Regional Banks vs. Tech: What Lies Ahead?

Tech’s Strong 2023

I wrote an article titled “5 Reasons to be Long Tech”, in mid-March. Twenty days later, many of the predictions came true. Mega-cap tech stocks have shined, while small caps have lagged. The reasons presented within the article included:

Positive technical setups and price action:At the time of the writing, the Nasdaq 100 Index was pulling back to its 50-day moving average for the first time since breaking out. Also, the 50-day moving average had just crossed above the 200-day moving average, forming a bullish “golden cross”.

Image Source: Zacks Investment Research

Fed Pivot Potential: While the Fed has not done a complete 360, expectations for the remainder of the year point to a slowdown in rate hikes or a pause.

Money Flow out of Small Caps: Regional banks have acted as the proverbial “pebble in the shoe” for the general market. However, money has flowed out of small-caps and into large-cap tech stocks such as Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOGL).

_______________________________________________________________

What now?

2023’s market is one of the most bifurcated markets in recent memory. The Russell 2000 Small Cap Index ETF (IWM) remains stuck below its 200-day moving average and continues to look vulnerable. Meanwhile, the Nasdaq 100 ETF (QQQ) is coming off a scorching hot 20% first quarter.

Regional Banks are Vulnerable

As long as regional banks have held steady, outside sectors have been able to gain ground. However, any time they break down further, they tend to drag down the entire equities market. The SPDR Regional Bank ETF (KRE) is the most popular proxy for smaller banking stocks in trouble. If you consider KRE’s technical picture, another leg down may be in the works. First, the index is shows a ton of relative weakness – KRE was down 29% in March, while QQQ was up 10%. Second, it continues to lag and is breaking down from a classic bear flag pattern.

Image Source: Zacks Investment Research

Looking deeper, individual banking stocks are still showing concerning price action despite insiders doing their best to defend the stocks. For example, banking and brokerage firm Charles Schwab (SCHW) saw a temporary boost when CEO Walter Bettinger decided to showed that he has skin in the game. Bettinger purchased 50,000 shares for nearly $3 million. Despite the vote of confidence by the CEO, shares are down 6 weeks in a row and look poised to retest the panic lows.

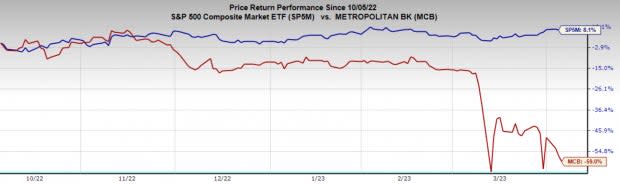

Metropolitan Commercial Bank (MCB) is in a similar situation to Schwab. The stock split wide open a few weeks ago. Then, insiders tried to defend the stock, but it continues to roll over.

Image Source: Zacks Investment Research

The strongest banks in the market currently are the larger, well-capitalized banks such as JP Morgan (JPM), UBS (UBS), and HSBC (HSBC). Based on the price action in regional banks, it would not be a surprise if more banks were to go bankrupt or get purchased for pennies on the dollar like Credit Suisse (CS).

Tech Deserves a Rest

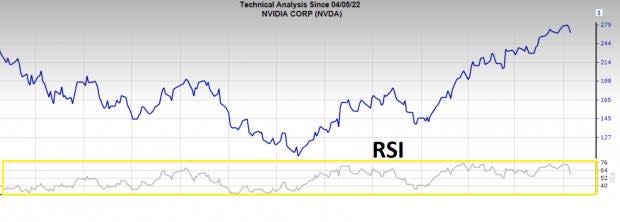

As I mentioned earlier, tech has brushed off the current banking crisis since regional banks have stabilized. That said, another leg lower in regional banks may drag down Nasdaq stocks too. Beyond regional bank weakness, leading stocks such as Nvidia (NVDA) are becoming extended from a technical basis. Earlier this week, NVDA’s relative strength index (RSI) reading flashed the most overbought levels in more than a year.

Image Source: Zacks Investment Research

Bottom Line

As legendary trader Jesse Livermore once warned, “There’s a time to go long, a time to go short, and a time to go fishing.” For traders, being patient and picking spots is a superpower. With tech stocks extended and regional banks breaking down, now may be an excellent time to build a watch list and wait for “your pitch”. While the market may not need to pullback, a reset or a consolidation would be a healthy development and would provide more attractive reward-to-risk zones.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Credit Suisse Group (CS) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

iShares Russell 2000 ETF (IWM): ETF Research Reports

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

SPDR S&P Regional Banking ETF (KRE): ETF Research Reports

Metropolitan Bank Holding Corp. (MCB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance