Republic Services (RSG) Q3 Earnings & Revenues Beat Estimates

Republic Services, Inc. RSG reported impressive third-quarter 2018 results, with earnings and revenues beating the Zacks Consensus Estimate.

Adjusted earnings per share (EPS) of 82 cents outpaced the Zacks Consensus Estimate by a penny and improved 22.4% year over year. The bottom line had a $0.12 benefit from the tax reform, partially offset by a $0.08 headwind from recycling business.

During the reported quarter, Republic Services invested $53 million in tuck-in acquisitions. The company’s shares have gained 4.6% in the past year compared with the industry’s rise of 1.2%.

Revenues

Quarterly revenues of $2.6 billion beat the consensus mark by $1.8 million and improved marginally on a non-adjusted basis year over year. The figure improved 4.1% year over year on a proforma basis. The improvement includes internal growth of 2.2% and acquisitions of 1.9%.

Revenues in the Collection segment totaled $1.9 billion, up 1.3% on year over year on a non-adjusted basis and 3.2% on proforma basis. It contributed 74.3% to total revenues.

Transfer segment revenues of $144 million registered year-over-year increase of 6.8% on non-adjusted basis and 7.9% on proforma basis. It contributed 5.6% to total revenues.

Landfill segment revenues of $331.4 million delivered year-on-year rise of 2.5% on non-adjusted basis and 3.9% on proforma basis. It contributed 12.9% to total revenues.

Energy services segment revenues of $51.5 million registered year-over-year increase of 28.8% on non-adjusted basis and 30.4% on proforma basis. It contributed 2% to total revenues.

Other segment revenues of $132.5 million declined 27.1% on non-adjusted basis and improved 6.7% year over year on proforma basis. It contributed 5.2% to total revenues.

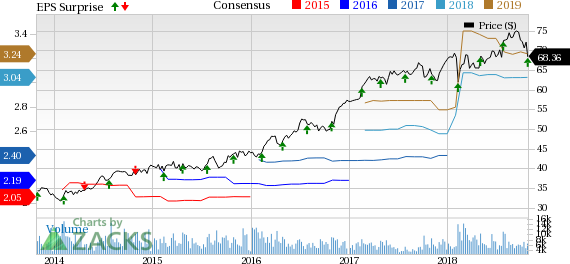

Republic Services, Inc. Price, Consensus and EPS Surprise

Republic Services, Inc. Price, Consensus and EPS Surprise | Republic Services, Inc. Quote

Operating Results

Adjusted EBITDA of $727.5 million inched up 1.3% year over year on a non-adjusted basis and 1.5% on a proforma basis. Adjusted EBITDA margin was 28.4% compared with 28% on a non-adjusted basis and 29.1% on a proforma basis in the prior-year quarter.

Operating income for third-quarter 2018 was $440.3 million compared with $448.1 million in the year-ago quarter. Operating margin was 17.2% compared with 17.5% in the year-ago quarter.

Total selling, general and administrative expenses were $260.9 million compared with $266.7 million in the year-ago quarter.

Balance Sheet and Cash Flow

Republic Services exited third-quarter 2018 with cash and cash equivalents of $81.9 million compared with $61.3 million at the end of the prior quarter. Long-term debt was $7.6 billion compared with $8.2 billion at the end of the prior quarter.

In the quarter, the company generated $555.9 million of cash from operating activities and spent $277.8 million in Capex. Adjusted free cash flow was $289 million compared with $323.1 million at the end of the prior quarter.

Share Repurchase and Dividend Payout

In the quarter, Republic Services returned $203 million to shareholders through dividends and share repurchases. The company repurchased almost 1.3 million shares at an aggregate cost of $90.5 million and an average price of $72.20 per share. As of Sep 30, the company had $1.3 billion available under its share repurchase authorization.

Additionally, on the same day of earnings release, the board of directors announced a quarterly cash dividend of 37.5 cents per share payable on Jan 15, 2019, to shareholders of record as of Jan 2, 2019.

As of Sep 30, 2018, the company‘s quarterly dividend payable was $121.7 million to shareholders of record as of Oct 1. The dividend was paid on Oct 15. In July, the company paid a cash dividend of $112.3 million to shareholders of record as of Jul 2, 2018.

2018 Outlook

Republic Services reaffirmed 2018 guidance for adjusted EPS and adjusted free cash flow. The company expects adjusted EPS in the range of $3.05-$3.10 billion. The Zacks Consensus Estimate of $3.04 is below the midpoint of the guidance.

Adjusted free cash flow is anticipated in the range of $1.09-$1.11 billion.

The company plans to invest $200 million in value-enhancing acquisitions.

Preliminary 2019 Outlook

Republic Services provided an impressive 2019 guidance. The company now anticipates adjusted EPS in the range of $3.23-$3.28. The Zacks Consensus Estimate of $3.24 is below the midpoint of the current guidance.

Adjusted free cash flow is anticipated in the range of $1,125-$1,175 million. Moreover, Republic Services plans to reinvest $75 million of its tax-reform savings to upgrade its fleet and front-line employee facilities. The annual effective tax rate is expected to be 27%.

Zacks Rank & Upcoming Releases

Republic Services currently has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Investors interested in the broader Business Services sector are keenly awaiting earnings reports from Automatic Data Processing, Inc. ADP, BG Staffing, Inc. BGSF and Avis Budget Group, Inc. CAR. While Automatic Data Processing will report first-quarter fiscal 2019 on Oct 31, BG Staffing will release third-quarter 2018 results on Oct 30. Avis Budget Group is expected to announce third-quarter 2018 results on Nov 5.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

BG Staffing Inc (BGSF) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Republic Services, Inc. (RSG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance