Reliance Steel's (RS) Shares Pop 37% in 6 Months: Here's Why

Reliance Steel & Aluminum Co.’s RS shares have shot up 36.9% over the past six months. The company has also outperformed its industry’s rise of 26% over the same time frame. It has also topped the S&P 500’s roughly 8.4% rise over the same period.

Let’s take a look into the factors that are driving this Zacks Rank #1 (Strong Buy) stock.

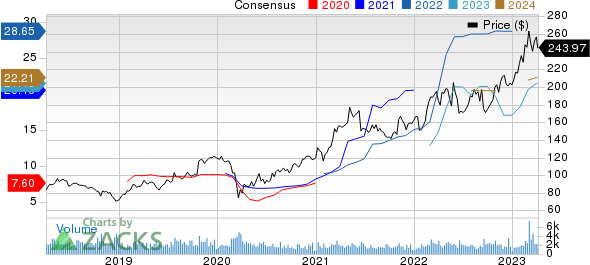

Image Source: Zacks Investment Research

What’s Going in RS’ Favor?

Reliance Steel is riding on strong underlying demand in its major markets. Demand in non-residential construction, the company’s biggest market, remained healthy in the fourth quarter of 2022. The company is optimistic that demand for non-residential construction activity in the key areas in which it operates will remain at healthy levels into the first quarter of 2023.

Reliance Steel is also seeing strength in the semiconductors market as witnessed in the fourth quarter. The company also witnessed higher demand for the toll processing services that it provides to the automotive market due to increased production rates by certain automotive manufactures despite the impact of supply-chain challenges. Additionally, demand in commercial aerospace improved during the fourth quarter and the company is cautiously optimistic that demand will continue to improve in the first quarter. Demand in energy (oil and natural gas) also remained stable year over year in the fourth quarter and the company is cautiously optimistic that demand will improve in the first quarter.

The company, in its fourth-quarter call, said that it envisions healthy demand trends to continue into the first quarter notwithstanding the current macroeconomic uncertainty, ongoing supply-chain disruptions and geopolitical factors. It estimates its tons sold to be up 11-13% sequentially in the first quarter.

The company has also been following an aggressive acquisition strategy for a while as part of its core business policy to drive operating results. Its latest acquisitions of Rotax Metals, Admiral Metals and Nu-Tech Precision Metals are in sync with its strategy of investing in high-quality businesses.

Reliance Steel also remains committed to boost returns to shareholders. It repurchased around 3.5 million shares of its common stock for $630.3 million in 2022. The company also returned $847.4 million to its stockholders during 2022 through dividends and the repurchases. Reliance Steel has also increased its quarterly dividend by 14.3% to $1.00 per share.

Reliance Steel & Aluminum Co. Price and Consensus

Reliance Steel & Aluminum Co. price-consensus-chart | Reliance Steel & Aluminum Co. Quote

Stocks to Consider

Other top-ranked stocks worth considering in the basic materials space include Steel Dynamics, Inc. STLD, Olympic Steel, Inc. ZEUS and Linde plc LIN.

Steel Dynamics currently sports a Zacks Rank #1. The Zacks Consensus Estimate for STLD's current-year earnings has been revised 37.2% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 11.3%, on average. STLD has gained around 23% in a year.

Olympic Steel currently sports a Zacks Rank #1. The Zacks Consensus Estimate for ZEUS's current-year earnings has been revised 60.6% upward in the past 60 days.

Olympic Steel’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 26.2%, on average. ZEUS has rallied around 36% in a year.

Linde currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 2.5% upward in the past 60 days.

Linde beat Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 5.9% on average. LIN’s shares have gained roughly 12% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance