Reflecting On Sit-Down Dining Stocks’ Q1 Earnings: Red Robin (NASDAQ:RRGB)

Earnings results often indicate what direction a company will take in the months ahead. With Q1 now behind us, let’s have a look at Red Robin (NASDAQ:RRGB) and its peers.

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

The 14 sit-down dining stocks we track reported an ok Q1; on average, revenues missed analyst consensus estimates by 0.9%. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and while some of the sit-down dining stocks have fared somewhat better than others, they collectively declined, with share prices falling 1.5% on average since the previous earnings results.

Red Robin (NASDAQ:RRGB)

Known for its bottomless steak fries, Red Robin (NASDAQ:RRGB) is a chain of casual restaurants specializing in burgers and general American fare.

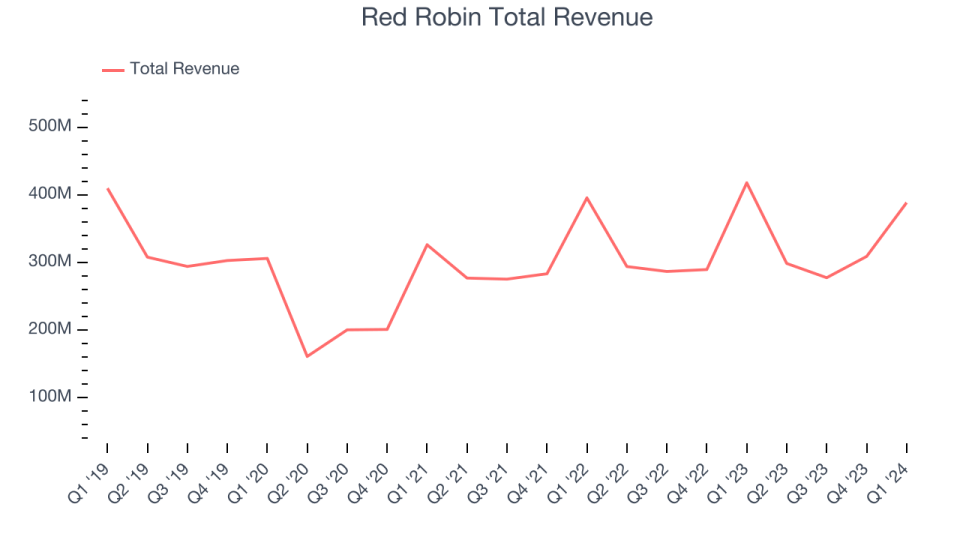

Red Robin reported revenues of $388.5 million, down 7% year on year, falling short of analysts' expectations by 1.1%. It was a mixed quarter for the company: Red Robin beat analysts' gross margin expectations. Its full-year revenue and adjusted EBITDA guidance was maintained and came in higher than Wall Street's estimates. On the other hand revenue and EPS missed analysts' expectations.

Red Robin delivered the slowest revenue growth of the whole group. The stock is up 18.3% since the results and currently trades at $8.

Read our full report on Red Robin here, it's free.

Best Q1: BJ's (NASDAQ:BJRI)

Founded in 1978 in California, BJ’s Restaurants (NASDAQ:BJRI) is a chain of restaurants whose menu features classic American dishes, often with a twist.

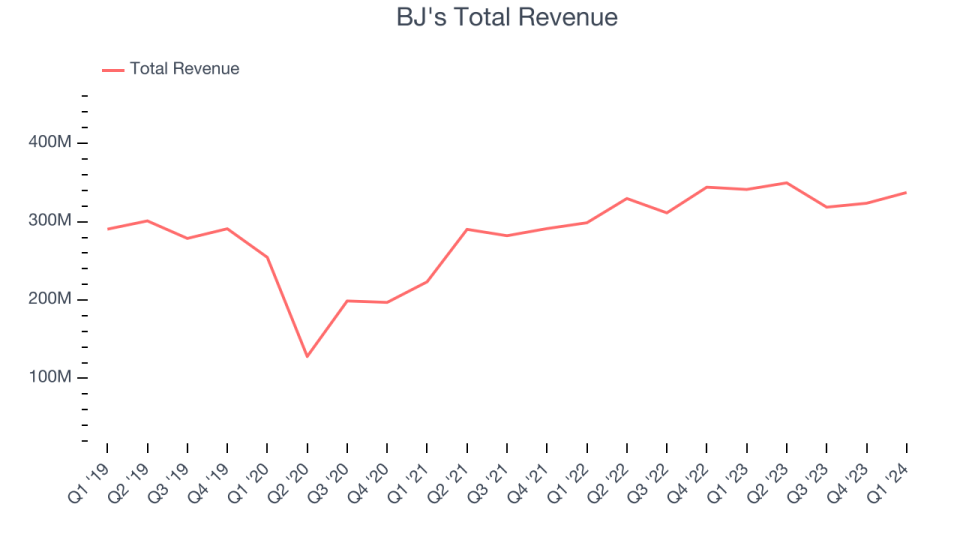

BJ's reported revenues of $337.3 million, down 1.2% year on year, in line with analysts' expectations. It was an exceptional quarter for the company, with an impressive beat of analysts' earnings and gross margin estimates.

The stock is up 8.2% since the results and currently trades at $35.41.

Is now the time to buy BJ's? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Dine Brands (NYSE:DIN)

Operating a franchise model, Dine Brands (NYSE:DIN) is a casual restaurant chain that owns the Applebee’s and IHOP banners.

Dine Brands reported revenues of $206.2 million, down 3.5% year on year, falling short of analysts' expectations by 2%. It was a weak quarter for the company, with a miss of analysts' earnings and gross margin estimates.

The stock is down 13.6% since the results and currently trades at $37.72.

Read our full analysis of Dine Brands's results here.

First Watch (NASDAQ:FWRG)

Based on a nautical reference to the first work shift aboard a ship, First Watch (NASDAQ:FWRG) is a chain of breakfast and brunch restaurants whose menu is heavily-focused on eggs and griddle items such as pancakes.

First Watch reported revenues of $242.4 million, up 14.7% year on year, falling short of analysts' expectations by 1.1%. It was a strong quarter for the company, with an impressive beat of analysts' gross margin estimates and a decent beat of analysts' earnings estimates.

The stock is down 25.8% since the results and currently trades at $18.65.

Read our full, actionable report on First Watch here, it's free.

Brinker International (NYSE:EAT)

Founded by Norman Brinker in Dallas, Texas, Brinker International (NYSE:EAT) is a casual restaurant chain that operates under the Chili’s, Maggiano’s Little Italy, and It’s Just Wings banners.

Brinker International reported revenues of $1.12 billion, up 3.4% year on year, falling short of analysts' expectations by 0.1%. It was a very strong quarter for the company, with an impressive beat of analysts' gross margin estimates and optimistic earnings guidance for the full year.

The stock is up 37.2% since the results and currently trades at $68.1.

Read our full, actionable report on Brinker International here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance