Relative Strength Found Within These 3 Medical Stocks

The Zacks Medical sector has displayed relative strength and modestly outperformed the S&P 500 over the last three months, up more than 7% vs. the general market’s 4% gain.

For a quick and easy explanation, relative strength focuses on stocks or other assets that have performed well relative to the market as a whole or a relevant benchmark.

Investors who target stocks displaying relative strength find themselves in favorable trends, no matter the direction of the general market.

Three dividend-paying stocks from the sector – Eli Lilly and Company LLY, AbbVie ABBV, and Pfizer PFE – could all be considerations for investors wanting to tap into the relative strength.

Below is a chart illustrating the performance of all three stocks over the last three months, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three have outperformed the general market by wide margins over the last several months, indicating positive momentum. Let’s take a deeper dive into all three.

Eli Lilly and Company

Eli Lilly is one of the world’s largest pharmaceutical companies, boasting a diversified product profile that includes a solid lineup of new successful drugs.

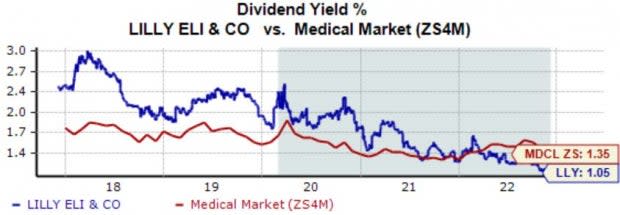

LLY’s annual dividend currently yields 1.1%, below that of its Zacks Medical sector average. Still, the company’s 14.6% five-year annualized dividend growth rate picks up the slack in a big way.

Image Source: Zacks Investment Research

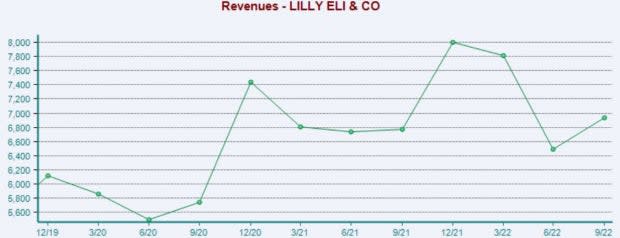

LLY has primarily posted better-than-expected earnings as of late, exceeding earnings and revenue estimates in two of its last three quarters. In its latest release, the company registered a slight 0.5% EPS beat paired with a 0.4% sales surprise.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

AbbVie

AbbVie is a global research-based biopharmaceutical company that delivers innovative medicines, becoming one of the top-most pharma companies after it acquired Botox maker Allergan in a cash-and-stock deal for $63 billion in May 2020.

Undoubtedly a major positive, AbbVie is a member of the elite Dividend King group. The company’s annual dividend currently yields an impressive 3.4% paired with a rock-solid 14% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

In addition, the company’s free cash flow growth is hard to ignore; in its latest release, AbbVie reported free cash flow of $7.4 billion, reflecting a 52% sequential increase.

Image Source: Zacks Investment Research

Pfizer

Pfizer is a multinational pharmaceutical and biotechnology corporation headquartered in New York City, well-known for its COVID-19 vaccine.

PFE’s dividend metrics would please any income-focused investor; the company’s annual dividend currently yields 3.1% paired with a 4.5% five-year annualized dividend growth rate.

Further, the company’s 25% payout ratio is very sustainable.

Image Source: Zacks Investment Research

PFE has also posted strong quarterly results as of late, exceeding the Zacks Consensus EPS Estimate by double-digit percentages in back-to-back releases. Just in its latest print, the pharmaceutical titan penciled in a 21% EPS beat paired with a 7.6% sales surprise.

Image Source: Zacks Investment Research

Bottom Line

Targeting stocks displaying relative strength is an excellent way for investors to ride favorable trends.

And over the last three months, all three stocks above – Eli Lilly LLY, AbbVie ABBV, and Pfizer PFE – have all outperformed the general market, displaying inspiring relative strength.

And for the cherry on top, all three companies pay out dividends, limiting drawdowns in other positions and providing a passive income stream.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance