Restructuring Efforts, Lower Rates to Boost KEY Amid Asset Quality Woes

Balance sheet repositioning, minority equity stake, decent loan demand and lower rates are expected to support KeyCorp KEY. Meanwhile, elevated expenses and weak asset quality are major near-term concerns.

Minority Equity Stake, Balance Sheet Repositioning to Aid KEY

On Aug. 12, KeyCorp announced a minority equity investment of $2.8 billion (in aggregate) by Canada’s The Bank of Nova Scotia BNS (also known as Scotiabank) in two tranches at a fixed price of $17.17 per share. The first phase was completed on Aug. 30, and now BNS holds a 4.9% equity stake in KEY.

The second part involves BNS making an additional $2 billion of investment, expected to close in the first quarter of 2025, pending the Fed’s consent. After this, BNS will have a 14.9% equity interest in KeyCorp.

After the first phase of investment, KeyCorp sold its low-yielding available-for-sale (AFS) investment securities portfolio worth almost $7 billion. The company expects to incur an after-tax loss of $700 million in the third quarter of 2024 because of the sale. The securities sold had a weighted average book yield of roughly 2.3% and an average duration of nearly six years.

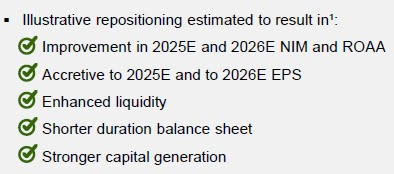

The sale of AFS is likely to lead to approximately $400 million in additional net interest income (NII) in 2025 and 2026. It will also be low single-digit accretive to KeyCorp’s 2025 earnings and slightly accretive to its 2026 earnings.

Compelling Financial Benefits

Image Source: KeyCorp

This is almost similar to the steps taken by Truist Financial TFC earlier this year. The company completed the sale of its remaining stake in its insurance subsidiary — Truist Insurance Holdings — and used the proceeds to reposition its balance sheet and invest in shorter-duration investment securities. These initiatives will add almost $710 million to TFC’s 2024 NII.

Though the Federal Reserve has started lowering interest rates, those are likely to remain relatively high in the near term. Supported by higher rates and decent loan growth, KeyCorp’s net interest margin (NIM) is likely to continue witnessing growth, though the pace of expansion will slow down on higher funding costs.

While NIM witnessed a decline in 2023 and the first six months of 2024 because of higher deposit costs, it is expected to improve going forward, supported by higher rates, balance sheet repositioning, improving deposit mix and loan growth. We anticipate NIM to be 2.18%, 2.53% and 2.62% in 2024, 2025 and 2026, respectively.

KeyCorp has been witnessing decent top-line growth over the past several years, supported by impressive growth in loans. Management remains optimistic about stabilization and potential loan growth in the second half of 2024. Supported by decent loan demand and solid pipelines, along with the company’s efforts to strengthen fee income, its top line is expected to keep improving. Though we project total revenues (TE) to decline 1% in 2024, the metric is expected to rebound and grow 11.7% and 6.5% in 2025 and 2026, respectively.

Poor Asset Quality & High Expense Level Ail KeyCorp

Weak asset quality is a major headwind for KEY. The company witnessed a volatile trend for provisions and net charge-offs (NCOs). While provisions dipped in 2023 and the first half of 2024, NCOs continued to rise. A tough macroeconomic backdrop is likely to put pressure on asset quality. Per our estimates, provisions are expected to decline in 2024, while NCOs are expected to rise 48.6% on a year-over-year basis.

Also, KeyCorp’s mounting expense base remains a concern. The non-interest expenses experienced a five-year CAGR of 3.6% (ended 2023). The increase was attributed to higher personnel costs. The ongoing investments in franchises, technological upgrades and inorganic growth initiatives are expected to keep expenses elevated. Though we estimate total non-interest expenses to decline 5.4% in 2024, the same will rise 4.8% and 2.6% in 2025 and 2026, respectively.

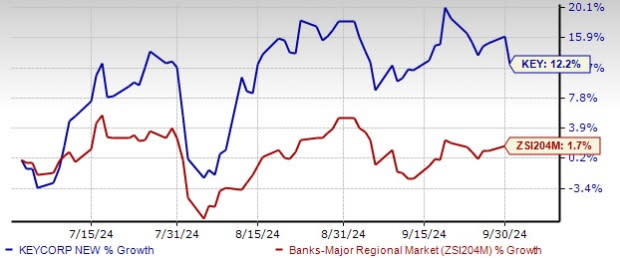

Shares of KeyCorp have risen 12.2% in the past three months, outperforming the industry’s growth of 1.7%.

Three-Month Price Performance

Image Source: Zacks Investment Research

KeyCorp currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KeyCorp (KEY) : Free Stock Analysis Report

Bank of Nova Scotia (The) (BNS) : Free Stock Analysis Report

Truist Financial Corporation (TFC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance