Reinsurance Group of America Reports Q1 Earnings: A Detailed Comparison with Analyst Projections

Net Income: Reported at $210 million, falling short of the estimated $304.34 million.

Earnings Per Share (EPS): Achieved $3.16, below the estimated $4.55.

Revenue: Totalled $5.4 billion, surpassing the estimated $4558.43 million.

Adjusted Operating Income: Reached $401 million, with an EPS of $6.02, reflecting growth from the previous year's $349 million and $5.16 respectively.

Premium Growth: Experienced a significant increase of 58.8% year-over-year, amounting to $5.4 billion.

Book Value Per Share: Increased to $143.92 from $114.60 the previous year.

Return on Equity (ROE): Reported at 10.2%, with an adjusted operating ROE of 14.8% for the trailing twelve months.

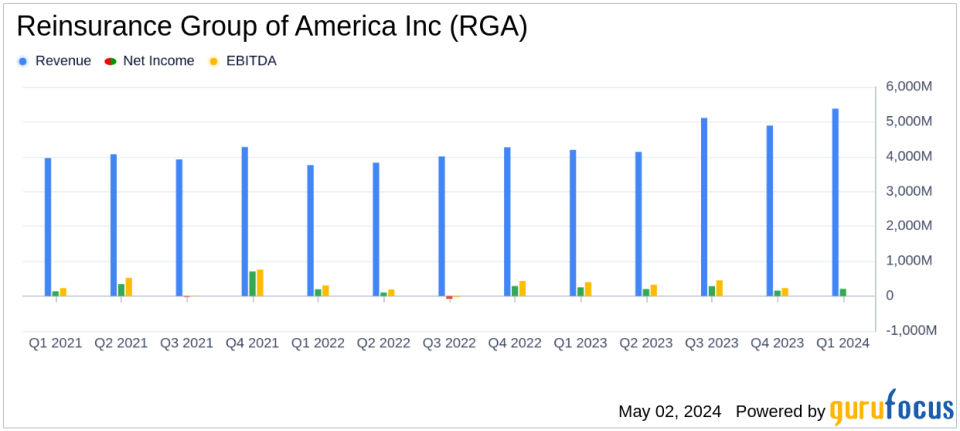

On May 2, 2024, Reinsurance Group of America Inc (NYSE:RGA) released its 8-K filing, unveiling the financial results for the first quarter of the year. The company, a prominent global provider of life and health reinsurance, reported a net income available to shareholders of $210 million, translating to $3.16 per diluted share. This marks a decrease from the previous year's $252 million, or $3.72 per diluted share. However, adjusted operating income saw an increase, reaching $401 million or $6.02 per diluted share, up from $349 million or $5.16 per diluted share in the prior year.

Company Overview

Reinsurance Group of America Inc is an insurance holding company with a diverse global presence, including operations in the United States, Latin America, Canada, Europe, Africa, Asia, and Australia. The company's offerings encompass a wide range of services such as life reinsurance, living benefits reinsurance, group reinsurance, health reinsurance, financial solutions, facultative underwriting, and product development. RGA operates through two main business segments: traditional and financial solutions.

Financial Performance and Market Challenges

The first quarter saw RGA achieving a significant premium growth of 58.8% year-over-year, amounting to $5.4 billion, with a notable $1.9 billion contribution from a single premium pension risk transfer transaction in the U.S. Financial Solutions business. Despite this growth, the company's net income available to shareholders fell, influenced by various market and operational factors. The adjusted operating income, however, suggests a robust underlying performance, excluding notable items.

The return on equity (ROE) stood at 10.2%, with the adjusted operating ROE at an impressive 14.8% for the trailing twelve months. These figures highlight RGA's effective capital deployment and operational efficiency. The company also reported deploying a record $737 million into in-force transactions, reflecting strong momentum in organic new business activity.

Segment-Wise Performance

The U.S. and Latin America segments showed mixed results. Traditional business in these regions experienced favorable claims experience in Individual Life and Health, contributing to a pre-tax adjusted operating income of $128 million. However, the Financial Solutions segment underperformed due to lower variable investment income, with a pre-tax adjusted operating income of $90 million.

In Canada, both the Traditional and Financial Solutions segments performed well, reflecting favorable claims experience and alignment with expectations. The EMEA and Asia Pacific regions also reported positive outcomes, with slight variances due to foreign currency exchange rates.

Strategic Outlook and Dividend Declaration

Tony Cheng, President and CEO of RGA, expressed optimism about the company's trajectory, citing strong performance in the Traditional business and a successful quarter in Financial Solutions. The company's balance sheet strength was underscored by an excess capital of approximately $0.6 billion at the quarter's end. Furthermore, the board of directors declared a regular quarterly dividend of $0.85, payable on May 28, 2024, to shareholders of record as of May 14, 2024.

In conclusion, while the net income for Reinsurance Group of America has seen a decline, the adjusted operating income and substantial growth in premiums paint a promising picture of the company's operational strengths and market positioning. With strategic capital deployment and a focus on high-growth areas, RGA is well-positioned to navigate the complexities of the global reinsurance landscape.

Explore the complete 8-K earnings release (here) from Reinsurance Group of America Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance