Richelieu Hardware (TSE:RCH) Is Aiming To Keep Up Its Impressive Returns

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. With that in mind, the ROCE of Richelieu Hardware (TSE:RCH) looks attractive right now, so lets see what the trend of returns can tell us.

What is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Richelieu Hardware:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

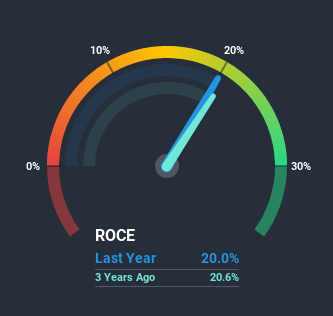

0.20 = CA$126m ÷ (CA$769m - CA$138m) (Based on the trailing twelve months to February 2021).

So, Richelieu Hardware has an ROCE of 20%. In absolute terms that's a great return and it's even better than the Trade Distributors industry average of 14%.

Check out our latest analysis for Richelieu Hardware

In the above chart we have measured Richelieu Hardware's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What Does the ROCE Trend For Richelieu Hardware Tell Us?

We'd be pretty happy with returns on capital like Richelieu Hardware. The company has employed 71% more capital in the last five years, and the returns on that capital have remained stable at 20%. Returns like this are the envy of most businesses and given it has repeatedly reinvested at these rates, that's even better. If these trends can continue, it wouldn't surprise us if the company became a multi-bagger.

The Bottom Line

In short, we'd argue Richelieu Hardware has the makings of a multi-bagger since its been able to compound its capital at very profitable rates of return. And the stock has followed suit returning a meaningful 99% to shareholders over the last five years. So while investors seem to be recognizing these promising trends, we still believe the stock deserves further research.

While Richelieu Hardware looks impressive, no company is worth an infinite price. The intrinsic value infographic in our free research report helps visualize whether RCH is currently trading for a fair price.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance