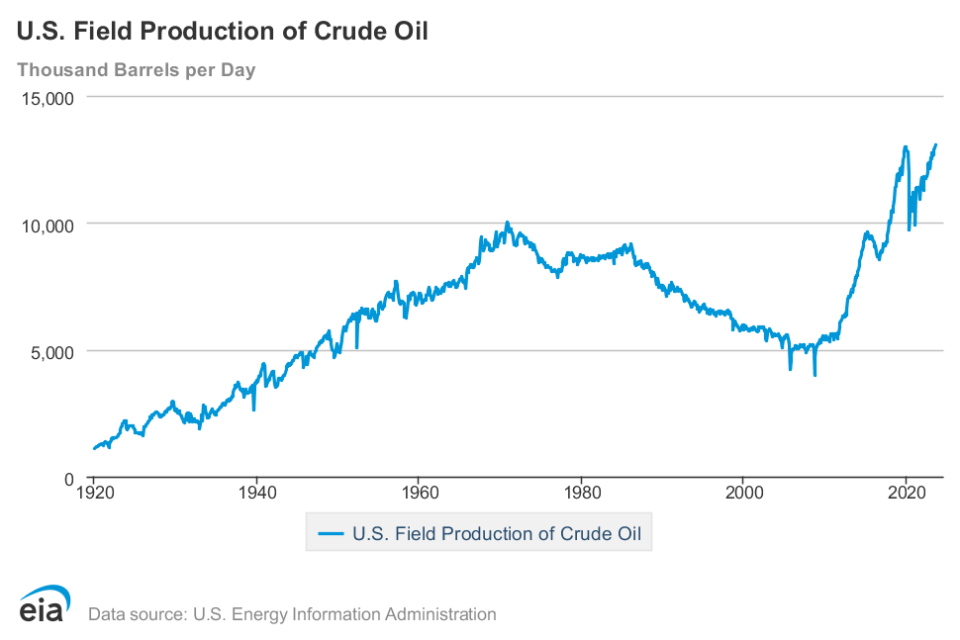

Pumping oil at a record pace. From Bloomberg: "U.S. crude production jumped to a record high of 13.05 million barrels a day in August, the US Energy Information Administration said [Oct. 31] in a monthly report. The output surpassed a previous high set in November 2019 of 13 million barrels a day. US crude has been playing an increasingly vital role in global oil markets due OPEC+ leaders Saudi Arabia and Russia extending production cuts."

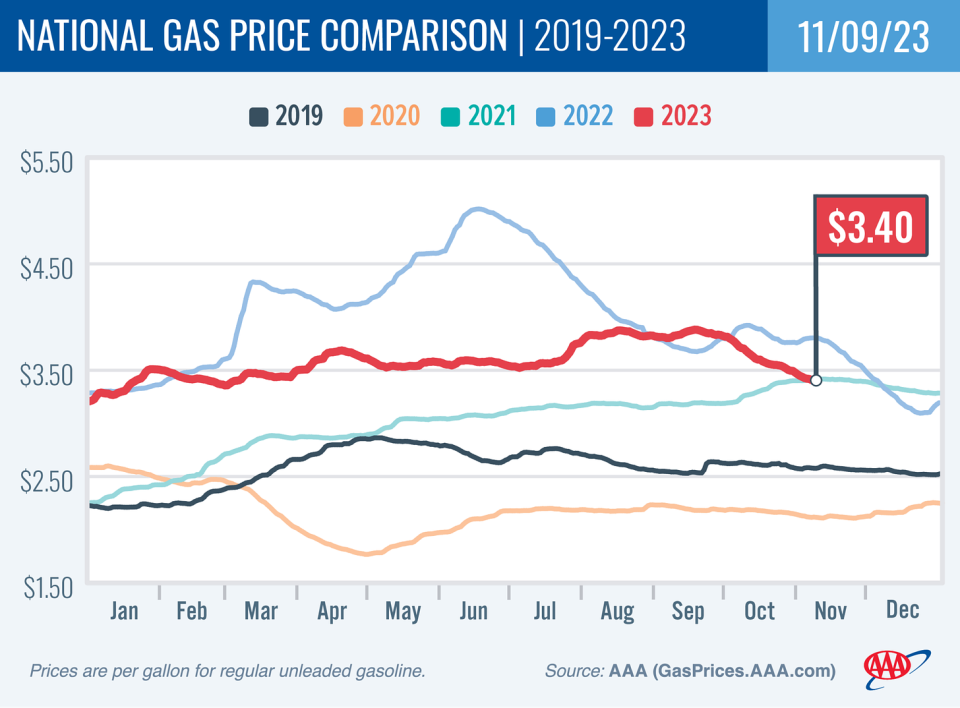

Gas prices fall. From AAA: "The national average for a gallon of gas dropped four cents since last week to $3.40. However, the steady, if slow, decline may gain speed after recent drops in the price of oil. Parked in the mid-$80s per barrel a week ago, oil is now hovering around the mid-$70s. Since it is the main ingredient in gasoline, less expensive oil usually leads to falling gas prices."

Here’s an interesting way of thinking about gas prices from Justin Wolfers: The number of minutes of work it takes to pay for a gallon of gas.

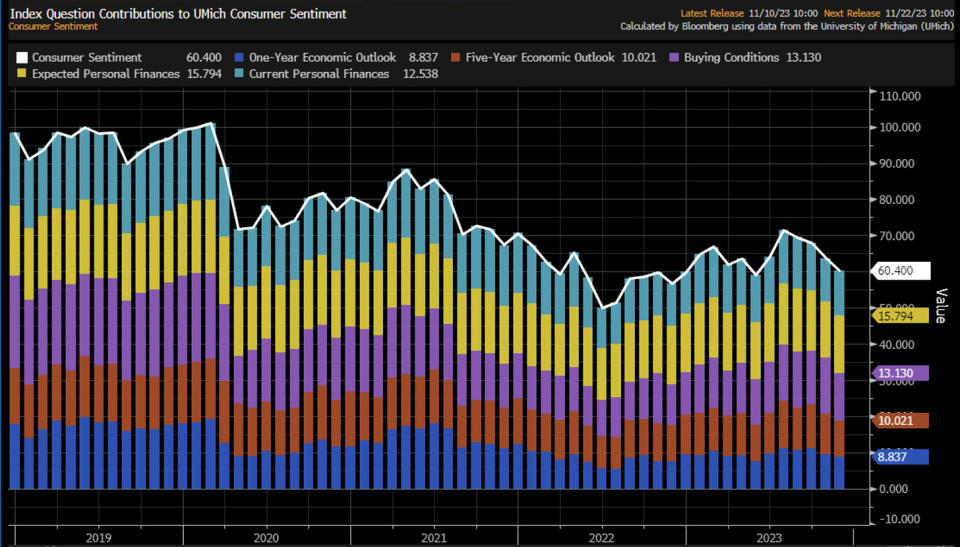

Consumer sentiment sours. From the University of Michigan’s November Surveys of Consumers: "Consumer sentiment slipped for the fourth straight month, falling 5% in November. While current and expected personal finances both improved modestly this month, the long-run economic outlook slid 12%, in part due to growing concerns about the negative effects of high interest rates. Ongoing wars in Gaza and Ukraine weighed on many consumers as well. Overall, lower-income consumers and younger consumers exhibited the strongest declines in sentiment. In contrast, sentiment of the top tercile of stock holders improved 10%, reflecting the recent strengthening in equity markets."

Inventory levels are down. Wholesale inventories stood at $901.8 billion in September. The inventories/sales ratio was 1.33, down from 1.36 the previous year.

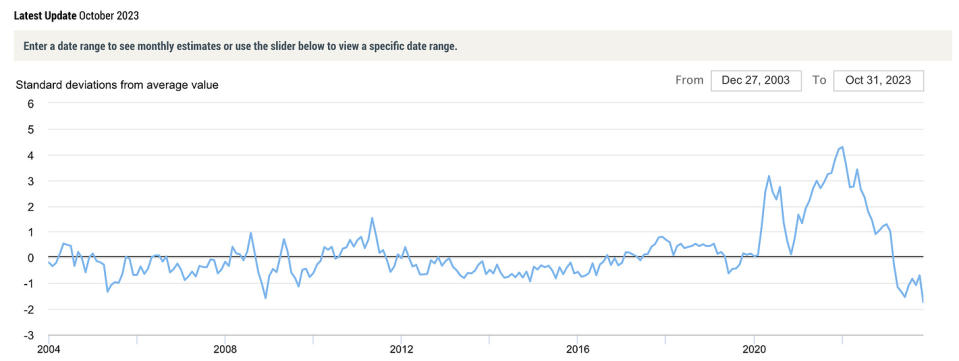

⛓️ Supply chain pressures loosen. The New York Fed’s Global Supply Chain Pressure Index — a composite of various supply chain indicators — ticked lower in October and remains below levels seen even before the pandemic. That's way down from its December 2021 supply chain crisis high.

Near-term GDP growth estimates remain positive. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 2.1% rate in Q4.

Putting it all together

We continue to get evidence that we could see a bullish "Goldilocks" soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

This comes as the Federal Reserve continues to employ very tight monetary policy in its ongoing effort to bring inflation down. While it’s true that the Fed has taken a less hawkish tone in 2023 than in 2022, and that most economists agree that the final interest rate hike of the cycle has either already happened or is near, inflation still has to cool more and stay cool for a little while before the central bank is comfortable with price stability.

So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms — meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.

Note: A version of this article was published on TKer.co.

Yahoo Finance

Yahoo Finance