Regulator on Volcker Rule workaround: 'This was not the intent'

Financial regulators have a clear message for large banks: They will not be able to benefit from regulatory relief intended for small community banks.

On Tuesday, regulators clarified that large banks will not be permitted to resume proprietary trading under a post-crisis regulation known as the Volcker Rule, setting up a legal battle over the correct interpretation of a bill passed in May offering some exemptions to smaller institutions.

Alternative Interpretation

As Yahoo Finance reported less than two weeks ago, large banks are hoping to take advantage of some double negatives in the law that may have opened the door for firms larger than $10 billion to get exemptions from the rule.

The Volcker Rule, part of the Dodd-Frank regulatory framework, generally prohibits banks from engaging in short-term proprietary trading designed to boost corporate profits instead of helping clients and customers.

In May, President Donald Trump signed a bill offering regulatory relief to smaller banks, including an exemption from the Volcker Rule for “community banks.” But double negatives in the bill made it unclear if banks needed to have less than $10 billion in total assets and less than 5% of their total assets in trading assets and liabilities, or if the negatives flipped the “and” into an “or.”

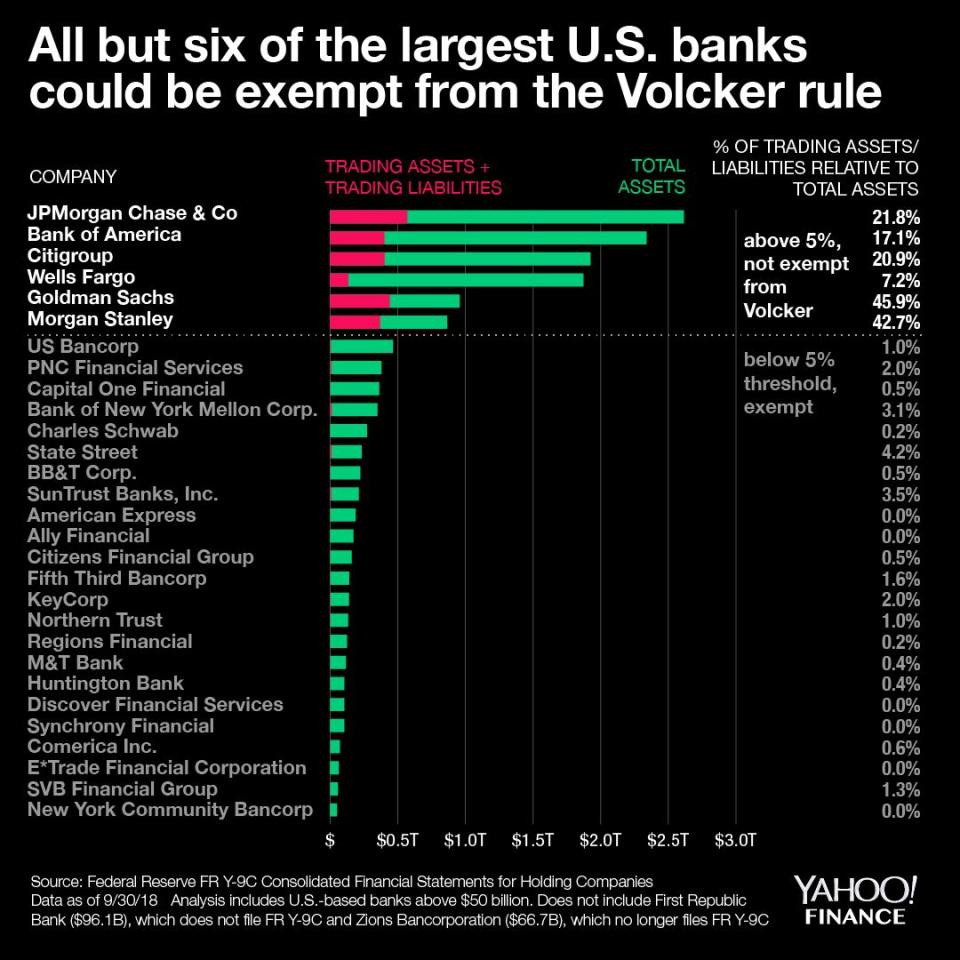

Under the alternative interpretation, banks far above $10 billion could get an exemption as long as they also have relatively small holdings of trading assets and liabilities. Although this would not affect the mega-banks like JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C), or Wells Fargo (WFC), banks as large as U.S. Bancorp (USB) and PNC Financial (PNC) could escape from the regulation, effectively allowing those institutions to get into risky proprietary trading for the sake of extra profits.

Yahoo Finance reported that a former regulator, Keith Noreika, was consulting a number of larger banks on the possibility of filing a lawsuit over that interpretation.

‘This was not the intent’

On Tuesday, an alphabet soup of regulators — Federal Reserve, the Federal Deposit Insurance Corp., the Office of the Comptroller of the Currency, the Securities and Exchange Commission, and the Commodity Futures and Trading Commission — released a notice of proposed rulemaking clarifying that banks will need to “satisfy two conditions” to qualify for the exemption.

"First, the insured depository institution, and every entity that controls it, must have total consolidated assets equal to or less than $10 billion. Second, total consolidated trading assets and liabilities of the insured depository institution, and every entity that controls it, must be equal to or less than five percent of its total consolidated assets."

In a meeting Tuesday, FDIC Board Member Martin Gruenberg acknowledged the “discussion that the new statute can be read in a way that would allow any bank, regardless of asset size, to be exempt from the Volcker Rule.” Gruenberg expressed concern that this interpretation would allow some of the global systemically-important firms to dip below the 5% threshold and earn an exemption. According to regulatory data pulled by Yahoo Finance, Wells Fargo — one of the G-SIBs — has about 7.2% of its total assets in trading assets and liabilities.

“This was not the intent of the new statute as I understand it,” said Gruenberg, an Obama-appointee who served as the FDIC Chairman until being replaced by Trump pick Jelena McWilliams in June. “Indeed the heading of the provision in the statute is ‘Community Bank Relief.’”

Even though the regulators have made their stance clear, any bank interested in mounting a challenge in court will likely have to wait. All of the agencies need to approve the notice, solicit public comment, finalize the rule, and then set an effective date for the rule. In other words, banks would not be able to claim damages until the whole rule-making process is complete, which could take months, if not longer.

In the meantime, the regulators will accept public comments on how they should implement the Volcker Rule exemption. Smaller financial institutions have already expressed worry about the possibility of large banks getting relief as well; the National Association of Federally-Insured Credit Unions wrote to the regulators last week warning that big banks need to play by the rules.

“Loosening requirements...would revive the risky trading practices that contributed to the financial crisis and fundamentally degrade the stability and liquidity of capital markets,” NAFCU wrote.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Read more:

Fears of looming recession cast light on Fed balance sheet

Why 2019 could be the year of the big bank merger

Congress may have accidentally freed nearly all banks from the Volcker Rule

NY Fed’s Williams: There’s still room for ‘further gradual’ rate increases

Yahoo Finance

Yahoo Finance