Restaurant Industry on the Rise: 3 Stocks to Buy for Smart Investors

The restaurant industry is showing promising signs of growth, buoyed by key developments in August sales. The recent Federal Reserve’s decision to lower interest rates for the first time in four years adds another layer of opportunity for investors.

As inflation subsides and consumer habits evolve, the restaurant industry is entering a pivotal phase. Despite a challenging macroeconomic environment, the industry has demonstrated stability, enabling companies to meet and harness new demand. Resilience and adaptability are evident as restaurants attract fresh customers and drive transactions through innovative products and strategic marketing.

Key players like El Pollo Loco Holdings, Inc. LOCO, Texas Roadhouse, Inc. TXRH and Potbelly Corporation PBPB are well-positioned to capitalize on these trends.

August Restaurant Sales: A Closer Look

Per the U.S. Census Bureau data, eating and drinking places recorded $94.5 billion in sales in August 2024 compared with $91.1 billion in July 2024. Although the figure rose 2.7% on a year-over-year basis, the figure represents a minimal change in terms of volumes posted in the previous four months.

Consumer Interest in Dining Out Remains Strong

Consumer interest in dining out remains robust. Per the National Restaurant Association survey, roughly 43% of millennials and Gen Xers, 42% of baby boomers and 40% of Gen Z adults express a desire for more dining-out opportunities. Lower-income households are driving a significant portion of this pent-up demand, with around half of the consumers earning less than $50,000 per year willing to avail of restaurant services. Also, higher-income households (earning over $100,000) play a crucial role.

Federal Reserve Interest Rate Cuts: A Game Changer?

Meanwhile, the Federal Reserve's recent decision to cut key lending rate by 0.5 percentage points, bringing it to a range of 4.75% to 5%, signals a shift after years of aggressive rate hikes aimed at curbing inflation.

With borrowing costs expected to decline, restaurant operators may now have more flexibility to pursue expansion projects like opening new locations or remodeling existing ones. For those reliant on credit to maintain operations or fund strategic growth, this rate cut provides some much-needed financial relief.

Additionally, lower interest rates typically boost consumer spending, as individuals save money on mortgages, car loans, and credit card payments. This increase in disposable income could lead to more frequent dining-out occasions. As inflation moderates, the restaurant industry may see a pickup in consumer confidence and spending.

What Next for the Industry?

The world's largest central bank by assets, the Fed's decision is closely watched for its potential ripple effects. Analysts are closely monitoring how far the Fed will go with rate cuts, given the significant influence of its actions on global markets.

Despite ongoing macroeconomic challenges such as fluctuating customer spending and staffing shortages, we believe that providing a cohesive, integrated, and consistent experience across all customer touchpoints will significantly boost guest satisfaction and foster frequent customer engagement. As we anticipate improvements in dining room performance and growth in takeout and delivery services, input cost stabilization is likely to remain vital for the respective company's margin improvements in the near future.

Here, we have highlighted three stocks that are likely to witness earnings growth in 2024, buoyed by the above-mentioned tailwinds.

3 Restaurant Stocks to Buy Now

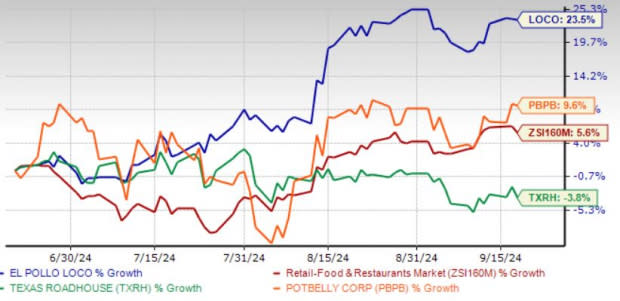

3-Month Share Price Performance

Image Source: Zacks Investment Research

El Pollo Loco operates a unique and expanding restaurant chain specializing in fire-grilled, citrus-marinated chicken within the limited-service segment. The restaurant integrates Mexican culinary traditions with a healthier lifestyle, offering a signature menu featuring fire-grilled chicken and a variety of Mexican and LA-inspired dishes.

El Pollo Loco is taking a strategic approach to its cost-saving measures, ensuring that food quality and customer experience are enhanced throughout the process. The company made strategic hires, including a new chief development officer, to streamline operations and reduce unit build costs. These efforts are expected to improve franchise growth and financial performance in the coming years.

El Pollo Loco currently carries a Zacks Rank #2 (Buy) and has gained 23.5% in the past three months compared with the industry’s 5.6% growth. The Zacks Consensus Estimate for LOCO’s current financial-year sales and earnings per share (EPS) suggests growth of 2% and 12.7%, respectively, from the year-ago period. LOCO has a trailing four-quarter earnings surprise of 21.6%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Texas Roadhouse operates not only the Texas Roadhouse brand but also Bubba’s 33 and Jaggers, both of which are gaining significant traction. The company’s ability to maintain strong traffic growth is underpinned by its commitment to providing a high-quality dining experience. The brand’s unique proposition, centered on value and customer loyalty, has kept it competitive in the casual dining industry despite rising competition and promotional activity from rivals.

Texas Roadhouse currently carries a Zacks Rank #2 and has declined 3.8% in the past three months. The Zacks Consensus Estimate for Texas Roadhouse’s current financial-year sales and EPS suggests growth of 15.6% and 39.2%, respectively, from the year-ago reported figures. TXRH has a trailing four-quarter earnings surprise of 0.4%, on average.

Potbelly, through its subsidiaries, owns, operates and franchises Potbelly sandwich shops in the United States. Potbelly’s growth strategy revolves around aggressive franchising, and the company is making significant progress in expanding its footprint. With inflationary pressures impacting consumer spending, Potbelly has positioned itself as a value-driven brand.

The introduction of the $7.99 Everyday Value Combo has been a notable success, attracting price-conscious customers while still protecting margins. This value-driven menu strategy has not only driven incremental sales but has also boosted customer satisfaction and return intent, making Potbelly a go-to option in a price-sensitive market.

Potbelly currently carries a Zacks Rank #2 and has gained 9.6% in the past three months. The Zacks Consensus Estimate for Potbelly's fiscal 2024 EPS suggests growth of 33.3% from the year-ago reported figure. PBPB has a trailing four-quarter earnings surprise of 77.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Roadhouse, Inc. (TXRH) : Free Stock Analysis Report

Potbelly Corporation (PBPB) : Free Stock Analysis Report

El Pollo Loco Holdings, Inc. (LOCO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance