Redrow plc's (LON:RDW) Stock is Soaring But Financials Seem Inconsistent: Will The Uptrend Continue?

Redrow's (LON:RDW) stock is up by a considerable 11% over the past three months. However, we wonder if the company's inconsistent financials would have any adverse impact on the current share price momentum. Specifically, we decided to study Redrow's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Redrow

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Redrow is:

7.1% = UK£126m ÷ UK£1.8b (Based on the trailing twelve months to December 2020).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each £1 of shareholders' capital it has, the company made £0.07 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Redrow's Earnings Growth And 7.1% ROE

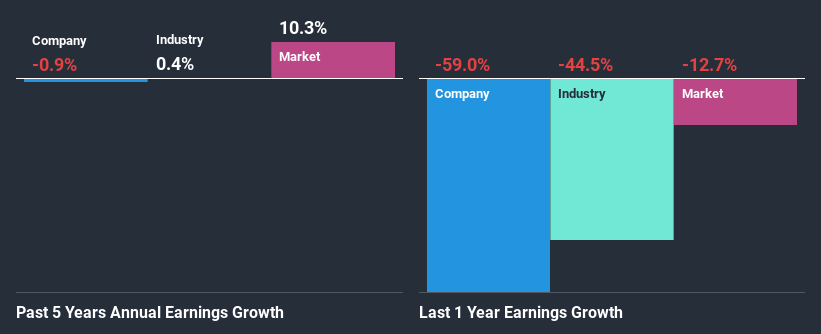

At first glance, Redrow's ROE doesn't look very promising. However, its ROE is similar to the industry average of 6.2%, so we won't completely dismiss the company. However, Redrow has seen a flattish net income growth over the past five years, which is not saying much. Bear in mind, the company's ROE is not very high. Hence, this provides some context to the flat earnings growth seen by the company.

Next, on comparing with the industry net income growth, we found that Redrow's reported growth was a little less than the industry growth of0.4% in the same period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Has the market priced in the future outlook for RDW? You can find out in our latest intrinsic value infographic research report.

Is Redrow Making Efficient Use Of Its Profits?

In spite of a normal three-year median payout ratio of 29% (or a retention ratio of 71%), Redrow hasn't seen much growth in its earnings. Therefore, there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

Moreover, Redrow has been paying dividends for seven years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer dividends over earnings growth. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 34%. Still, forecasts suggest that Redrow's future ROE will rise to 13% even though the the company's payout ratio is not expected to change by much.

Conclusion

On the whole, we feel that the performance shown by Redrow can be open to many interpretations. While the company does have a high rate of reinvestment, the low ROE means that all that reinvestment is not reaping any benefit to its investors, and moreover, its having a negative impact on the earnings growth. Having said that, looking at current analyst estimates, we found that the company's earnings growth rate is expected to see a huge improvement. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance