The Reata Pharmaceuticals (NASDAQ:RETA) Share Price Is Up 567% And Shareholders Are Delighted

The last three months have been tough on Reata Pharmaceuticals, Inc. (NASDAQ:RETA) shareholders, who have seen the share price decline a rather worrying 33%. But that doesn't displace its brilliant performance over three years. Over that time, we've been excited to watch the share price climb an impressive 567%. Arguably, the recent fall is to be expected after such a strong rise. Only time will tell if there is still too much optimism currently reflected in the share price.

It really delights us to see such great share price performance for investors.

See our latest analysis for Reata Pharmaceuticals

Reata Pharmaceuticals isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Reata Pharmaceuticals actually saw its revenue drop by 19% per year over three years. So it's pretty amazing to see the stock price has zoomed up 88% per year in that time. This clear lack of correlation between revenue and share price is surprising to see in a money losing company. So there is a serious possibility that some holders are counting their chickens before they hatch.

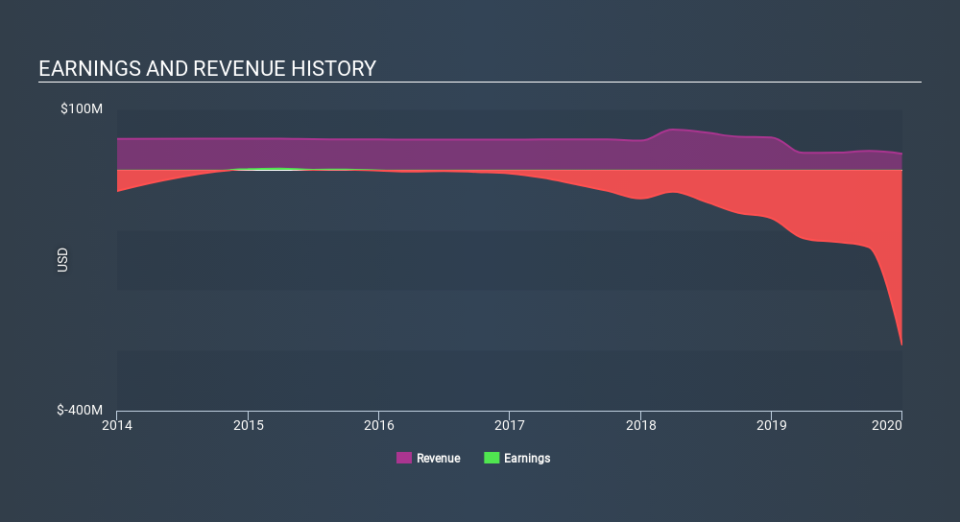

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Reata Pharmaceuticals will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that Reata Pharmaceuticals shareholders have gained 70% (in total) over the last year. But the three year TSR of 88% per year is even better. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Reata Pharmaceuticals , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance