Reflecting On Electrical Systems Stocks’ Q1 Earnings: Hubbell (NYSE:HUBB)

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Hubbell (NYSE:HUBB) and the rest of the electrical systems stocks fared in Q1.

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 11 electrical systems stocks we track reported a weaker Q1; on average, revenues were in line with analyst consensus estimates. while next quarter's revenue guidance was below consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and while some of the electrical systems stocks have fared somewhat better than others, they collectively declined, with share prices falling 4.8% on average since the previous earnings results.

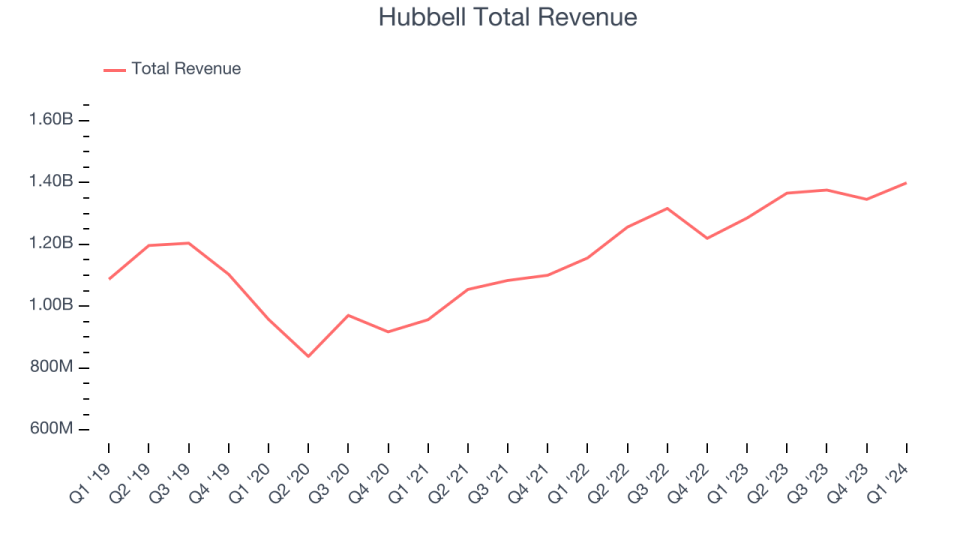

Hubbell (NYSE:HUBB)

A respected player in the electrical segment, Hubbell (NYSE:HUBB) manufactures electronic products for the construction, industrial, utility, and telecommunications markets.

Hubbell reported revenues of $1.40 billion, up 8.8% year on year, topping analysts' expectations by 1.4%. It was an ok quarter for the company, with a narrow beat of analysts' earnings estimates but a miss of analysts' organic revenue estimates.

“Hubbell is off to a solid start in 2024,” said Gerben Bakker, Chairman, President and CEO.

The stock is down 8.9% since the results and currently trades at $371.29.

Is now the time to buy Hubbell? Access our full analysis of the earnings results here, it's free.

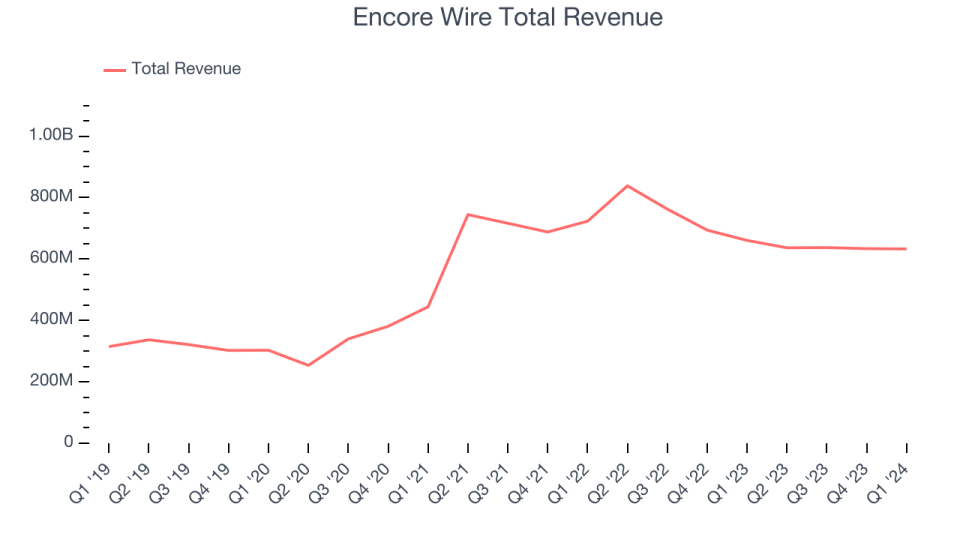

Best Q1: Encore Wire (NASDAQ:WIRE)

Started in a small warehouse in Texas in 1989, Encore Wire (NASDAQ:WIRE) manufactures a range of electrical building wire and cables.

Encore Wire reported revenues of $632.7 million, down 4.2% year on year, outperforming analysts' expectations by 7.3%. It was an impressive quarter for the company, with revenue and EPS exceeding expectations.

Encore Wire scored the biggest analyst estimates beat among its peers. The stock is up 2.2% since the results and currently trades at $289.95.

Is now the time to buy Encore Wire? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Identiv (NASDAQ:INVE)

Emerging from bankruptcy and rebranding in 2013, Identiv (NASDAQCM:INVE) provides digital identity and security solutions for various industries.

Identiv reported revenues of $22.49 million, down 13.5% year on year, falling short of analysts' expectations by 2.2%. It was a weak quarter for the company, with the company missing analysts' sales and earnings estimates.

The stock is down 18.6% since the results and currently trades at $4.11.

Read our full analysis of Identiv's results here.

Whirlpool (NYSE:WHR)

Credited with introducing the first automatic washing machine, Whirlpool (NYSE:WHR) is a manufacturer of a variety of home appliances.

Whirlpool reported revenues of $4.49 billion, down 3.4% year on year, surpassing analysts' expectations by 1.7%. It was a very strong quarter for the company, with an impressive beat of analysts' volume estimates and a decent beat of analysts' earnings estimates.

Whirlpool pulled off the highest full-year guidance raise among its peers. The stock is down 4.5% since the results and currently trades at $100.94.

Read our full, actionable report on Whirlpool here, it's free.

Acuity Brands (NYSE:AYI)

One of the pioneers of smart lights, Acuity (NYSE:AYI) designs and manufactures light fixtures and building management systems used in various industries.

Acuity Brands reported revenues of $968.1 million, down 3.2% year on year, falling short of analysts' expectations by 2.9%. It was a weak quarter for the company, with a miss of analysts' organic revenue estimates.

The stock is up 1.3% since the results and currently trades at $243.31.

Read our full, actionable report on Acuity Brands here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance