Regenxbio Inc (RGNX) Q1 2024 Earnings: Misses Analyst Revenue and EPS Forecasts

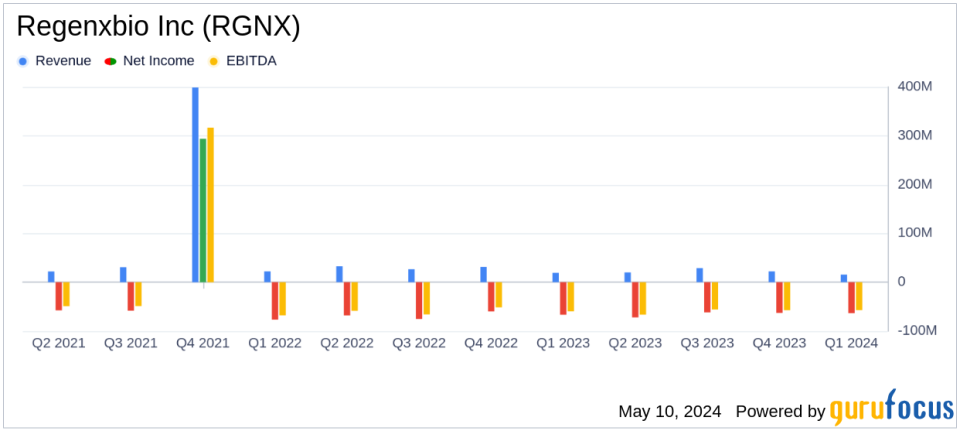

Revenue: Reported at $15.6 million for Q1 2024, a decrease from $19.1 million in Q1 2023, falling short of estimates of $24.17 million.

Net Loss: Reported at $63.3 million for Q1 2024, an improvement from a net loss of $66.7 million in Q1 2023, but still above the estimated net loss of $53.86 million.

Earnings Per Share (EPS): Reported a net loss per share of $1.38, compared to a net loss per share of $1.53 in Q1 2023, falling short of the estimated EPS of -$1.26.

Cash Position: Ended Q1 2024 with $380.5 million in cash, cash equivalents, and marketable securities, up from $314.1 million at the end of 2023.

Research and Development Expenses: Decreased to $54.8 million in Q1 2024 from $58.5 million in Q1 2023, reflecting efficiency in spending.

General and Administrative Expenses: Decreased to $18.3 million in Q1 2024 from $22.6 million in Q1 2023, due to reduced headcount and lower corporate overhead costs.

Financial Guidance: Expects current cash reserves to fund operations into 2026, indicating a strong liquidity position.

On May 8, 2024, Regenxbio Inc (NASDAQ:RGNX) disclosed its financial results for the first quarter ending March 31, 2024, through its 8-K filing. The report revealed a revenue of $15.6 million and a net loss of $63.3 million, or $1.38 per share, missing analyst expectations on both fronts.

Regenxbio Inc, a pioneer in the development of AAV Therapeutics for treating severe genetic disorders, has reported a decline in revenue from $19.1 million in Q1 2023 to $15.6 million in Q1 2024. This decrease is primarily due to non-recurring development milestone revenue recognized in the previous year, alongside a slight decrease in Zolgensma royalty revenues.

Financial Highlights and Operational Achievements

The company's cash position strengthened significantly, with cash, cash equivalents, and marketable securities totaling $380.5 million as of March 31, 2024, up from $314.1 million at the end of 2023. This increase was largely due to $131.1 million in net proceeds from a recent public offering, positioning the company to fund operations into 2026.

Regenxbio continues to make significant strides in its clinical programs. Notably, the company is progressing towards a Biologics License Application (BLA) for RGX-121 for treating MPS II, and pivotal trials for its Duchenne muscular dystrophy treatment, RGX-202, are set to commence between Q3 and Q4 2024.

Analysis of Income Statement and Balance Sheet

Research and Development expenses saw a slight decrease to $54.8 million from $58.5 million in the previous year, reflecting efficiencies in manufacturing and clinical supply costs, offset by increased clinical trial expenses. General and Administrative expenses also decreased to $18.3 million from $22.6 million, due to reduced headcount and lower professional service costs.

The balance sheet remains robust with an increase in total assets to $629.2 million from $574.0 million at the end of 2023. The company's financial health is further underscored by a solid equity standing of $390.7 million, up from $311.7 million, reflecting successful capital raising efforts and prudent financial management.

Market and Future Outlook

Despite the current financial results not meeting analyst expectations, Regenxbio's strategic advancements in its clinical programs and strong cash reserves lay a solid foundation for future growth. The company's ongoing collaborations, like those with AbbVie on ABBV-RGX-314 for retinal diseases, and its innovative NAV Technology platform, continue to promise substantial developments in gene therapy treatments.

Regenxbio's management remains optimistic about the accelerated approval pathways for its leading candidates and the potential market opportunities upon successful trial completions and regulatory approvals.

Investors and stakeholders will be looking forward to the upcoming webcast and conference call to gain deeper insights into the company's strategic initiatives and financial planning post-Q1 results.

For detailed financial tables and further information, please refer to the official SEC filing.

Regenxbio's journey through complex clinical developments and its financial maneuvers demonstrates a resilient strategy aimed at long-term value creation, pivotal for investors focusing on growth through innovation in the biotechnology sector.

Explore the complete 8-K earnings release (here) from Regenxbio Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance