Ribbon Communications Inc. (RBBN) Q1 2024 Earnings: Misses Revenue Estimates, Narrows Losses

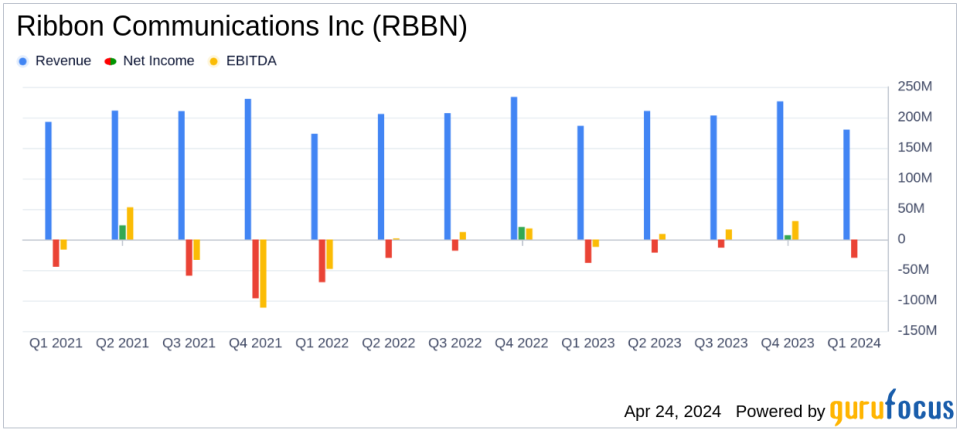

Revenue: Reported $180 million for Q1 2024, a decrease from $186 million in Q1 2023, falling short of estimates of $185.03 million.

Net Income: GAAP net loss of $30 million in Q1 2024, improved from a loss of $38 million in Q1 2023, but below the estimated net loss of $0.97 million.

Earnings Per Share (EPS): GAAP diluted loss per share was $0.18, an improvement from $0.23 year-over-year, yet significantly below the estimated EPS of -$0.01.

Gross Margin: Increased significantly by over 700 basis points year-over-year, contributing to a stronger profitability profile.

Adjusted EBITDA: Improved to $12 million in Q1 2024 from a negative $2 million in Q1 2023, indicating enhanced operational efficiency.

Future Outlook: Projects Q2 2024 revenue between $200 million and $210 million with non-GAAP gross margin expected to range from 53.5% to 54.5%.

Strategic Developments: Announced a new multi-year network modernization program with Verizon, expected to bolster future revenue streams.

Ribbon Communications Inc (NASDAQ:RBBN) released its 8-K filing on April 24, 2024, revealing its financial results for the first quarter ended March 31, 2024. The company reported a revenue of $180 million, falling short of the estimated $185.03 million. However, it significantly narrowed its losses with a GAAP net loss of $30 million compared to $38 million in the same quarter of the previous year. Non-GAAP net loss was reduced to $1 million from $3 million year-over-year.

About Ribbon Communications Inc.

Ribbon Communications Inc provides advanced network solutions to service providers and enterprises globally. It operates through two segments: Cloud and Edge, and IP Optical Networks. The majority of its revenue is generated from the Cloud and Edge segment, offering products and services for VoIP communications and Voice Over LTE to service providers and enterprise customers, primarily in the United States.

Financial Performance and Challenges

The company's revenue decline from $186 million in Q1 2023 to $180 million in Q1 2024 reflects a challenging environment in the U.S. Tier One Service Provider spending. Despite this, Ribbon Communications has seen a strong performance in the EMEA region, with sales growing 24% year-over-year, and a 9% increase in sales in the IP Optical Networks segment. This marks the seventh consecutive quarter of growth for this segment.

Strategic Developments and Financial Highlights

Ribbon Communications announced a significant new multi-year project with Verizon for Network Modernization, which is expected to bolster future revenues. The company has also shown a robust improvement in profitability with a more than 700 basis point increase in both GAAP and Non-GAAP Gross Margins, attributed to lower product costs and strong regional sales mix.

Key Financial Metrics and Outlook

The company's financial resilience is further underscored by its solid order bookings and cash from operations totaling $13 million for the quarter. Looking ahead to Q2 2024, Ribbon Communications projects revenue between $200 million and $210 million and anticipates Non-GAAP gross margin to range from 53.5% to 54.5%, with Adjusted EBITDA expected to be between $20 million and $25 million.

Analysis of Company's Performance

Despite the revenue shortfall relative to analyst expectations, Ribbon Communications' strategic initiatives like the Verizon deal and ongoing improvements in operational efficiency are pivotal. The company's ability to reduce losses and improve margins amidst challenging market conditions speaks to the strength of its operational management and strategic direction.

Conclusion

Ribbon Communications Inc. is navigating a complex market landscape with strategic partnerships and operational improvements that are beginning to yield financial benefits. As the company continues to execute its growth strategies, particularly in high-potential areas like IP Optical Networks and enterprise solutions, it remains a notable player in the telecommunication services industry.

For more detailed financial results and future projections, investors and interested parties are encouraged to visit Ribbon Communications' investor relations webpage.

Explore the complete 8-K earnings release (here) from Ribbon Communications Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance