Should You Retain Entergy (ETR) in Your Portfolio Now?

We issued an updated research report on Entergy Corporation ETR on Aug 29. Of late, Entergy is gradually shifting from being a hybrid to a pure-play utility.

The company began this process by closing Vermont Yankee power plant in 2014. Going forward, it plans to shut down its Palisades power plant in October 2018 and its Pilgrim plant in May 2019. In April 2020 and 2021, the company plans to close Indian Point Units 2 and 3.

The company aims to increase investments toward the modernization of grid buoyed by rising customer demand and favorable regulatory support.

Of the recently made investments, in April 2017, the company signed a purchase and sale agreement with a subsidiary of Calpine Corporation. Per the deal, Calpine will construct the plant, which will consist of two natural gas-fired combustion turbine units with a total nominal capacity of approximately 360 MW. Once completed in 2021, Entergy will purchase the plant for $261 million.

To diminish the risk and volatility in the EWC business, the company is gradually reducing its EWC footprint. In line with this, the EWC earned 10.2% less net income in second-quarter 2017 for the company compared to the prior-year quarter’s level.

On the flip side, higher nuclear labor costs are hampering the company’s operational growth, which in turn is escalating its nuclear generation expense. Moreover, Entergy recently witnessed lower generation from its nuclear plants, primarily due to an increase in outage days and lower fuel expense which resulted from impairments.

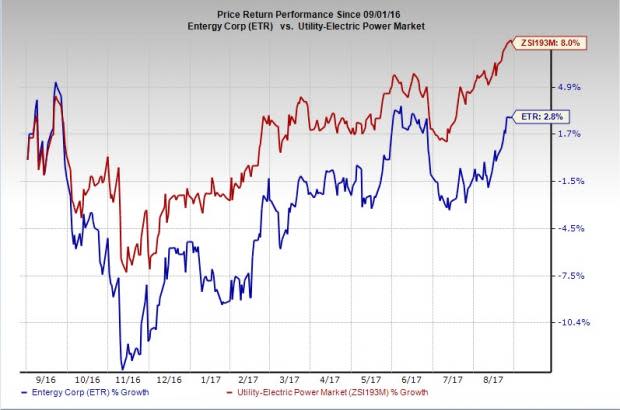

This might have lead the company to underperform its broader market. Evidently, Entergy’s share price has gained 2.8% in the last one year, compared to its broader industry's gain of 8%.

The company also faces tough competition from its peers like Ameren Corporation AEE, CenterPoint Energy, Inc. CNP and Duke Energy Corporation DUK.

Zacks Rank

Entergy Corp currently carries a Zacks Rank #3 (Hold). You can seethe complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance