Reasons to Retain Waste Management (WM) in Your Portfolio Now

Waste Management’s WM stock has had an impressive run over the past year. Shares have gained 24.7% compared with the 4.6% rally of the industry it belongs to and the 16.1% rise of the Zacks S&P 500 composite.

The company’s revenues for 2024 and 2025 are expected to increase 5.5% and 6.3%, respectively, on a year-over-year basis. Earnings are anticipated to grow 18.3% in 2024 and 8.4% in 2025. The company has an expected long-term (three to five years) earnings per share growth rate of 11.8%.

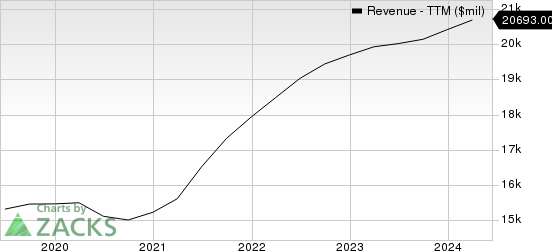

Waste Management, Inc. Revenue (TTM)

Waste Management, Inc. revenue-ttm | Waste Management, Inc. Quote

Factors That Auger Well

Increasing environmental concerns, rapid industrialization, rising population and an expected surge in non-hazardous waste as a result of swift economic growth are anticipated to improve business opportunities for waste management. Government initiatives to introduce sustainable waste management mechanisms, lower greenhouse gas emissions and control illegal dumping are also expected to drive demand.

WM continues to execute core operating initiatives targeting focused differentiation and continuous improvement. Also, it aims at instiling price and cost discipline to achieve higher margins. While differentiation through capitalization of extensive assets ensures profitable growth and competitive advantages in the long term, cost control and process improvement assist in improving the quality of services.

The company pays out steady dividends and has a robust share repurchase policy. In 2023, 2022 and 2021, WM repurchased shares worth $1.3 billion, $1.5 billion and $1.35 billion, respectively. It paid out $1.14 billion, $1.1 billion and $970 million in dividends in 2023, 2022 and 2021, respectively. Waste Management plans to return significant cash to shareholders via dividends and share repurchases.

Some Risks

WM operates in a highly competitive and consolidated waste industry. Counties and municipalities are a significant threat to the company's market share and benefit from the availability of tax revenues and tax-exempt financing. Price hikes become difficult in such a fiercely competitive situation, thereby weighing on the company's top line.

Increased financing costs are concerning. The rise in interest expenses for 2023 can be attributed mainly to an uptick in the weighted average borrowing rate by approximately 80 basis points. Increasing finance costs impact the company's earnings negatively.

Zacks Rank & Stocks to Consider

Waste Management currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the broader Zacks Business Services sector are Charles River Associates CRAI and Lightspeed POS LSPD.

Charles River Associates currently sports a Zacks Rank of 2 (Buy). It has a long-term earnings growth expectation of 16%. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

CRAI delivered a trailing four-quarter earnings surprise of 19.1%, on average.

Lightspeed presently flaunts a Zacks Rank of 2. It has a long-term earnings growth expectation of 33.4%.

LSPD delivered a trailing four-quarter earnings surprise of 191.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Waste Management, Inc. (WM) : Free Stock Analysis Report

Lightspeed Commerce Inc. (LSPD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance