Get Rich With These 2 Growth Stocks in the Next Market Crash

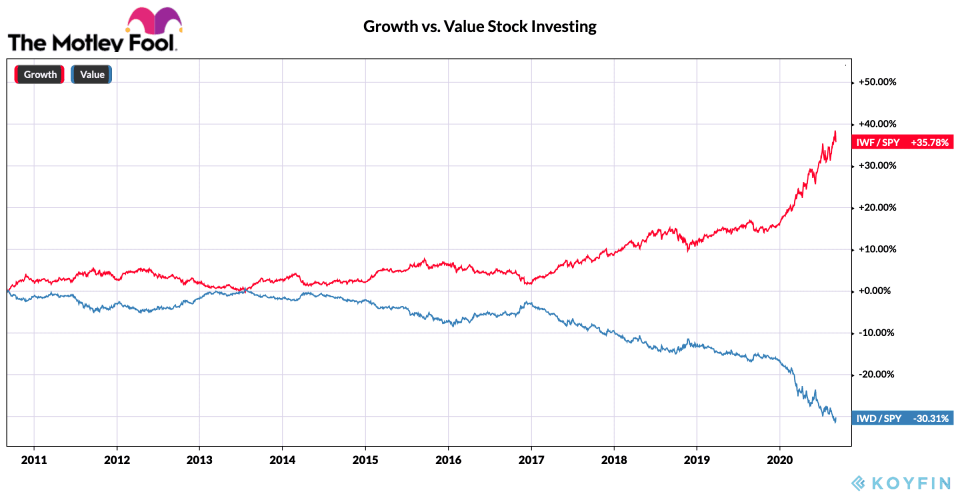

Growth stocks have massively outperformed value stocks in the last decade, as shown in the chart below. Therefore, investors should highly consider having a meaningful portion of their stock portfolios invested for high growth.

The 2020 market crash sheds some light on the behaviours of growth stocks. The Canadian stock market (based on the iShares S&P TSX 60 Index ETF with the ticker XIU) fell about 33% from the peak before the March market crash to the trough of the crash. From the trough, the market appreciated about 34%.

Here’s how these growth stocks fared against the market.

Shopify stock

In the last market crash, Shopify (TSX:SHOP)(NYSE:SHOP) stock lost about 28% of its value. From the trough, Shopify stock more than doubled by appreciating 130%.

The tech company is still growing fast. Its trailing 12-month revenue was more than US$2 billion, which was 60% higher than a year ago. Its Q2 revenue climbed 97% against Q2 2019. In the past 12 months, the stock appreciated 162%.

In Q2, Shopify’s gross merchandise volume, which is the total dollar value of orders facilitated through its platform, increased 119% year over year. This was helped by new stores that grew 71% versus Q1, as Shopify offered a limited-time extension for the free trial of its standard plan from 14 days to 90 days. This special offer should convert a bunch of users that created stores in April and May into paid merchants through the end of August 2020, which will be reflected in the Q3 results.

The onset of the pandemic made e-commerce more critical to businesses, as it ushered faster progress on their online strategies.

On Tuesday, Shopify announced an equity offering, raising gross proceeds of US$990 million at US$900 per share. That announcement also includes an offering of US$800 million of convertible senior notes. Both offerings will dilute current shareholders in the near term, but if the funds are invested properly in Shopify’s growth strategies as management intends to, they can drive long-term growth.

The stock is easily one of the best-performing stocks but also one of the most expensive on the planet. Currently, SHOP stock trades at a forward enterprise value to sales of 35 times. Interested investors should consider buying it on dips or consolidations.

Lightspeed stock

As a younger tech stock with a similar growth story as Shopify, Lightspeed (TSX:LSPD)(NYSE:LSPD) stock was hit harder in the last market crash. However, it has also rebounded with a stronger rally.

The last market crash saw the little tech stock fall 70% from peak to trough. From the trough, the tech stock almost tripled by appreciating nearly 200%!

Its TTM revenue was nearly US$133 million, which was 58% higher than a year ago. Last quarter, it reported revenue growth of 51% against the prior year’s quarter.

The company just had its initial public offering on the NYSE, successfully raising gross proceeds of US$332 million at US$30.50 per share.

Currently, Lightspeed stock trades at a forward enterprise value to sales of 16.6 times, which is a cheaper alternative to Shopify.

The Foolish takeaway

As a bigger company with a wider moat, Shopify stock could hold up better in a market crash. In any case, during a market crash and especially on material corrections, it would be a good idea to buy shares of growth stocks like Shopify and Lightspeed to get rich by riding on the secular trend of e-commerce.

The post Get Rich With These 2 Growth Stocks in the Next Market Crash appeared first on The Motley Fool Canada.

More reading

Fool contributor Kay Ng owns shares of Shopify. Tom Gardner owns shares of Shopify. The Motley Fool owns shares of and recommends Shopify and Shopify. The Motley Fool owns shares of Lightspeed POS Inc.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2020

Yahoo Finance

Yahoo Finance