The rise and fall of FTX's Sam Bankman-Fried, the onetime crypto billionaire who was sentenced to 25 years in prison

Sam Bankman-Fried catapulted into a crypto billionaire. Now, his empire is in ruins, and he's been sentenced to prison.

On Thursday, he was sentenced to 25 years in prison after being convicted in November on seven criminal counts.

Here's the story of his rise and fall from grace.

A few years ago, Sam Bankman-Fried was a 30-year-old with a mop of brown hair and enough clout to go by his initials, SBF. He had a cryptocurrency exchange called FTX, a trading firm called Alameda Research, and $15.6 billion to his name, according to estimates from Bloomberg.

He had catapulted into one of the biggest names in crypto in the span of a few years and was setting his sights on mainstream finance.

Now, he's been sentenced to prison.

A federal judge on Thursday sentenced the disgraced FTX founder to 25 years in prison, following his conviction in November on seven counts of fraud and conspiracy.

Here's how SBF went from crypto's poster child to its greatest cautionary tale:

Bankman-Fried grew up in Silicon Valley as the son of two Stanford Law professors.

He spent his childhood playing games like chess and bridge. His brother, Gabe, said, "playing games growing up, his inclination is if a board game is fun, you should play two simultaneous games at once with a timer."

Source: Business Insider

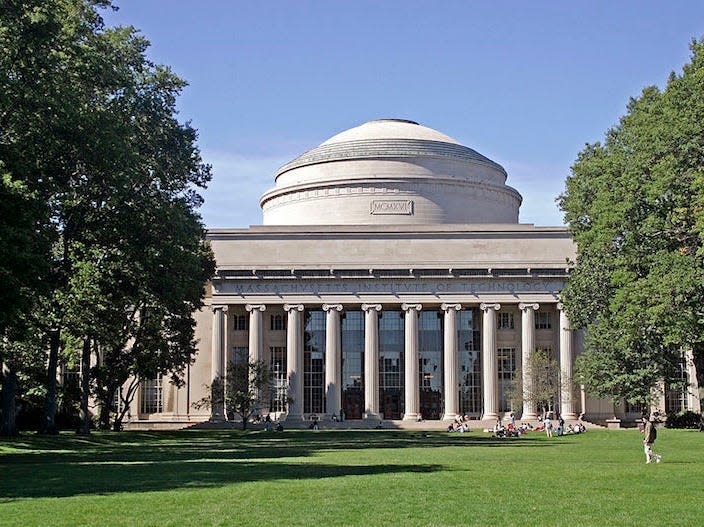

Bankman-Fried studied physics at Massachusetts Institute of Technology where he juggled several extracurriculars alongside his academics. "I worked like an hour and a half a day in total and had trouble getting places on time," Bankman-Fried previously told BI. "I was a really negligent student."

Source: Business Insider

During college, Bankman-Fried became especially interested in effective altruism, a philosophical movement that uses calculations to understand how people can use their time, money, and resources to best help others.

After college, Bankman-Fried went to work for the global trading firm, Jane Street. That's where he learned the art of arbitrage— a form of trading in which traders buy an asset for a low price in one market and sell it for higher in another market.

During his three years at Jane Street, Bankman-Fried would give away half of his salary to animal-welfare groups and effective altruism charities, according to Bloomberg. He left to work for MacAskill's Centre for Effective Altruism, set up by William MacAskill, one of the leaders of the effective altruism movement.

By 2017, crypto was booming, and people were trading on private exchanges. Bankman-Fried noticed that some coins were selling for higher prices on some exchanges than others. He realized he could use his arbitrage skills to exploit the gaps in prices.

By October of 2017, Bankman-Fried had set up his own crypto trading firm, Alameda Research, in Berkeley, California. His Alameda colleagues previously told BI that he was adept at finding ways to move faster than other traders.

Source: Business Insider

At its peak, Alameda was moving almost $15 million a day between markets, according to Bloomberg. Bankman-Fried soon earned the nickname "the Moby Dick of crypto whales" for the waves he was making in the crypto industry.

In 2018, he abruptly moved Alameda's team to Hong Kong, after realizing how lax the rules were compared to the United States. "I think we're losing $50,000 a day by not working out of Hong Kong instead of Berkeley," one of his colleagues who previously spoke to BI recalled him saying.

Source: Business Insider

As Bankman-Fried continued to rack up money from trading, his ambitions grew, too. He began entertaining thoughts of building an alternative to what he called the "shitshow exchanges" he was trading in between the years of 2017 and 2018.

By the start of 2019, Bankman-Fried and his team were fervently working towards building their own crypto exchange. After four months of coding, they launched FTX that May.

FTX was a win. The platform boasted cost-effective features like low trading fees and offered several types of coins for traders to bet on. FTX even allowed traders to swap cash as collateral for coins.

In 2020, Bankman-Fried also opened a small US branch of FTX. He had designs of eventually taking a major slice of the U.S. crypto market and began lobbying Congress for new crypto rules a few times a year. He's also donated millions to pro-crypto super PAC, GMI PAC, according to Politico.

In September 2021, Bankman-Fried decided to move FTX's operations to the Bahamas. It was just a flight away from Miami, but the platform could still operate outside of the SEC's purview.

FTX only took a minor cut of every trade, but by 2020, an average of $1 billion was being traded daily on the platform, according to Bloomberg. In 2021 alone, Bankman-Fried raked in a profit of $350 million from FTX, and another $1 billion from Alameda, according to Bloomberg.

Major investors like SoftBank Vision Fund, Tiger Global, Sequoia Capital, and BlackRock placed bets on FTX in funding rounds. By early 2022, FTX and its U.S. operations were valued by investors at a combined $40 billion, according to Forbes.

At his peak, Bankman-Fried's own net worth was $26 billion, according to Bloomberg.

He's allocated that wealth towards sponsorships, funding political leaders, and furthering effective altruism.

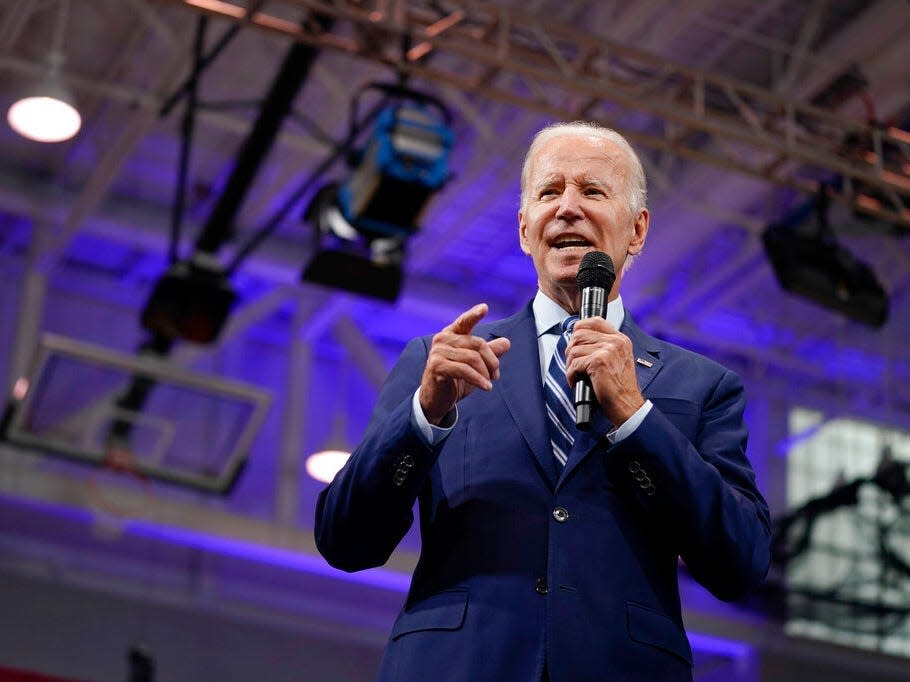

He suddenly emerged as a major political donor in 2020 and spent over $10 million backing Joe Biden's presidential campaign, according to Politico. But Bankman-Fried actually made his political first donation back in 2010 to Democratic Senator Michael Bennet of Colorado, Politico reported.

He spent over $40 million on campaigns in 2022, according to Federal Election Committee filings reviewed by Politico.

He's made donations on both sides of the political aisle though the majority of his funding has skewed towards Democratic leaders. The Los Angeles Times reported that Bankman-Fried has given $1 million to the Senate Majority PAC and $6 million to the House Majority PAC— two super PACs that are dedicated to keeping Congress in the hands of Democrats. He also funded Protect Our Future, a Super PAC that focuses exclusively on Democratic House primaries, according to Politico.

He's also the principle funder of Guarding Against Pandemics, a nonprofit run by his brother Gabe, according to Politico.

Bankman-Fried has said his donations are about furthering his larger belief in effective altruism. He told Bloomberg that he would eventually only keep 1% of his income or a minimum of $100,000 a year.

His simple lifestyle, too, followed the ideas of effective altruism. He drove a Toyota Corolla, lived with roommates, and is vegan.

At the same time, he's funneled money into flashy corporate sponsorships. His most notable is acquiring naming rights for the Miami Heat's arena which cost him about $135 million over 19 years, according to Bloomberg.

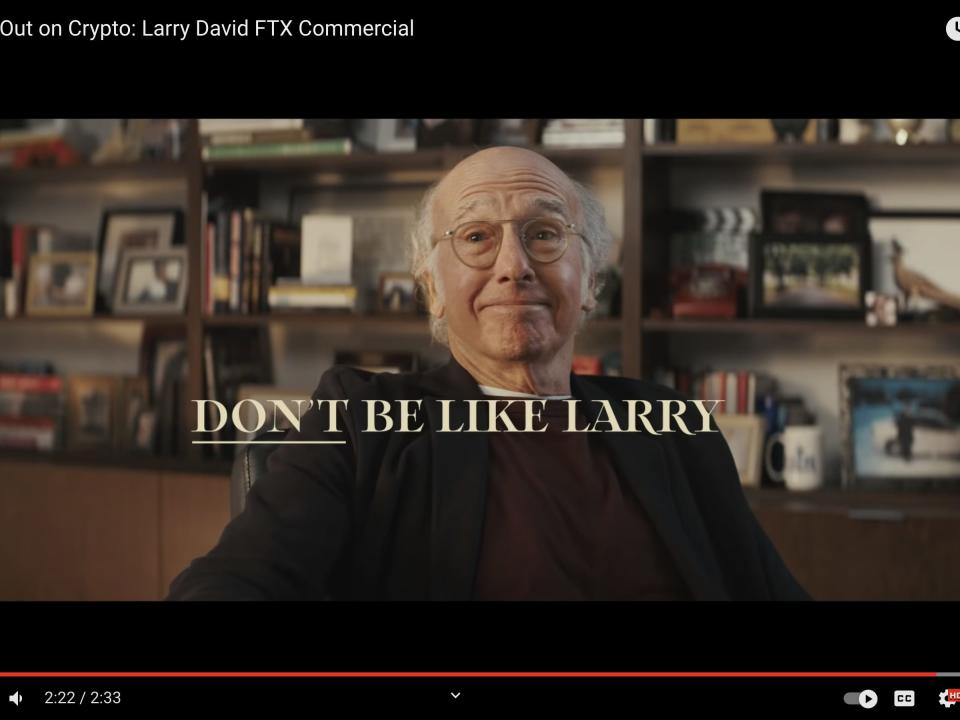

He also spent about $30 million airing an ad in the 2022 Super Bowl with the comedian Larry David, according to Bloomberg.

Through FTX, Bankman-Fried has also forged deals with major basketball teams like the Washington Wizards and Golden State Warriors. FTX has also struck deals with individual athletes like basketball player Steph Curry and quarterback Tom Brady.

Bankman-Fried seemed unstoppable— until he wasn't. In November 2022, the crypto publication CoinDesk reported a leaked balance sheet that showed that Alameda Research was on unstable grounds.

The report revealed that most of Alameda's assets were tied up in FTX's in-house token, FTT. With the broader crypto market already reeling, traders began worrying about a sudden drop in the value of FTT.

Changpeng Zhao, the founder of Binance, FTX's rival exchange, announced shortly after that Binance would be selling its holdings of FTT. With that traders across the board began rushing to withdraw their own holdings from FTX's platform. Bankman-Fried had no choice but to ask Binance to bail FTX out.

By November 9, 2022, Binance had walked away from the deal. Bankman-Fried's own assets dropped 94% and his net worth plummeted to around $1 billion, according to Bloomberg.

On November 11, 2022, FTX announced Bankman-Fried was resigning as CEO but would help "assist in an orderly transition" to new CEO John J. Ray III.

Ray has held several senior executives roles at other companies in the past, including at Enron to lead its turnaround efforts.

Having failed to secure a bailout, FTX, Alameda Research, and 130 additional affiliated companies started voluntary Chapter 11 bankruptcy proceedings.

"The immediate relief of Chapter 11 is appropriate to provide the FTX Group the opportunity to assess its situation and develop a process to maximize recoveries for stakeholders," said new CEO Ray. "The FTX Group has valuable assets that can only be effectively administered in an organized, joint process. I want to ensure every employee, customer, creditor, contract party, stockholder, investor, governmental authority and other stakeholder that we are going to conduct this effort with diligence, thoroughness and transparency."

As part of FTX's bankruptcy proceedings, the new CEO said he'd never "seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information" as what happened with the company.

Source: Business Insider

On November 22, 2022, the first day of FTX's bankruptcy hearing, the company's lawyer said one of its US branches bought almost $300 million worth of Bahamian real estate.

"Based on preliminary investigations, most of those real estate purchases related to homes and vacation properties that were used by senior executives of the company," James Bromley, a restructuring partner at Sullivan & Cromwell who is on FTX's bankruptcy team, said.

Bankman-Fried showed up for an interview on November 30, 2022, with Andrew Ross Sorkin at the DealBook Summit in a segment called "What Happened?"

Bankman-Fried said he's not focused on worrying about being held criminally liable for FTX's collapse, and that instead he wants to "help" the millions of customers and stakeholders who lost their money.

He appeared virtually from the Bahamas, and said he's "thought about" coming back to the US — denying that the reason he hasn't returned is because of fears of being arrested.

He denied reports of improper drug use and "wild parties" with his employees.

During his appearance at the DealBook Summit, Bankman-Fried told Sorkin that drugs he took were "totally on-label," and were prescribed to him for "focus and concentration."

Against the advice of his lawyers, Bankman-Fried also spoke to other news publications.

In addition to appearing at the DealBook Summit, Bankman-Fried has done interviews with Intelligencer and Good Morning America, and had his conversation with a Vox reporter, who is also a "longtime friend," published. At the DealBook Summit, Bankman-Fried said he "stupidly forgot" his friend "was also a reporter."

He also said at the summit that his lawyers don't want him talking, but, "I have a duty to talk to people... I have a duty to do everything I can to try and do what's right."

Bankman-Fried appeared on Good Morning America that December. He could've prevented FTX's implosion if he'd spent "an hour a day" on risk management, he said.

Source: Good Morning America

Then, Bankman-Fried was arrested in the Bahamas on December 12, 2022.

Bahamian authorities arrested Bankman-Fried at the US government's request.

"The Bahamas and the United States have a shared interest in holding accountable all individuals associated with FTX who may have betrayed the public trust and broken the law," Bahamian Prime Minister Philip Davis said in a press release.

Hours before his arrest, Bankman-Fried was doing an interview in Twitter Spaces with Unusual Whales, and said he didn't "believe" he would be arrested if he returned to the US.

During the interview, he was playing a video game called "Storybook Brawl" — a game his now collapsed company, FTX, acquired in March.

Hours after his arrest, the US Securities and Exchange Commission announced it would file charges against Bankman-Fried in relation "to his violations of securities laws."

"We commend our law enforcement partners for securing the arrest of Sam Bankman-Fried on federal criminal charges," Gurbir Grewal, the enforcement director for the SEC, wrote in a Twitter statement.

The SEC alleges Bankman-Fried violated the Securities Act through misusing FTX customer funds for his own benefits, and not being transparent about debts with investors.

Bankman-Fried was "orchestrating a massive, years-long fraud, diverting billions of dollars of the trading platform's customer funds for his own personal benefit and to help grow his crypto empire," the SEC said in its filing against him.

Bankman-Fried was formally charged with 8 criminal charges by US federal prosecutors in New York. The charges were unsealed on December 13, 2022.

Charges included allegations of fraud for using funds from FTX to support his hedge fund Alameda Research, wire fraud, conspiracy charges to commit securities fraud, money laundering, defrauding the US, and violating campaign finance laws.

That day, Bankman-Fried appeared in court in the Bahamas with his parents. Bankman-Fried indicated that he would not be waiving his rights to challenge his extradition to the United States. The judge denied him bail and initially remanded him to custody until February 2023.

Source: Business Insider

Bankman-Fried spent nine days at Fox Hill— a prison in the Bahamas— playing crossword puzzles, reading newspapers, and eating vegan food, according to Bloomberg.

An acting commissioner of corrections in the Bahamas said Bankman-Fried was "receiving no special treatment than any other inmate."

Source: Business Insider; Bloomberg

The following week, Bankman-Fried agreed to be extradited to the United States. He was flown into New York on December 21, 2022.

Source: Business Insider

Bankman-Fried was released on $250 million bail on December 22, 2022. He was ordered to surrender his passport and stay with his parents at their home in Palo Alto, California, until the FTX trial. US Magistrate Judge Gabriel W. Gorenstein, who presided over the bail hearing, also ordered an ankle monitor to be placed on Bankman-Fried.

Gorenstein said Bankman-Fried would only be allowed to leave his parents' home for court appearances and with "the permission of pretrial services" for exercise. He also forbade Bankman-Fried from starting new businesses or opening new financial accounts.

By New York law, defendants in criminal cases are not usually responsible for the full bail amount unless they make notable attempts to flee or violate bail conditions.

"I don't think there's any concern of safety or any additional crimes," Gorenstein said. "The defendant has achieved significant notoriety."

Still, Bankman-Fried's parents were required to secure a lien over their home. Several other unknown "responsible" individuals were required to post funds as well, Gorenstein noted at Thursday's hearing.

Source: Business Insider

Earlier that day, Damien Williams, the US attorney for the Southern District of New York, announced that Bankman-Fried's former colleague and onetime girlfriend Caroline Ellison, had pleaded guilty to seven criminal charges and was cooperating with prosecutors.

Ellison's agreement meant she waived any defenses to charges against her. However, she'll very likely serve nowhere near the maximum sentence of 110 years in prison for these charges because of her cooperation.

As part of the deal, Ellison was required to testify and hand over documents, records, and evidence to prosecutors. Ellison also agreed to pay restitution at an amount to be determined by the courts.

Gary Wang, another former colleague of Bankman-Fried, also pleaded guilty to fraud charges.

Source: Business Insider

In a brief court appearance on January 3, 2023, Bankman-Fried pleaded not guilty to the criminal charges against him.

Source: Business Insider

In an interview with Puck News published on January 10, 2023, Bankman-Fried said "most of the people who I was friends with are not talking to me."

He added, "I don't blame people for wanting to try and avoid getting drawn into the shitshow as best they can."

Source: Business Insider

On January 12, 2023, Bankman-Fried launched a newsletter on Substack. "I didn't steal funds, and I certainly didn't stash billions away," he wrote in his first post. "Nearly all of my assets were and still are utilizable to backstop FTX customers." He reiterated other points including the fact that he hasn't run Alameda Research in years.

Source: SBF's Substack

On February 15, 2023, a federal judge unsealed the names of two people sponsoring Bankman-Fried's $250 million bail, after media organizations including BI argued the names should be made public.

Source: Business Insider

The two people were Larry Kramer, a former dean of Stanford Law School, and Andreas Paepcke, a research scientist at Stanford. Kramer contributed $500,000 and Paepcke contributed $200,000.

Source: Business Insider

On February 23, 2023, federal prosecutors alleged that Bankman-Fried funneled political donations through two executives at FTX as a way to achieve bipartisan influence in Washington DC. Prosecutors said in the filing that Bankman-Fried "did not want to be known as a left-leaning partisan, or to have his name publicly attached to Republican candidates."

Prosecutors also wrote in the filing that Bankman-Fried "perpetuated his campaign finance scheme at least in part to improve his personal standing in Washington, D.C., increase FTX's profile, and curry favor with candidates that could help pass legislation favorable to FTX or Bankman-Fried's personal agenda, including legislation concerning regulatory oversight over FTX and its industry."

The updated indictment brought the number of criminal charges against Bankman-Fried to 12, up from the original eight.

Source: Business Insider

In July, prosecutors called for Bankman-Fried to be jailed after a controversy in the case over leaks to the New York Times about Ellison's Google Doc entries.

Prosecutors called for the FTX founder to be jailed for what they said was witness tampering., saying he crossed the line in showing Ellison's Google Docs to the New York Times, and in his other communications ahead of his trial.

The judge sided with prosecutors and sent SBF to jail for the matter.

SBF's trial began on October 3, 2023. Over the course of five weeks, key witnesses including his former colleagues Caroline Ellison, Gary Wang, and Nishad Singh, testified against him, while SBF denied committing fraud or stealing customers' funds but admitted he'd made mistakes.

In the end, the jury took just about 4 hours to deliberate. SBF was convicted in November 2023 on seven criminal counts of fraud and conspiracy.

On March 28, 2024, US District Judge Lewis Kaplan sentenced him to 25 years in prison.

At his sentencing, SBF expressed regret for FTX's implosion, saying it "haunts me everyday."

"My useful life is probably over," he said. "It's been over for a while now since before my arrest."

"A lot of people feel really let down. And they were very let down," he said. "And

I'm sorry about that. I'm sorry about what happened at every stage."

Kaplan said he'd recommend that the Federal Bureau of Prisons send Bankman-Fried to a facility near the San Francisco area so his family could visit him.

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance