Returns At Brisbane Broncos (ASX:BBL) Are On The Way Up

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So when we looked at Brisbane Broncos (ASX:BBL) and its trend of ROCE, we really liked what we saw.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Brisbane Broncos, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.16 = AU$7.4m ÷ (AU$58m - AU$12m) (Based on the trailing twelve months to December 2023).

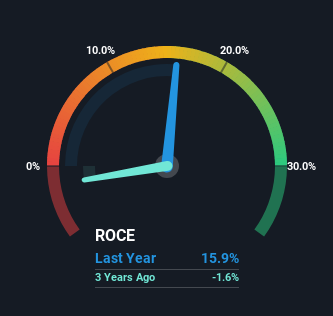

So, Brisbane Broncos has an ROCE of 16%. In absolute terms, that's a satisfactory return, but compared to the Entertainment industry average of 8.5% it's much better.

View our latest analysis for Brisbane Broncos

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Brisbane Broncos' past further, check out this free graph covering Brisbane Broncos' past earnings, revenue and cash flow.

So How Is Brisbane Broncos' ROCE Trending?

We like the trends that we're seeing from Brisbane Broncos. The data shows that returns on capital have increased substantially over the last five years to 16%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 22%. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

The Bottom Line On Brisbane Broncos' ROCE

To sum it up, Brisbane Broncos has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. And a remarkable 145% total return over the last five years tells us that investors are expecting more good things to come in the future. In light of that, we think it's worth looking further into this stock because if Brisbane Broncos can keep these trends up, it could have a bright future ahead.

One more thing, we've spotted 1 warning sign facing Brisbane Broncos that you might find interesting.

While Brisbane Broncos may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance