Reflecting On Apparel, Accessories and Luxury Goods Stocks’ Q1 Earnings: Tapestry (NYSE:TPR)

Let's dig into the relative performance of Tapestry (NYSE:TPR) and its peers as we unravel the now-completed Q1 apparel, accessories and luxury goods earnings season.

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 17 apparel, accessories and luxury goods stocks we track reported an ok Q1; on average, revenues were in line with analyst consensus estimates. while next quarter's revenue guidance was 2.2% below consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and while some of the apparel, accessories and luxury goods stocks have fared somewhat better than others, they collectively declined, with share prices falling 0.4% on average since the previous earnings results.

Tapestry (NYSE:TPR)

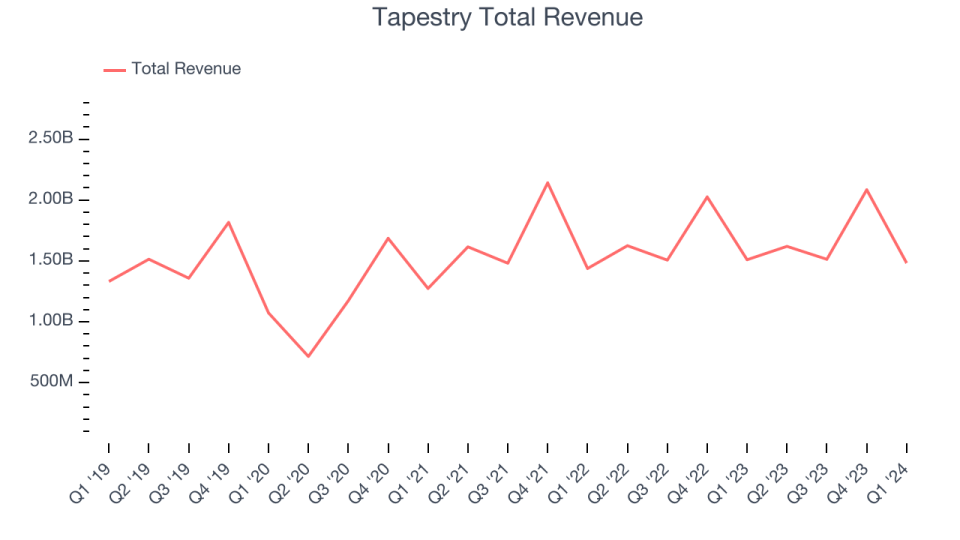

Originally founded as Coach, Tapestry (NYSE:TPR) is an American fashion conglomerate with a portfolio of luxury brands offering high-quality accessories and fashion products.

Tapestry reported revenues of $1.48 billion, down 1.8% year on year, falling short of analysts' expectations by 1.1%. It was a weaker quarter for the company with full-year revenue guidance missing analysts' expectations and a miss of analysts' earnings estimates.

Joanne Crevoiserat, Chief Executive Officer of Tapestry, Inc., said, “Our third quarter earnings results outperformed expectations, reflecting our unwavering commitment to disciplined brand building and operational excellence. Our talented global teams continued to advance our long-term initiatives, fueling innovation and consumer connections, while successfully harnessing the power of our customer engagement platform to navigate the dynamic backdrop with focus and agility. Moving forward, we are confident in our vision for the future and the significant runway to drive sustainable growth and shareholder value.”

The stock is up 9.4% since reporting and currently trades at $42.64.

Read our full report on Tapestry here, it's free.

Best Q1: Stitch Fix (NASDAQ:SFIX)

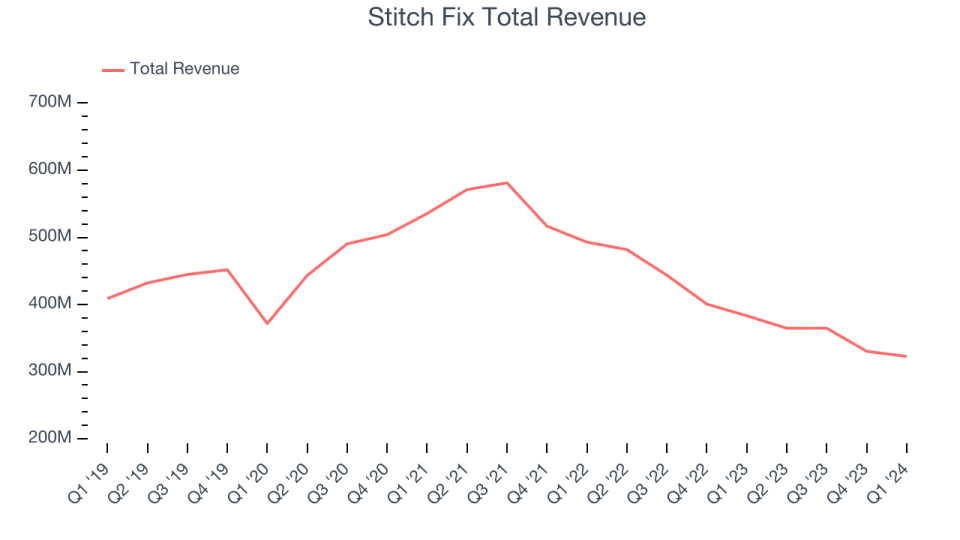

One of the original subscription box companies, Stitch Fix (NASDAQ:SFIX) is an online personal styling and fashion service that curates personalized clothing selections for customers.

Stitch Fix reported revenues of $322.7 million, down 15.8% year on year, outperforming analysts' expectations by 5.4%. It was a very strong quarter for the company with an impressive beat of analysts' earnings estimates and full-year revenue guidance exceeding analysts' expectations.

Stitch Fix achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 66.2% since reporting. It currently trades at $4.42.

Is now the time to buy Stitch Fix? Access our full analysis of the earnings results here, it's free.

ThredUp (NASDAQ:TDUP)

Founded to revolutionize thrifting, ThredUp (NASDAQ:TDUP) is a leading online fashion resale marketplace that offers a wide selection of gently-used clothing and accessories.

ThredUp reported revenues of $79.59 million, up 4.8% year on year, in line with analysts' expectations. It was a weak quarter for the company with a miss of analysts' earnings estimates and revenue guidance for next quarter missing analysts' expectations.

ThredUp posted the weakest full-year guidance update in the group. As expected, the stock is down 9.1% since the results and currently trades at $1.7.

Read our full analysis of ThredUp's results here.

Kontoor Brands (NYSE:KTB)

Founded in 2019 after separating from VF Corporation, Kontoor Brands (NYSE:KTB) is a clothing company known for its high-quality denim products.

Kontoor Brands reported revenues of $631.2 million, down 5.4% year on year, surpassing analysts' expectations by 3.8%. Looking more broadly, it was a strong quarter for the company with an impressive beat of analysts' earnings estimates.

The stock is flat since reporting and currently trades at $62.63.

Read our full, actionable report on Kontoor Brands here, it's free.

Movado (NYSE:MOV)

With its watches displayed in 20 museums around the world, Movado (NYSE:MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Movado reported revenues of $136.7 million, down 5.7% year on year, falling short of analysts' expectations by 5.9%. Looking more broadly, it was a solid quarter for the company with optimistic earnings guidance for the full year and a decent beat of analysts' earnings estimates.

Movado had the weakest performance against analyst estimates among its peers. The stock is down 8.2% since reporting and currently trades at $24.54.

Read our full, actionable report on Movado here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance